Key moments

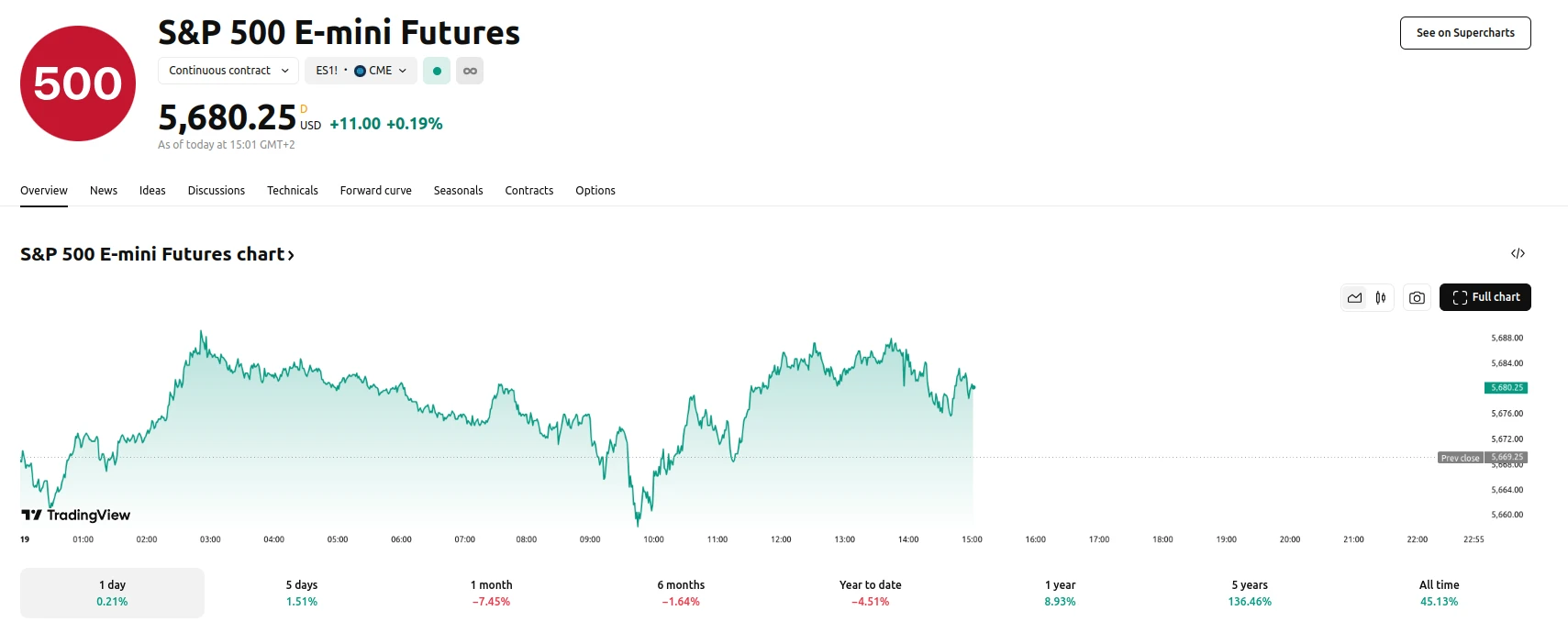

- Anticipation builds as S&P 500 futures experience modest gains ahead of the Federal Reserve’s policy announcement.

- Market volatility persists, with significant losses recorded on Tuesday following a brief period of recovery.

- Traders closely monitor the Federal Reserve’s economic forecasts, particularly regarding interest rates, GDP, inflation, and employment.

Pre-Fed Decision Market Fluctuations and Economic Outlook

Ahead of the Federal Reserve’s scheduled policy decision, U.S. equity futures demonstrated a slight upward trend. Market futures showed positive movement, as S&P 500 E-mini Futures futures increased by 0.2%, Nasdaq-100 futures by 0.3%, and Dow Jones futures added 0.1%.

However, this positive movement follows a period of significant volatility. Tuesday saw a sharp decline in major market indices, reversing gains from the preceding two trading sessions. The Dow Jones Industrial Average experienced a 0.6% drop, while the S&P 500 fell by more than 1%, placing it 8.6% below its February peak. The Nasdaq Composite also suffered a 1.7% decrease, with notable declines in technology sector stocks such as Tesla, Palantir, and Nvidia. This volatility highlights the uncertainty surrounding the U.S. economic outlook.

Investors are particularly focused on the Federal Reserve’s projections for future interest rate adjustments, as well as its assessments of economic indicators such as GDP, inflation, and unemployment. The central bank’s communication will be crucial in providing clarity to market participants navigating a period of economic ambiguity. The current market environment necessitates a reassessment of long-term investment strategies in light of potential near-term fluctuations. This period of market adjustment also reflects concerns related to recent economic data and uncertainties surrounding trade policies, as exemplified by the S&P 500 entering correction territory and the Nasdaq remaining in a correction phase.