Key moments

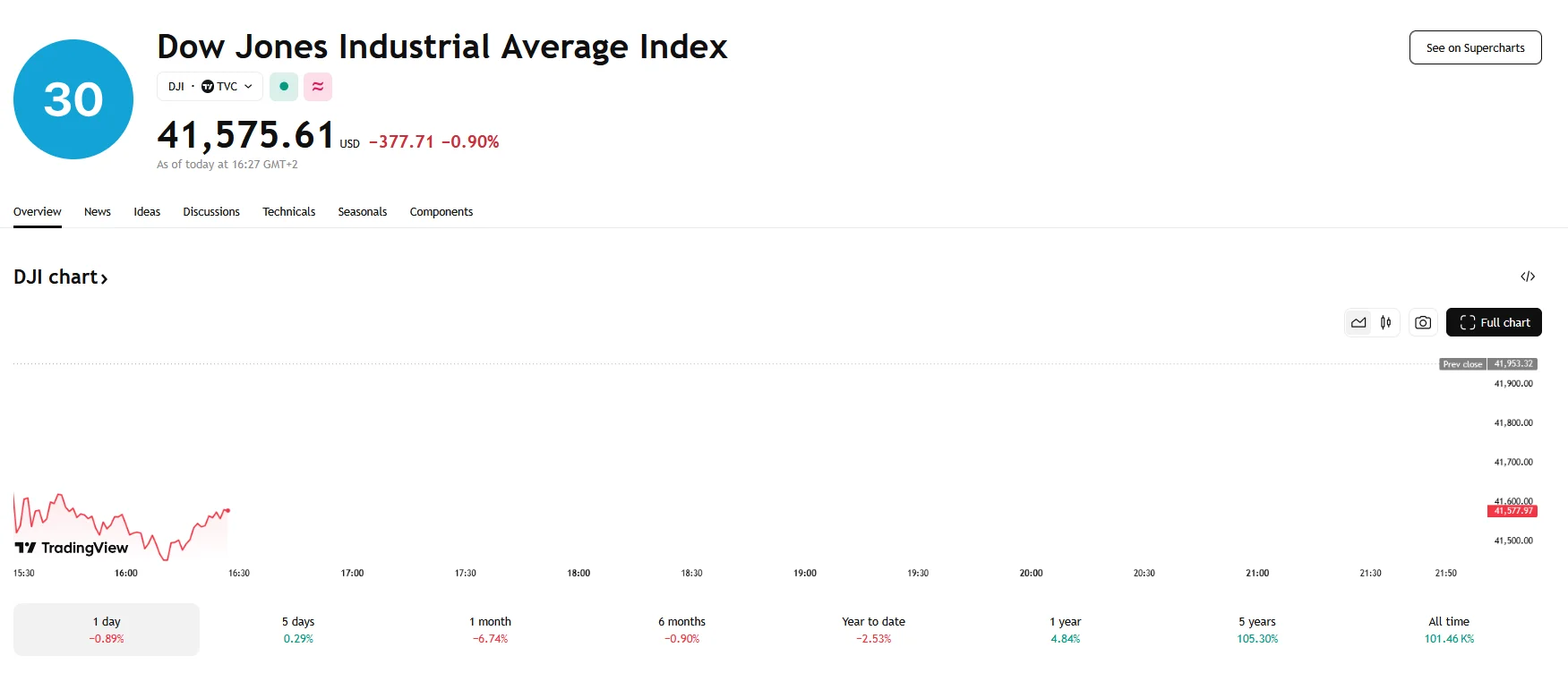

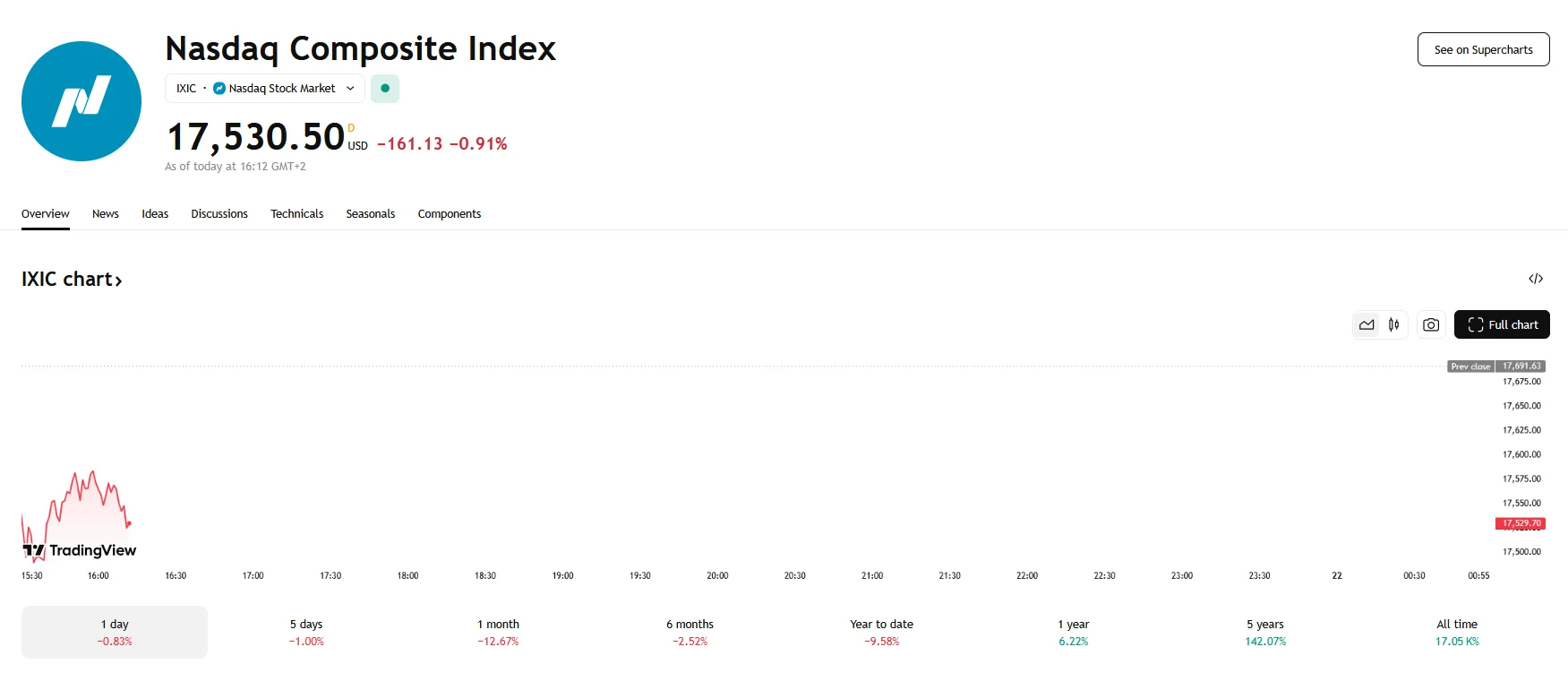

- Friday saw U.S. stock indices decline, with the Dow Jones Industrial Average and the Nasdaq Composite dropping by almost 1%.

- The S&P 500 fell 0.68%.

- President Trump’s upcoming trade policies continue to weigh on market sentiment.

Wall Street Wobbles, Major Indices Struggle as Potential Trade Tensions Grip Markets

U.S. stock indices experienced a downturn on Friday, with the Dow Jones Industrial Average falling by 0.90% and the Nasdaq Composite declining by 0.91%. The S&P 500 also retreated, dropping 0.68% as markets faced the implications of President Donald Trump’s upcoming policies.

This decline extends a period of market instability, with the S&P 500 now on track for yet another week of losses. The Nasdaq is also poised to record its fifth consecutive weekly loss. Investor sentiment has been increasingly bearish, marked by concerns over potential economic repercussions stemming from trade tensions and fluctuating economic forecasts.

Earlier this week, a brief rally occurred following the Federal Reserve’s decision to maintain interest rates and its initial economic outlook. However, subsequent analysis of the Fed’s projections revealed underlying concerns. The central bank’s updated forecasts indicated higher inflation and reduced economic growth, raising fears of a potential economic slowdown.

Trump’s upcoming trade policies, scheduled to go live on April 2nd, have further exacerbated market anxiety. The uncertainty surrounding potential trade tensions has led to increased volatility, with investors wary of the potential impact on corporate earnings and economic stability. The situation has also led to corporations becoming more cautious in their capital spending and hiring.

Treasury yields also reflected this market apprehension, with the 10-year yield declining to 4.22%. This drop in yields signals growing investor concerns about potential economic deceleration as tariffs threaten to disrupt global trade and slow down economic growth.

Despite reassurances from Federal Reserve Chair Jerome Powell regarding the manageability of trade-related economic impacts, the market remains on edge. The mixed messages and the approaching policy deadline have created a climate of uncertainty, contributing to the ongoing market decline. The day’s trading was also influenced by the expiration of options, which added to the volatility.