Key moments

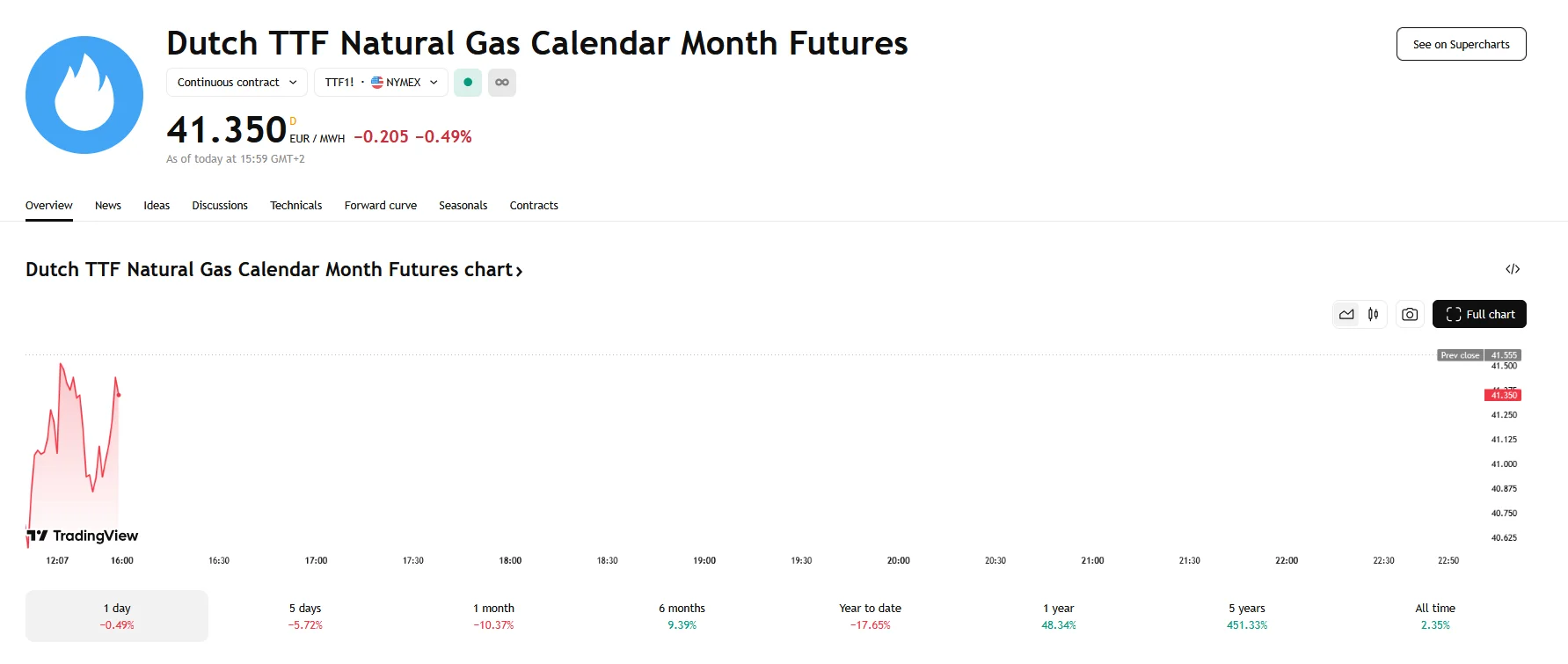

- The European natural gas market, represented by the Dutch TTF futures, observed a 0.49% decline on Wednesday.

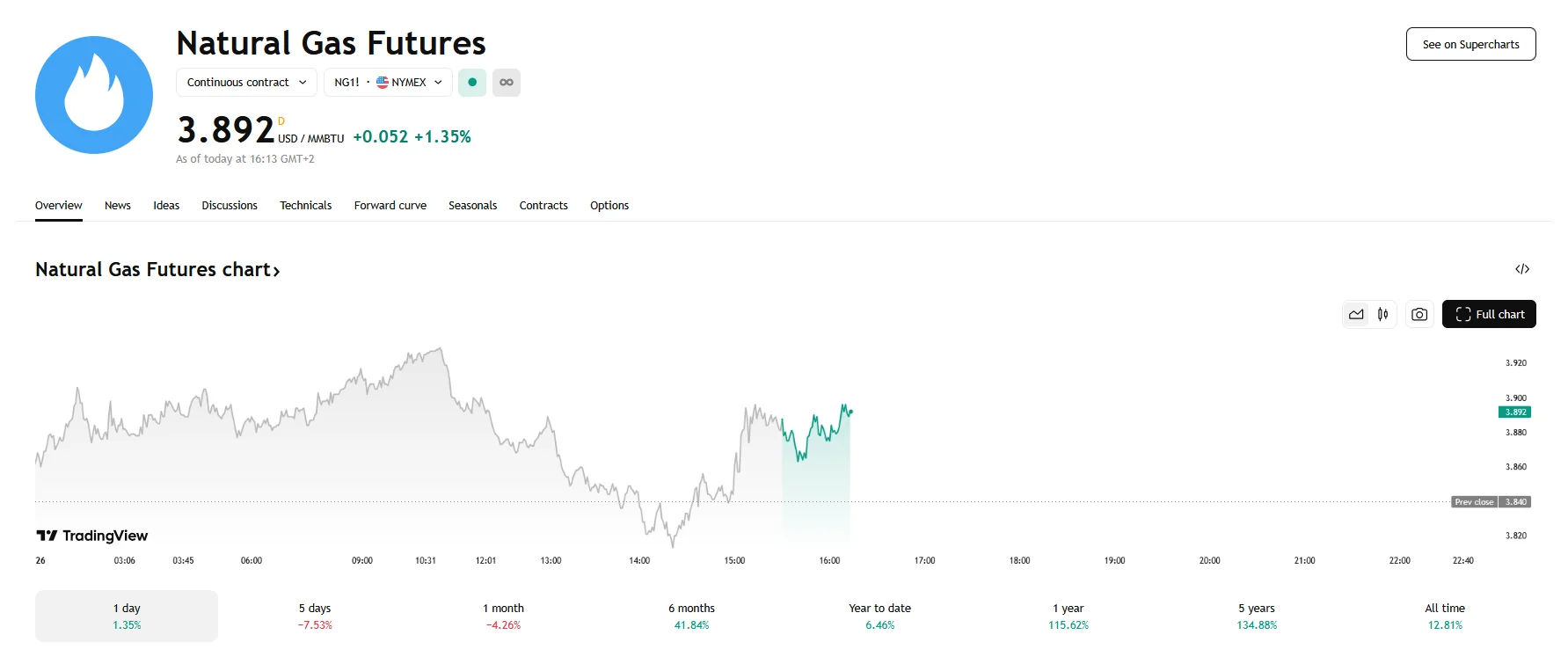

- Conversely, the North American market saw U.S. natural gas prices rise by over 1%.

- Despite mild U.S. temperatures, natural gas prices surged thanks to record-breaking LNG exports.

Europe’s TTF Slips, US Natural Gas Climbs on Export Boom

European and North American natural gas futures experienced contrasting price movements on Wednesday. The Dutch Title Transfer Facility (TTF) natural gas futures, a key indicator for Europe’s energy market, underwent a decline, registering a decrease of 0.49% to €41.350. This downward trend reflected a complex interplay of factors influencing European gas prices.

The European market saw a confluence of events contributing to the softened prices. A significant element was the arrival of spring, bringing with it warmer temperatures across northwest Europe, reducing demand for heating. Furthermore, the inflow of liquefied natural gas (LNG) into European ports increased, while indications pointed to a decrease in LNG demand from China, potentially freeing up supply for European markets.

The initial reports of potential, even partial, agreements between Russia and Ukraine regarding the Black Sea, provided some market relief. The overall picture painted a scenario where supply concerns eased, at least temporarily, leading to a downward pressure on natural gas prices.

In contrast, the North American natural gas market demonstrated a different trajectory. While fluctuations occurred throughout the trading day, U.S. natural gas prices managed to climb by over 1% and settled above the $3.890 mark.

The price increase occurred amid very mild temperatures across a large portion of the United States, as exceptional flow of natural gas to LNG export facilities propelled prices. The U.S. has solidified its position as the world’s leading LNG supplier, and the operational expansion of facilities like Venture Global’s Plaquemines LNG plant has further amplified volumes. This robust export activity creates a substantial demand pull, effectively counteracting the reduced domestic heating needs associated with warm weather.

Furthermore, demand forecasts for the upcoming two weeks have been revised upwards. Although the general trend points towards a decrease in overall demand due to seasonal changes, the updated projections indicate a stronger-than-anticipated consumption rate.