Key moments

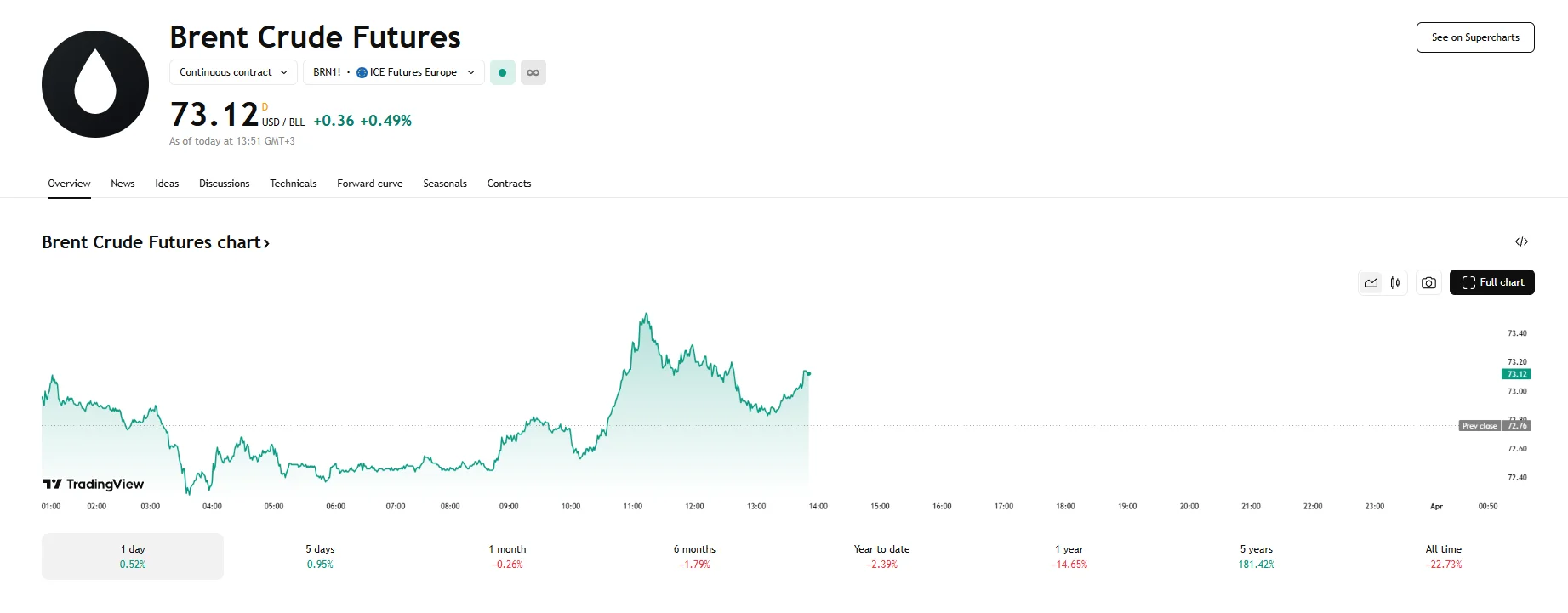

- Brent futures managed to breach the $73 mark, rising 0.49%.

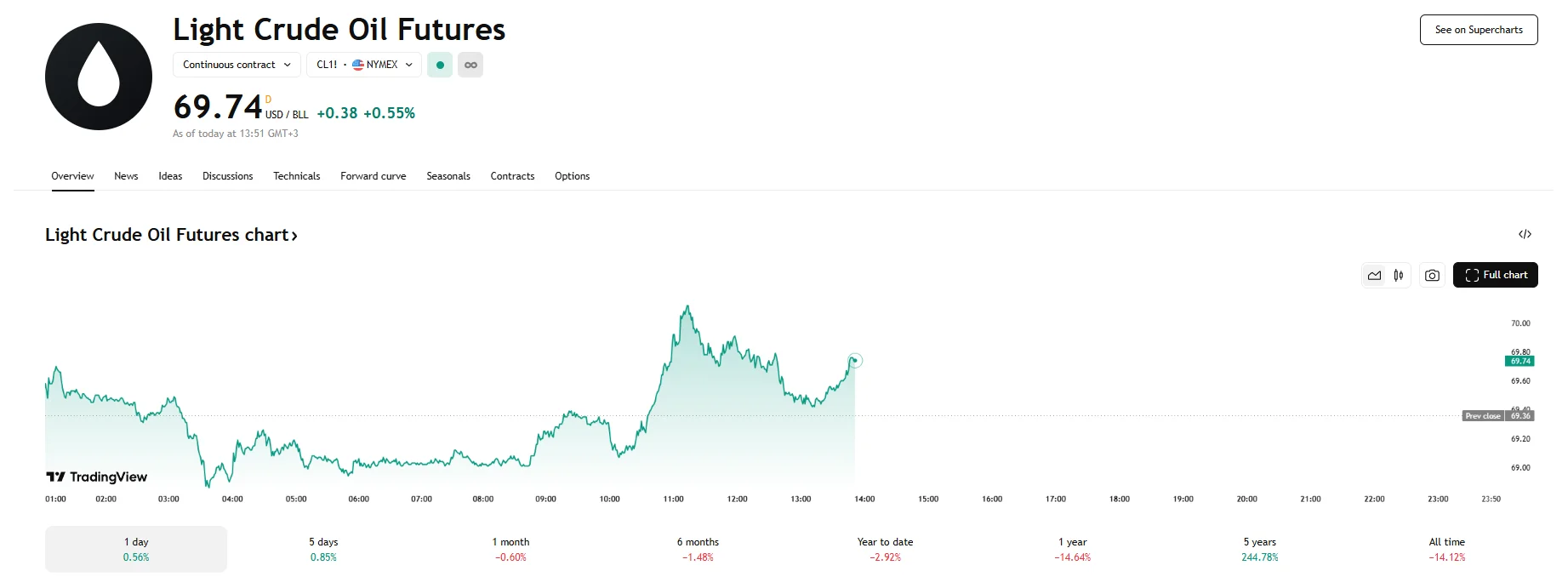

- WTI prices also rose on Monday, nearing $70.

- This surge occurred after U.S. President Donald Trump expressed his willingness to impose tariffs between 25% and 50% on Russian oil buyers.

Oil Market Jumps Amid Russian Oil Tariff Fears

Crude oil futures experienced a marginal increase on Monday, with both Brent and West Texas Intermediate (WTI) benchmarks trading roughly 0.50% higher at press time. This followed an earlier surge where both had briefly climbed by approximately 1%.

Brent crude futures are currently oscillating just above the $73 mark (up 0.49%), while WTI futures are hovering around $69.70. The slight price elevation is attributed to recent pronouncements by former U.S. President Donald Trump, who warned buyers of Russian crude could face tariffs ranging from 25% to 50%.

Furthermore, his simultaneous threats of sanctions and potential military action against Iran, should they fail to renegotiate their nuclear agreement, have added to the prevailing uncertainty. While these pronouncements triggered an initial spike in oil prices, the gains have been tempered by investor caution.

The potential implications of tariffs on Russian oil exports, particularly for China and India, are significant, as these countries are among the most prominent buyers of Russian oil. Given that Russia is a major global oil exporter, any disruption to its supply chains could have far-reaching consequences.

According to Warren Patterson of the ING, oil markets have grown “fatigued” by the Trump Administration’s tariff announcements, with investors now hesitant to take the threats at face value. Recent purchases made by Chinese buyers like Sinopec and Zhenhua Oil reinforced this market skepticism. According to Nomura Securities economist Yuki Takashima, in the immediate term, forecasts predict Brent and WTI crude futures will continue trading within between $65 and $75 per barrel, pending further clarification on U.S. sanctions and broader supply dynamics.

Despite the current market’s muted reaction, the long-term potential for supply disruptions remains a significant concern. Traders are also closely monitoring the potential responses from the Organization of the Petroleum Exporting Countries (OPEC). Any substantial disruption in Russian oil flows could prompt OPEC to adjust its production policies, further influencing global oil prices.