Key moments

- Yum Brands partners with Nvidia to enhance AI integration across its Taco Bell, KFC, and Pizza Hut restaurants.

- The collaboration aims to deploy AI-driven order-taking, computer vision, and performance assessments.

- Yum’s strategic shift involves leveraging Nvidia’s technology while retaining ownership of the AI intelligence through its Byte platform.

Yum Brands and Nvidia Forge AI Partnership to Transform Restaurant Operations

Yum Brands, the parent company of Taco Bell, KFC, and Pizza Hut, has announced a strategic partnership with Nvidia to accelerate the implementation of artificial intelligence within its restaurant operations. This collaboration will focus on deploying advanced AI technologies, including AI-powered order-taking systems, Nvidia-driven computer vision for operational efficiency, and AI-based restaurant performance assessments. The partnership signifies a significant step in Yum Brands’ ongoing efforts to enhance customer experience and streamline operations through technological innovation.

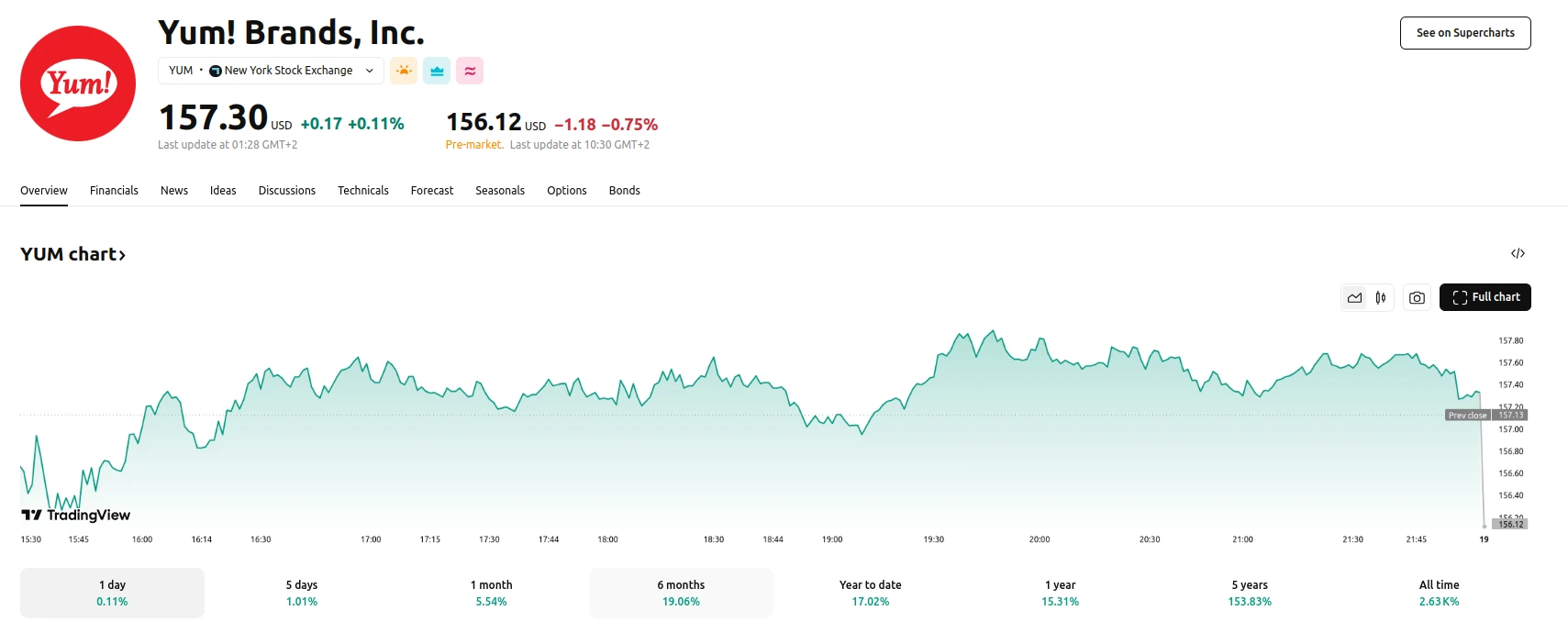

As of March 19, 2025, Yum Brands’ shares have risen 0.11% within the last trading day, and 17.02% YTD.

The move comes amidst a broader trend within the restaurant industry, where companies are increasingly investing in AI to optimize labor costs and improve operational efficiency. Fast-food chains, in particular, are exploring AI applications such as automated drive-thru order systems, order accuracy verification, and intelligent workforce scheduling. Yum Brands’ partnership with Nvidia represents a focused approach to integrating these technologies, leveraging Nvidia’s expertise in AI hardware and software.

Yum Brands’ strategic approach involves integrating Nvidia’s technology into its existing Byte platform, which consolidates the company’s internal tech operations. This allows Yum to maintain ownership of the AI intelligence, enabling customization and the integration of advanced AI models as needed. Pilot programs utilizing Nvidia technology are already underway in select Pizza Hut and Taco Bell locations, with a broader rollout planned for over 500 restaurants in the second quarter of 2025.

This partnership is Nvidia’s first major venture into the restaurant industry, and it reflects Yum’s proactive approach to adopting cutting-edge technology to maintain a competitive edge. The financial terms of the partnership have not been disclosed, but both companies have expressed commitment to finalizing definitive agreements. The companies’ market capitalizations differ significantly, with Nvidia valued at $2.9 trillion and Yum Brands at $43.8 billion.