Key moments

- February’s Canadian Consumer Price Index (CPI) is projected to indicate a slight uptick in annual inflation, moving from 1.9% to 2.1%.

- Bank of Canada (BoC) recent interest rate cut of 25 basis points to 2.75% amidst trade war concerns, with potential for a policy pause influenced by inflation data.

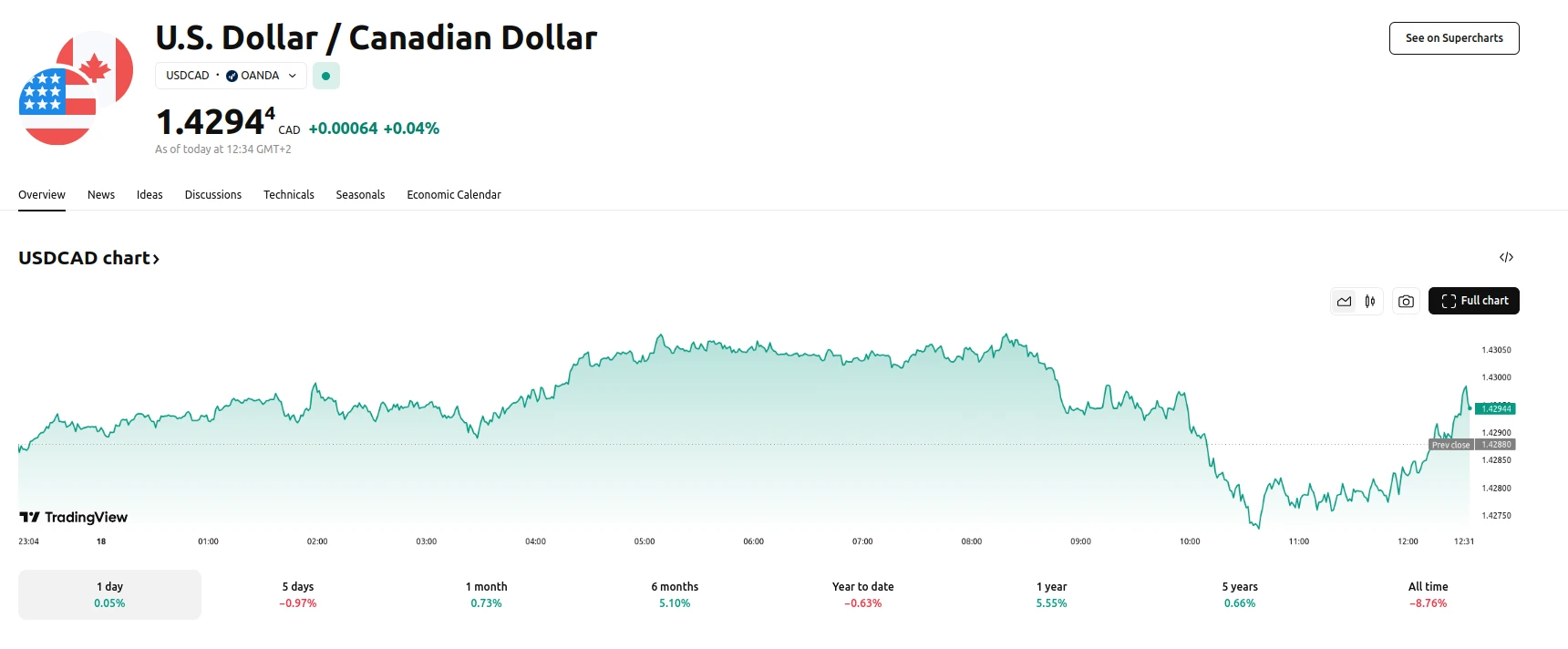

- USD/CAD pair currently trading around 1.4300, with market sentiment and inflation data anticipated to drive near-term fluctuations.

Canadian Inflation Data and Monetary Policy Under Trade War Scrutiny

Statistics Canada is set to release the February inflation report, with expectations of a slight increase in the annual CPI. This anticipated rise, while not considered alarming, introduces a layer of complexity to the Bank of Canada’s (BoC) monetary policy decisions. Reflecting anxieties about economic deceleration amid ongoing U.S. trade disputes, the central bank enacted its seventh successive interest rate cut, bringing the benchmark to 2.75%.

The BoC’s decision to lower interest rates was influenced by the implementation of 25% tariffs on Canadian steel and aluminum exports to the U.S. However, these tariffs also present an inflationary risk, potentially leading the BoC to reconsider its current easing cycle. The upcoming inflation data will be crucial in determining the central bank’s future policy direction.

Even with the market experiencing fluctuations, the USD/CAD pair has remained relatively stable, trading in the approximate range of 1.4300. Market sentiment, coupled with the release of the inflation report, is expected to drive near-term movements in the pair. Analysts suggest that higher-than-expected inflation figures could strengthen the Canadian Dollar, while lower figures might prompt further rate cuts. A considerable inflationary spike, however, could cast doubt on the Canadian economy’s robustness, with the potential to diminish the value of the Canadian dollar. The interplay between inflation data, BoC policy, and trade dynamics will continue to shape the Canadian Dollar’s trajectory.