Key moments

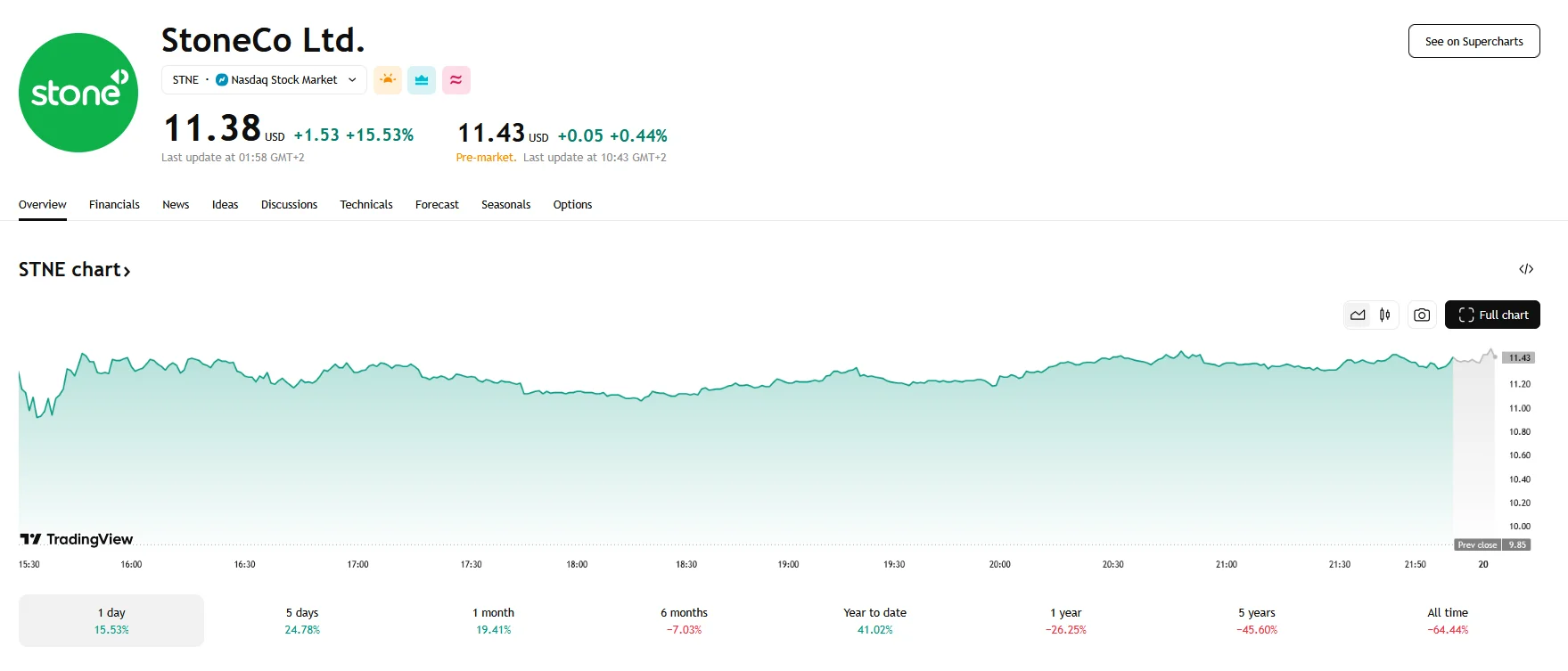

- StoneCo’s stock surged 15.53% to close at $11.38 on Wednesday.

- Investor confidence was bolstered by StoneCo’s strong financial report, according to which the company’s fourth-quarter net income rose 18.1%.

- StoneCo’s earnings per share also saw an increase, reaching $2.21.

StoneCo Delivers Strong Q4, Fuelling 15% Stock Price Increase

The Brazilian financial technology firm, StoneCo Ltd. (NASDAQ:STNE), experienced a notable surge in its stock value on Wednesday, culminating in a 15.53% increase with shares closing at $11.38. Pre-market trading has also been promising, indicating a continuation of the positive momentum as the stock gained an additional 0.44%. This significant upward movement was largely attributed to the company’s recently released financial report, which showcased robust performance and exceeded market expectations.

The firm’s fourth-quarter financial results demonstrated substantial growth. Specifically, StoneCo reported a net income of R$665.6 million, marking an increase of 18.1% compared to the same period in the previous year. Additionally, the company’s revenue saw an 11.1% increase, climbing to R$3.609 billion from R$3.248 billion.

Further bolstering investor confidence was the company’s earnings per share (EPS). StoneCo reported an EPS of $2.21, surpassing analysts’ estimates of $2.00. This outperformance highlighted the company’s ability to exceed market expectations and deliver strong financial results.

Looking at the broader annual performance, StoneCo’s net income for the entire year of 2024 witnessed a remarkable 41.3% growth, reaching R$2.2 billion compared to R$1.557 billion in the previous year. The company’s annual revenue also experienced a 10% increase, rising to R$13.257 billion from R$12.055 billion.

Despite the strong performance, StoneCo’s leadership has adopted a cautious outlook for the upcoming year. The company anticipates potential challenges stemming from projected increases in long-term interest rates, which could impact economic activity. In light of these uncertainties, StoneCo’s CEO, Pedro Zinner, emphasized the importance of prudent capital structure management to navigate potential volatility and emerging opportunities.