Key moments

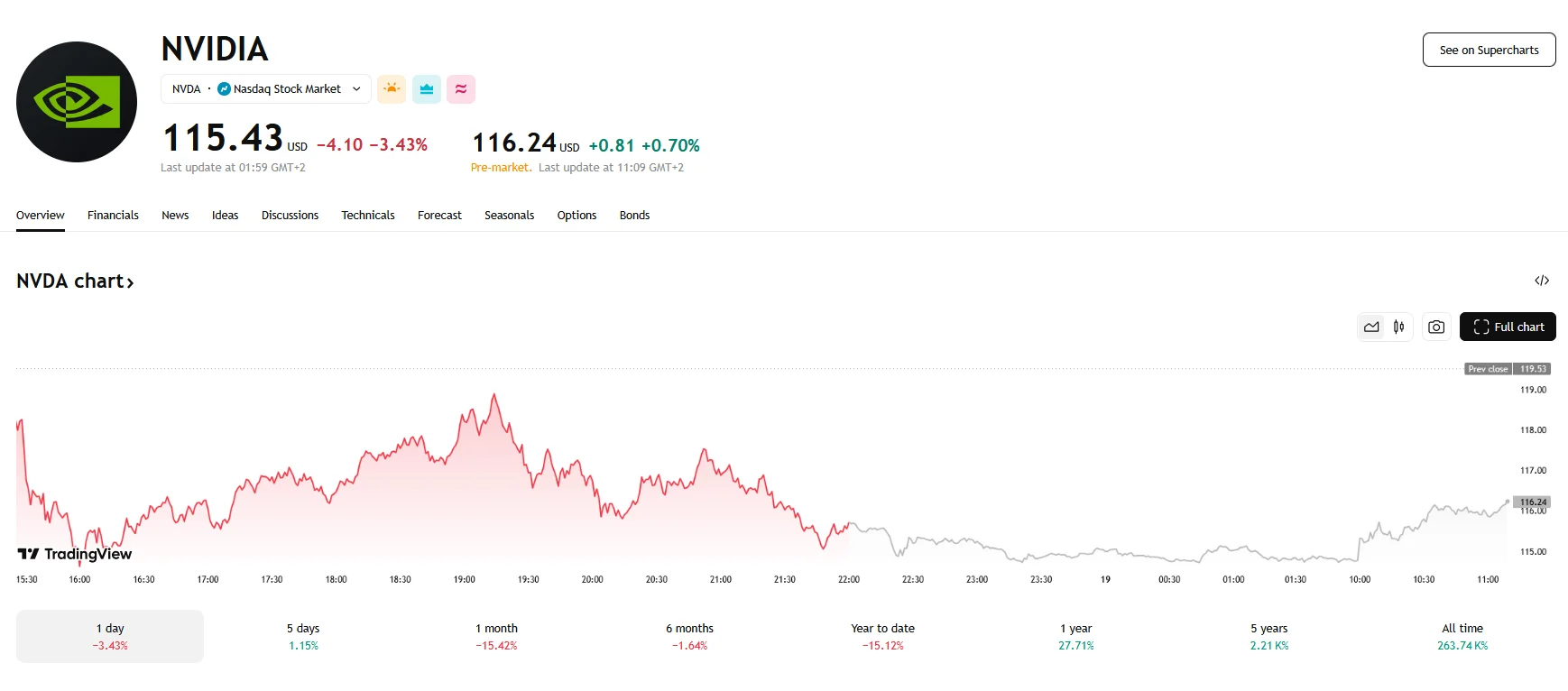

- Nvidia shares plummeted 3.43% to close at $115.43 on Tuesday.

- CEO Jensen Huang’s presentation on Nvidia’s future and AI advancements did not impress investors.

- Despite the daily drop, pre-market figures reached $116, and Nvidia’s market cap remains at $2.83 trillion.

Huang’s GTC Conference Speech Underwhelmed Investors

А highly anticipated keynote address from CEO Jensen Huang during the GPU Technology Conference (GTC) on Tuesday did not meet investor expectations, causing Nvidia’s share price to fall sharply. The stock closed at $115.43, which marked a 3.43% drop. This decline occurred within a context of fluctuating market sentiment as the stock, which reached a record high earlier in the year, has been experiencing frequent drops in March.

Investors were not swayed by Huang’s detailed presentation, which covered Nvidia’s future plans and AI technology breakthroughs. While the launch of the Blackwell and Rubin chip designs, along with partnerships like that with General Motors for AI manufacturing, evidenced Nvidia’s sustained innovation, the market’s muted response stemmed from the absence of unforeseen income channels.

The stock’s performance in early 2025 has been marked by a broader trend of pressure, with a 14% decrease since the year’s commencement. The stock’s decline has been exacerbated by worries about excessive expenditure on artificial intelligence infrastructure, alongside ambiguity regarding trade regulations. The GTC conference was anticipated to provide a transformative event, a “game-changer,” as some experts put it, capable of generating immediate revenue. However, the company’s focus remained on prolonged ventures, such as robotics and quantum computing, which, despite their potential, are not projected to produce significant profits in the short term.

However, it should be noted that pre-market figures hinted at a higher valuation of $116, and Nvidia’s market capitalization currently stands at $2.83 trillion. Moreover, BofA Securities opted to reiterate their Nvidia “Buy” rating, keeping the price target at $200, as the GTC event provided BofA Securities analysts with compelling evidence of Nvidia’s ongoing market dominance.

A pivotal aspect of Nvidia’s technological advancement lies in its exploration of optical chip technology. Huang detailed plans to integrate co-packaged optics into networking chips within server switches, emphasizing the potential for significant energy efficiency gains. Despite its potential advantages, the CEO made it clear that the technology does not currently meet the robustness standards necessary for broad integration into Nvidia’s primary graphics processors. The established and significantly superior reliability of copper-based links is the primary reason for this current limitation.