Key moments

- On Wednesday, President Trump announced that the U.S. will impose 25% tariffs on vehicles not manufactured in the U.S.

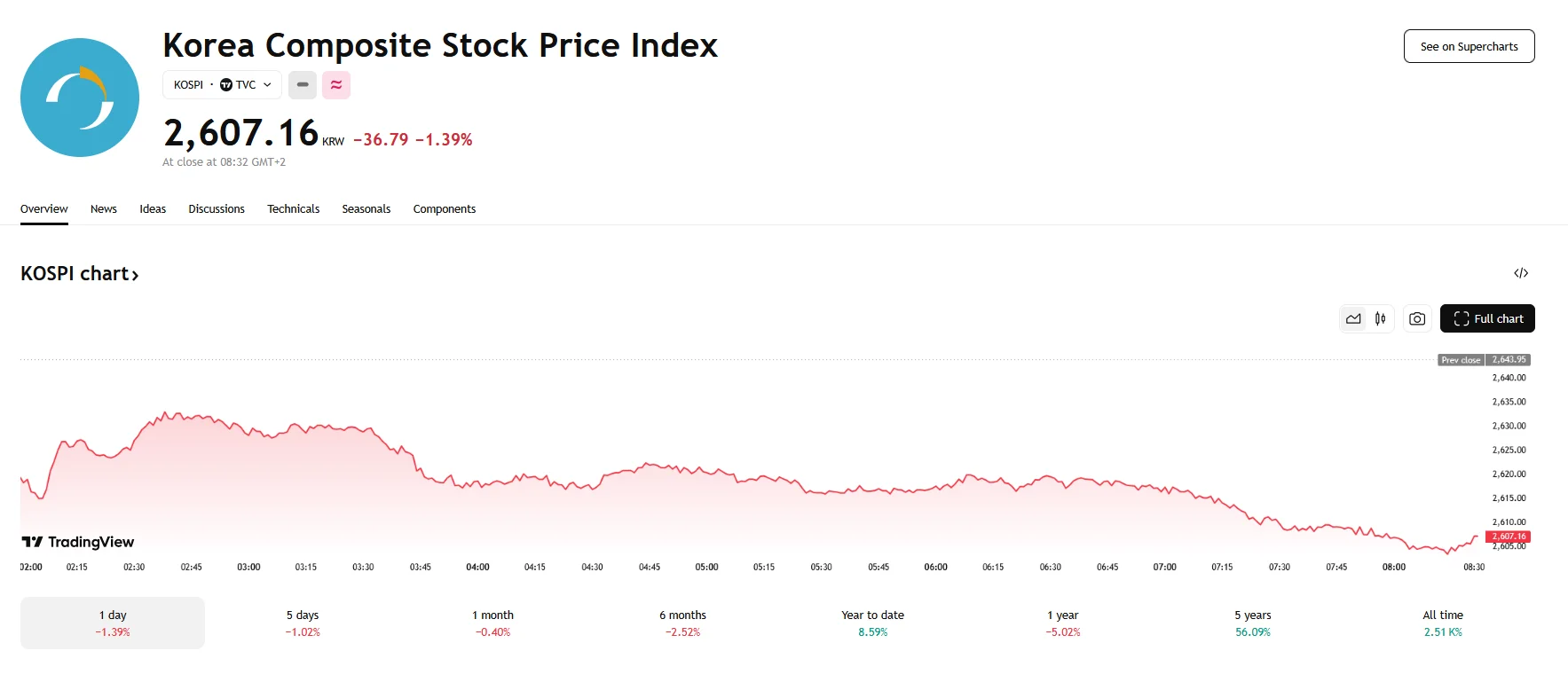

- In South Korea, the KOSPI index registered a decline of 1.39%.

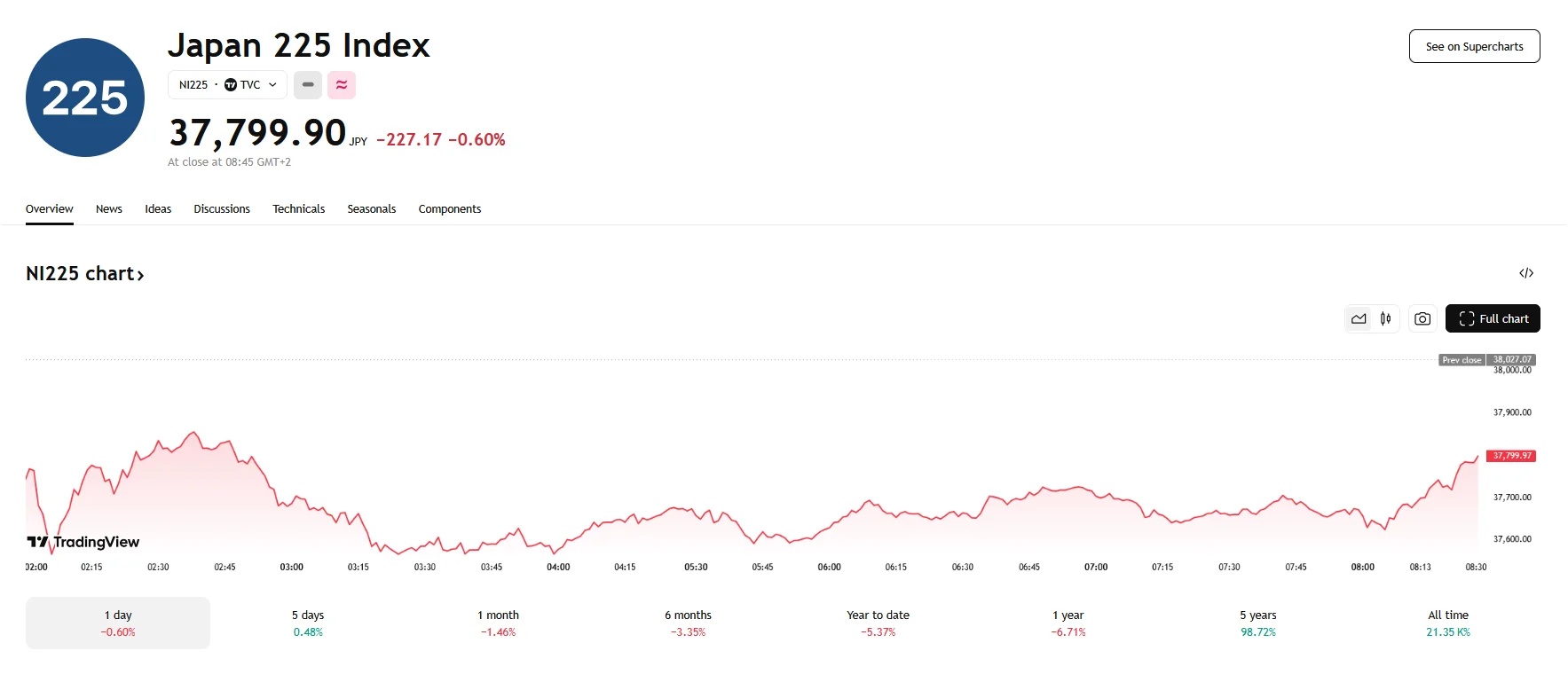

- Japan’s Nikkei 225 index also slipped, falling 0.60%.

Tariffs Send Asian Auto Stocks Reeling

U.S. President Donald Trump’s announcement of 25% tariffs that will be imposed on imported vehicles has sent shockwaves through Asian markets, triggering a notable decline in automotive stocks and raising concerns about the future of global trade. The levies, revealed on Wednesday, have directly impacted major automakers in Japan and South Korea, leading to a significant market downturn on Thursday.

The KOSPI index in South Korea experienced a 1.39% drop, with Hyundai Motor’s shares falling by 4.28%. Similarly, Japan’s Nikkei 225 index saw a 0.60% decrease, as major players like Subaru and Toyota witnessed their stock values decline by 4.96% and 2.04%, respectively.

Japanese Prime Minister Shigeru Ishiba has indicated that all available options are being considered in response to the tariffs, while South Korea has convened emergency meetings to assess the potential damage to its automotive industry. According to Ahn Duk-geun, South Korea’s Minister of Trade, Industry and Energy, U.S. tariffs are expected to pose significant challenges for Korean automobile companies. The global auto sector, already facing numerous challenges, now confronts additional uncertainty due to these trade developments.

Automotive imports in the U.S. reached $474 billion in 2024, and even domestic reception to the newly announced tariffs has been mixed. The United Auto Workers (UAW) union has voiced its support for the tariffs, viewing them as a means of revitalizing domestic job creation. Conversely, industry representatives, such as CEO of Autos Drive America Jennifer Safavian, have expressed concerns that the tariffs will negatively impact U.S. manufacturing jobs and that consumers will be faced with increasing vehicle prices.

The complexities involved in implementing these levies, including the Trump Administration’s reassurance that car parts will be temporarily exempted, have further contributed to market volatility. As April’s implementation deadline approaches, the automotive industry faces significant adjustments, with the long-term implications remaining uncertain.