Key moments

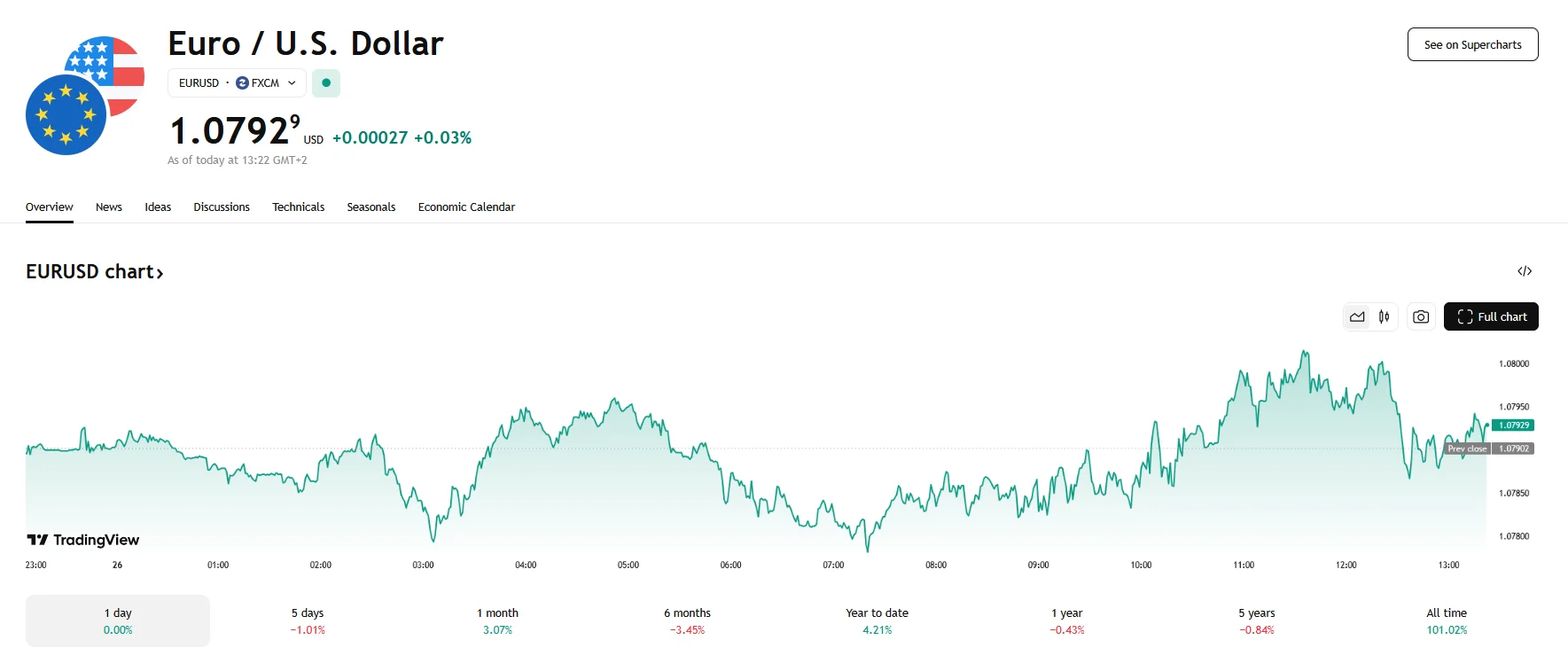

- The EUR/USD pair managed to reach the 1.0790 threshold after a decline.

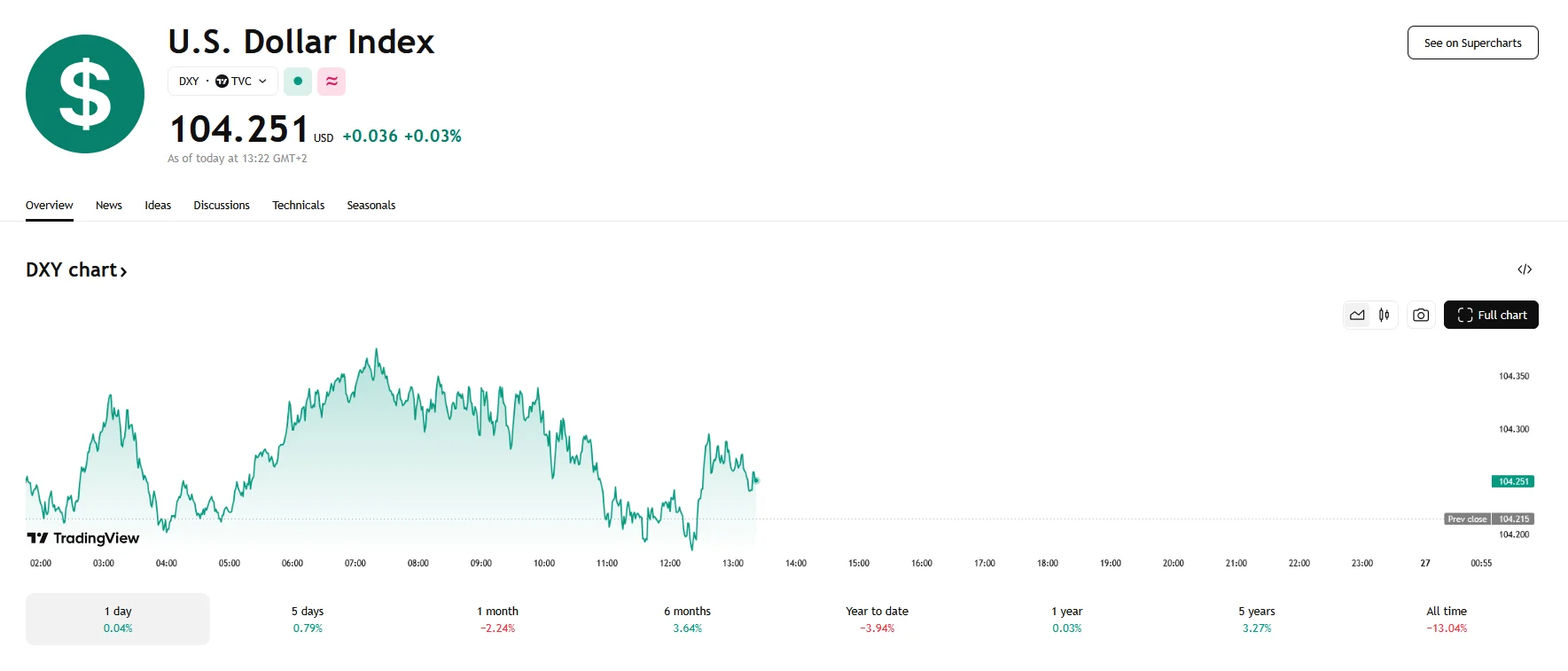

- The dollar index has strengthened, achieving a recovery to 104.251.

- U.S. Personal Consumption Expenditures (PCE) inflation data is likely to influence the Federal Reserve’s interest rate decisions.

EUR/USD Remains Stable Amid Market Uncertainty

The Euro has found itself in a balancing act, with the EUR/USD pair hovering near the 1.0790 mark after a notable dip earlier in the trading day. Despite managing to recover from a drop below 1.0770, the pair has struggled to establish a firm upward trajectory. This tentative stability is occurring against a backdrop of a robust U.S. Dollar, which experienced a rebound as the Dollar Index (DXY) reached a peak of 104.400 on Wednesday. At press time, the Dollar Index is trading just above 104.250.

Market participants are keenly awaiting the release of the U.S. Personal Consumption Expenditures (PCE) inflation data scheduled for Friday, as this will provide crucial insights into the Federal Reserve’s potential course of action regarding interest rates. The European Central Bank (ECB), conversely, has signaled a willingness to implement further rate cuts, adding to the divergent monetary policy landscapes that are influencing the EUR/USD pair.

The recent resilience of the U.S. Dollar is partly attributed to evolving perceptions of the potential impact of President Trump’s tariff policies. Initial fears of a widespread trade war, which could significantly disrupt global economic stability, have been somewhat mitigated. Trump’s indication that certain nations might receive exemptions from the proposed levies has eased concerns, suggesting a more targeted approach rather than a blanket imposition.

Despite this relative optimism, the U.S. consumer sentiment has shown signs of weakening. The latest data from the Conference Board revealed a substantial decline in consumer confidence, falling to 92.9 in March, 7.2 lower than last month. This drop suggests that the potential economic ramifications of the tariffs, particularly their impact on household purchasing power, are beginning to weigh on consumer perceptions.

The U.S. PCE inflation data will be a pivotal determinant of the U.S. Dollar’s trajectory. Economists anticipate a potential uptick in the core PCE inflation rate, the Federal Reserve’s preferred metric, which could reinforce the Dollar’s strength. This data is especially relevant following the Federal Reserve’s recent upward revision of its core PCE inflation forecast for the year.

Meanwhile, the Euro’s outlook remains clouded by expectations of further declines in interest rates and the potential for retaliatory tariffs from the U.S. Should these tariffs materialize, the Eurozone economy could face significant headwinds, which could be the catalyst for interest rate cuts.