Key moments

- Germany’s import prices rose 3.6% YoY, the highest since 2023.

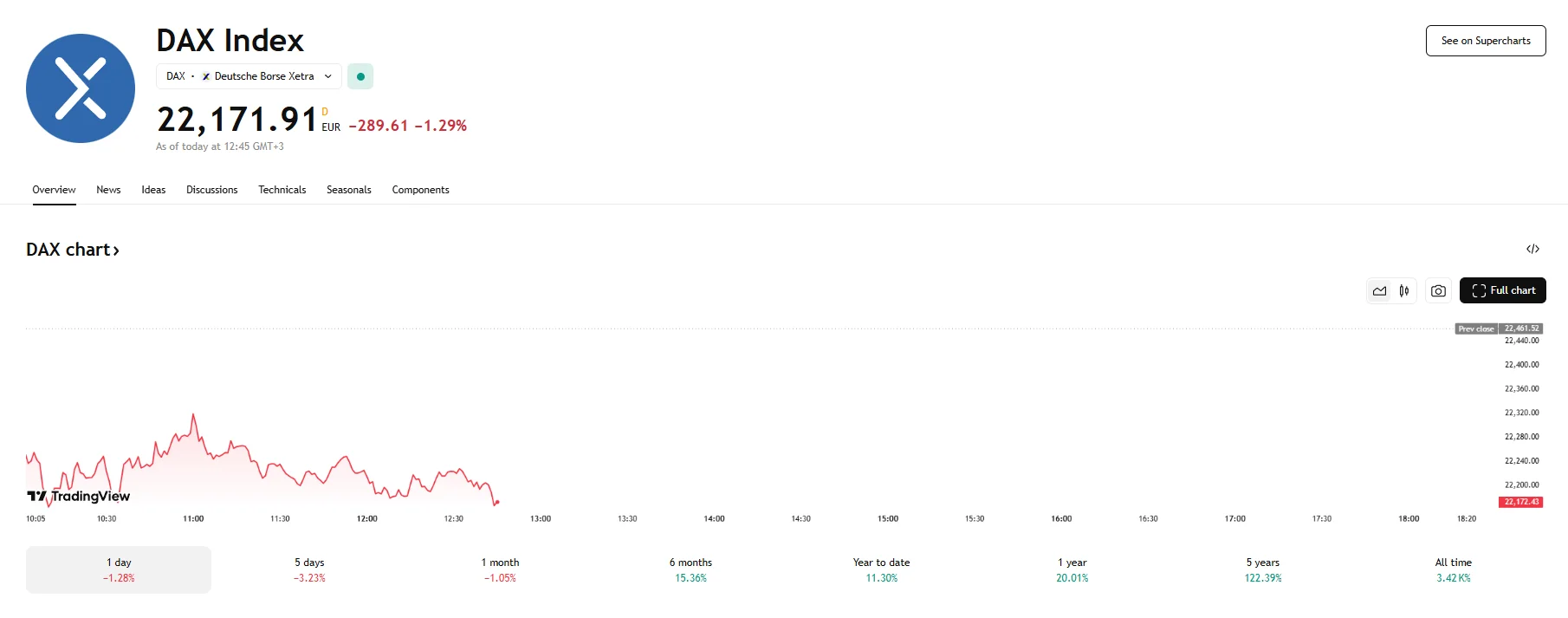

- DAX slipped over 1% on Monday.

- Investor concerns grow as impending U.S. tariff policies are set to come into effect later this week.

Import Price Surge Hits German Economy, Tariff Anxiety Fuels Investor Apprehension

The German DAX index experienced a significant downturn on Monday, falling over 1%, extending last week’s losses. This decline reflects a sharp drop in investor confidence, fueled by escalating trade tensions and the looming threat of widespread U.S. tariffs. The prospect of tariffs impacting all U.S. imports rather than specific nations has heightened concerns about a global recession.

Meanwhile, Germany’s economic data presents a mixed picture. Retail sales in February demonstrated positive momentum, achieving a 0.8% increase compared to the previous month. However, this positive news is overshadowed by rising import prices, which grew by 3.65% year-on-year in February 2025. This marks the highest increase since January 2023, driven primarily by higher costs for consumer and agricultural goods, as well as energy.

The rise in German import prices, particularly in energy and agricultural goods, presents a significant challenge to the nation’s economic outlook. Surging electricity and gas costs threaten widespread economic disruption, while increased agricultural prices may drive up food costs and thus dampen consumer spending. While February’s retail sales figures were positive, the looming threat of inflation could undermine these gains, potentially slowing down economic activity.

Other economic indicators contributed toward a pessimistic outlook among market participants. Unemployment grew, with 2.92 million German residents being unemployed according to the latest data. Furthermore, while the German inflation rate is expected to decline slightly, the overall economic climate remains turbulent, particularly in light of the escalating trade tensions.

The anticipation of President Trump’s “Liberation Day” announcement, where he is expected to unveil tariffs that will be imposed on numerous imported goods, has heightened concerns about a fundamental shift in global trade policies. This uncertainty has contributed to the DAX’s decline and the broader downturn in European markets.