Key moments

- Significant stock value decline across major UK supermarkets, including Tesco, Sainsbury’s, and Marks & Spencer, following Asda’s announcement of increased price competition.

- Asda’s strategic shift towards price reductions and enhanced in-store staffing, despite projected profit decreases, triggers market concerns.

- Analysts express uncertainty regarding Asda’s ability to sustain its price-cutting strategy and the potential for a broader grocery price war.

UK Supermarket Stocks Plummet Amidst Asda’s Price War Strategy

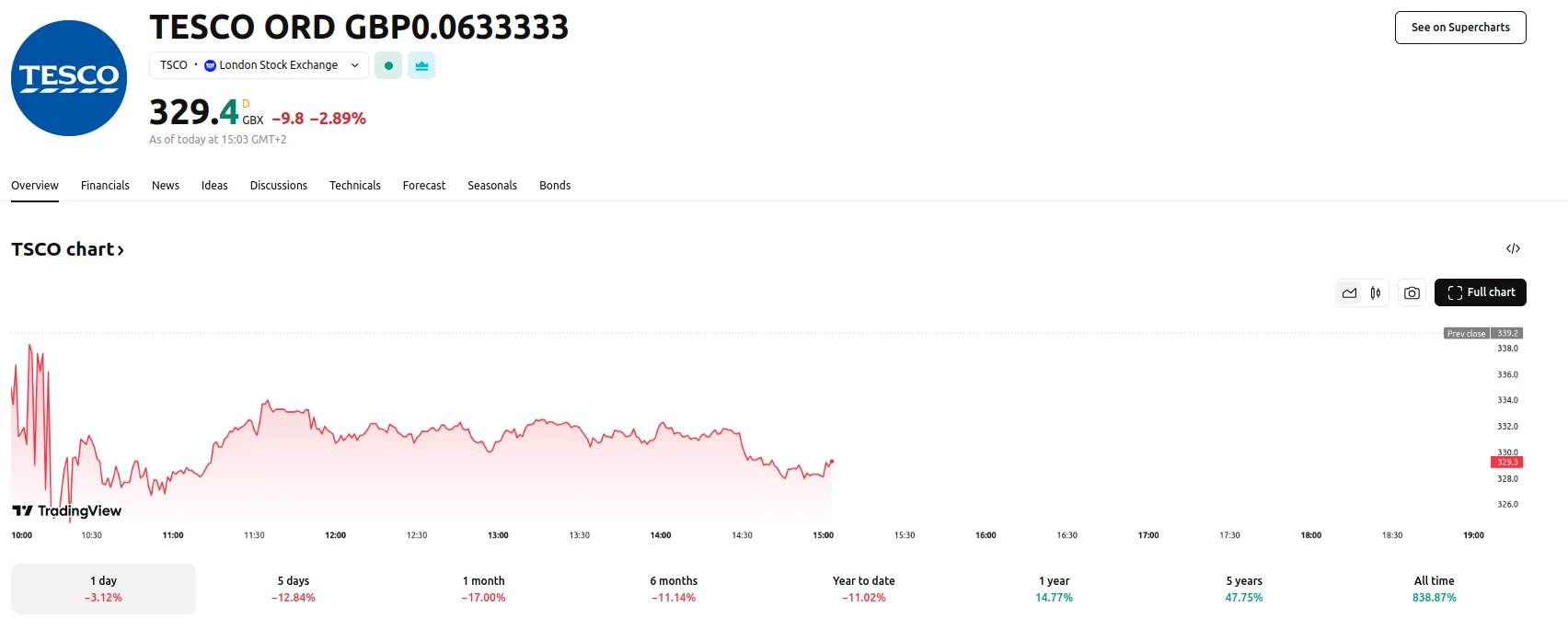

The UK’s major supermarket chains have experienced a substantial drop in stock value, with over £3.5 billion wiped off the combined market capitalization of Tesco, Sainsbury’s, and Marks & Spencer since Friday. This market downturn follows Asda’s declaration of its intention to intensify price competition, signaling a potential escalation of the ongoing grocery price war. Tesco, the market leader, saw the most significant decline, with its share price falling by more than 3% within the last day and -12.84% within the last five days, while Sainsbury’s and Marks & Spencer also experienced notable decreases.

Asda’s strategic adjustment involves a commitment to lowering prices and increasing staffing levels, despite anticipating a reduction in profits. This move is aimed at regaining market share lost to competitors in recent years. Analysts, however, have raised concerns regarding Asda’s capacity to maintain these price cuts, particularly if sales volumes do not significantly improve. The sustainability of Asda’s strategy is questioned, with some analysts suggesting that the announced measures may be difficult to implement if the company does not see a quick return in sales.

The market’s reaction reflects anxieties about a potential “irrational contagion” of price-cutting, which could negatively impact the profit margins of all major supermarkets. While Asda’s new chair, Allan Leighton, has emphasized the company’s financial reserves for tackling weak trading, analysts like Clive Black point out that Tesco and Sainsbury’s possess stronger balance sheets and broader customer bases, better positioning them to withstand competitive pressures. The overall market sentiment is one of caution, as the industry braces for potential shifts in pricing strategies and consumer behavior.

Asda’s strategic repositioning comes amidst a period of restructuring following its 2021 buyout. The company’s efforts to regain lost market share are seen as a long-term project, with Leighton estimating a five-year turnaround period. The market’s immediate response, however, underscores the potential for significant disruption within the UK grocery sector.