Key moments

- The U.S. Consumer Confidence Index experienced a sharp 7.2-point reduction to 92.9.

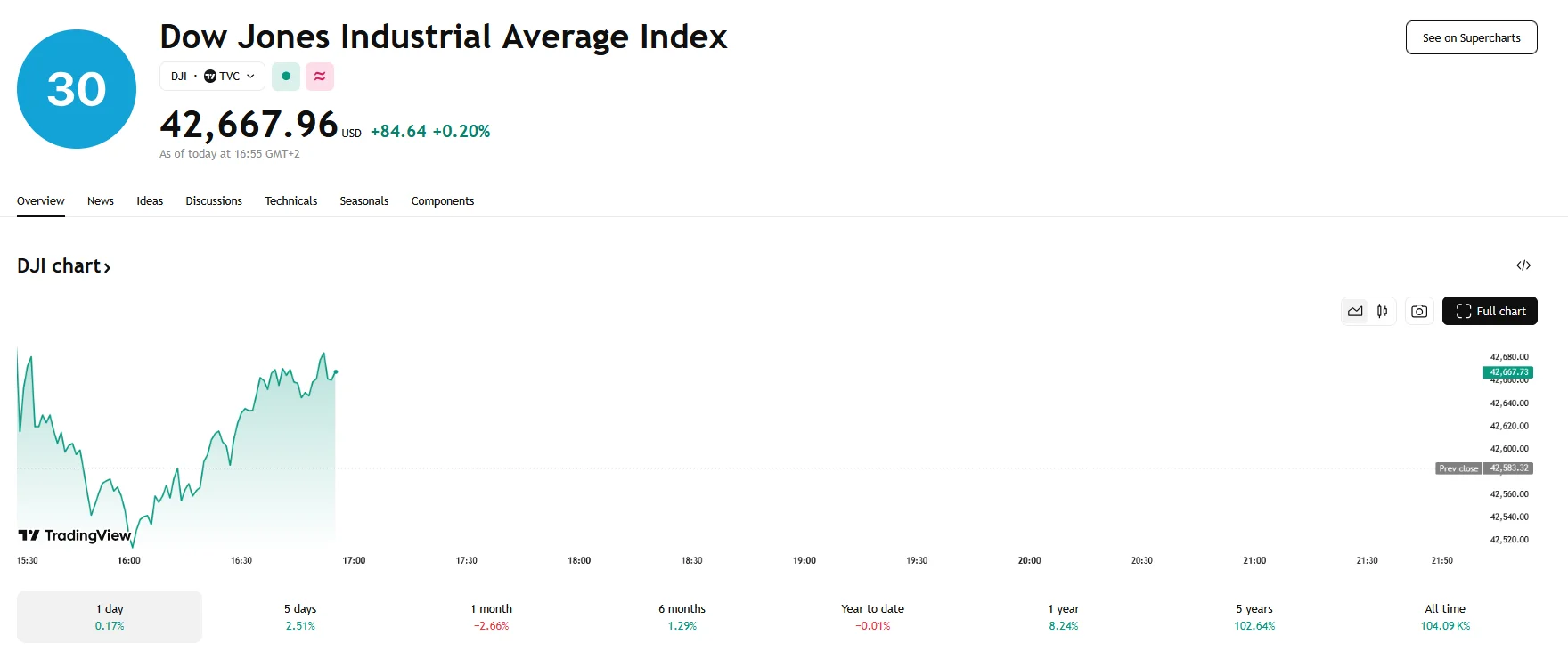

- U.S. stock indices remained resilient with modest gains.

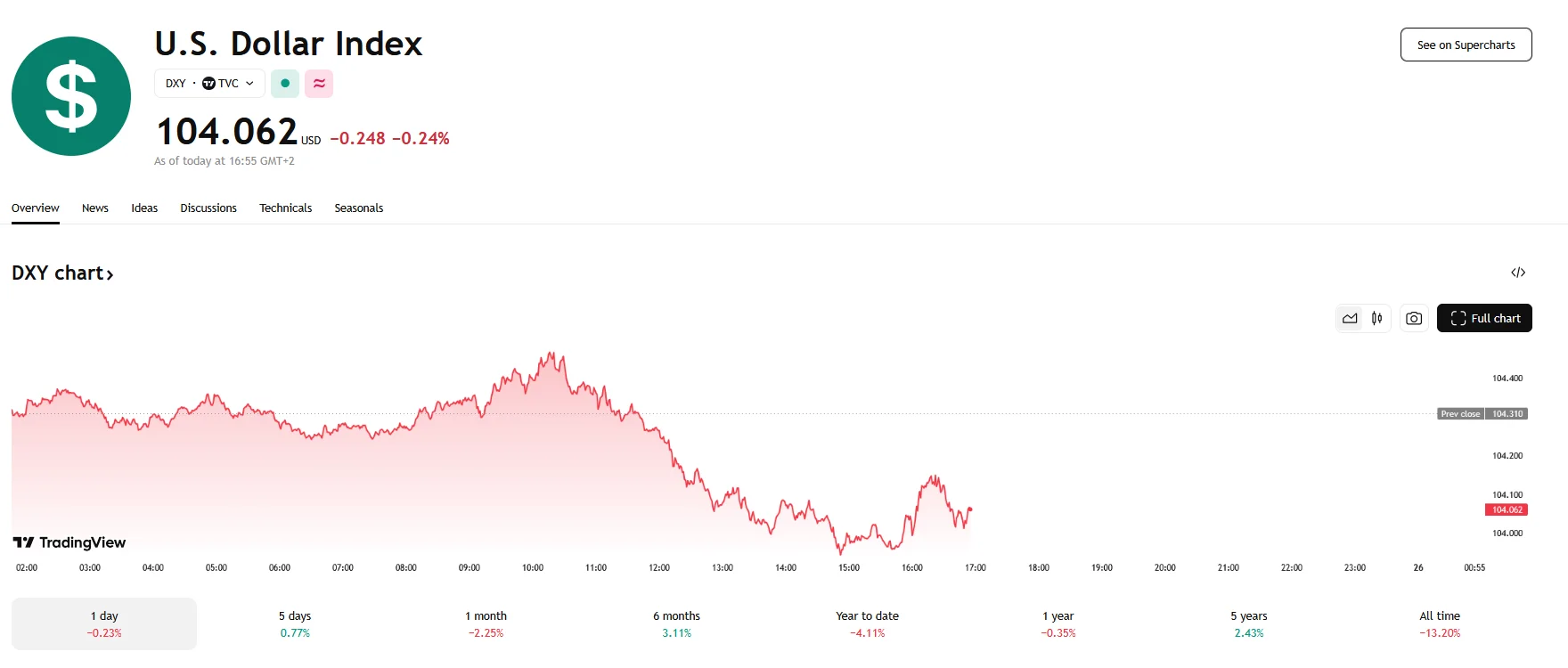

- The U.S. dollar index fell by 0.24%.

Tariff Tensions Contributed to the Decline in Consumer Confidence

The economic landscape of the United States witnessed a significant decline in consumer confidence during March, as reported by the Conference Board. The consumer confidence index plummeted by 7.2 points, settling at 92.9, a 12-year low. This four-month streak signals a growing unease among Americans regarding the nation’s economic health and their personal financial outlook.

Despite the concerning data, major U.S. indices displayed relative stability. The S&P 500 is up by 0.29%, while the Nasdaq Composite climbed by 0.39% on Tuesday. The Dow Jones Industrial Average also witnessed a slight increase, gaining 0.20%. However, the U.S. dollar index fell by 0.24%, potentially reflecting weaker consumer sentiments’ implications for the U.S. economy.

The report from the Conference Board revealed a stark divergence between consumers’ assessment of the present situation and their expectations for the future. A 3.6-point drop brought the Present Situation Index, which measures current business and labor market health, to 134.5.

Additionally, consumers’ short-term predictions for income, business, and employment, as measured by the Expectations Index, fell significantly below the critical threshold of 80 and settled at 65.2. The aforementioned threshold is typically associated with an impending recession. Stephanie Guichard, Senior Economist and head of The Conference Board’s Global Business Cycle Indicators team, highlighted the pervasive pessimism among consumers regarding future employment prospects and income expectations.

The prevailing uncertainty surrounding U.S. trade policies, specifically the tariffs imposed by President Donald Trump, played a significant role in eroding consumer confidence. The fluctuating nature of these policies, coupled with the potential for trade wars and inflationary pressures, contributed to a sense of unease among Americans. The announcement by the U.S. government that not all proposed tariffs would be implemented by April 2 served to alleviate market anxieties to a certain extent. Yet, the long-term impact of these policies remains a source of concern.