Key moments

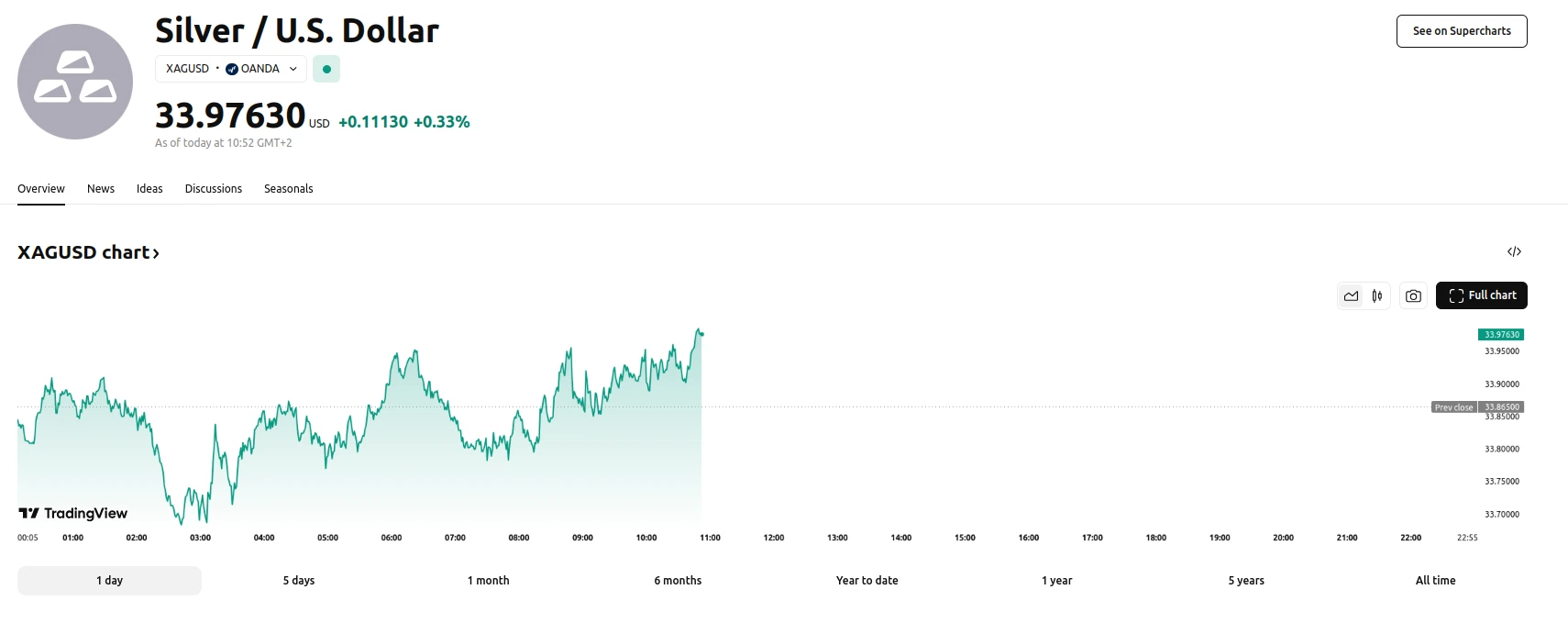

- Driven by increased demand for secure investments, silver prices maintained a level near $33.96.

- President Trump’s tariff threats on European goods intensify global trade concerns, bolstering silver’s appeal.

- Growing expectations of Federal Reserve rate cuts, following subdued US inflation data, provide further support to silver prices.

XAG/USD Maintains Strong Position near $34.00, Influenced by Global Trade Disputes and US Monetary Policy Outlook

Silver (XAG/USD) has demonstrated resilience, maintaining a strong position near the $34.00 mark, reflecting upward movement for four days in a row. This stability is largely attributed to the heightened demand for secure investments, as global trade tensions continue to escalate. The recent threat of a 200% tariff on European wines and champagnes, issued by US President Donald Trump, has significantly contributed to market anxiety, thereby increasing the appeal of silver as a low-risk asset.

The precious metal is also benefiting from the evolving expectations surrounding US monetary policy. The release of weaker-than-anticipated US inflation data has reinforced market predictions of potential Federal Reserve rate cuts. The Producer Price Index (PPI) and Consumer Price Index (CPI) figures, both indicating a downward trend in inflationary pressures, have solidified these expectations. Silver, being a non-interest-bearing asset, becomes more attractive in environments where interest rates are expected to decline. This is due to the opportunity cost of holding silver being reduced when other interest-bearing assets are yielding less.

However, the potential for further gains in silver prices may be constrained by the strengthening US dollar. The dollar’s value, as tracked by the DXY against a basket of currencies, is presently fluctuating around 104.00. An appreciating dollar increases the cost of silver for those using other currencies, which could lead to reduced demand. In addition, US domestic policy discussions continue, with Senate Democratic Leader Chuck Schumer supporting a stopgap funding bill, and US Commerce Secretary Howard Lutnick outlining plans for budget balancing.