Key moments

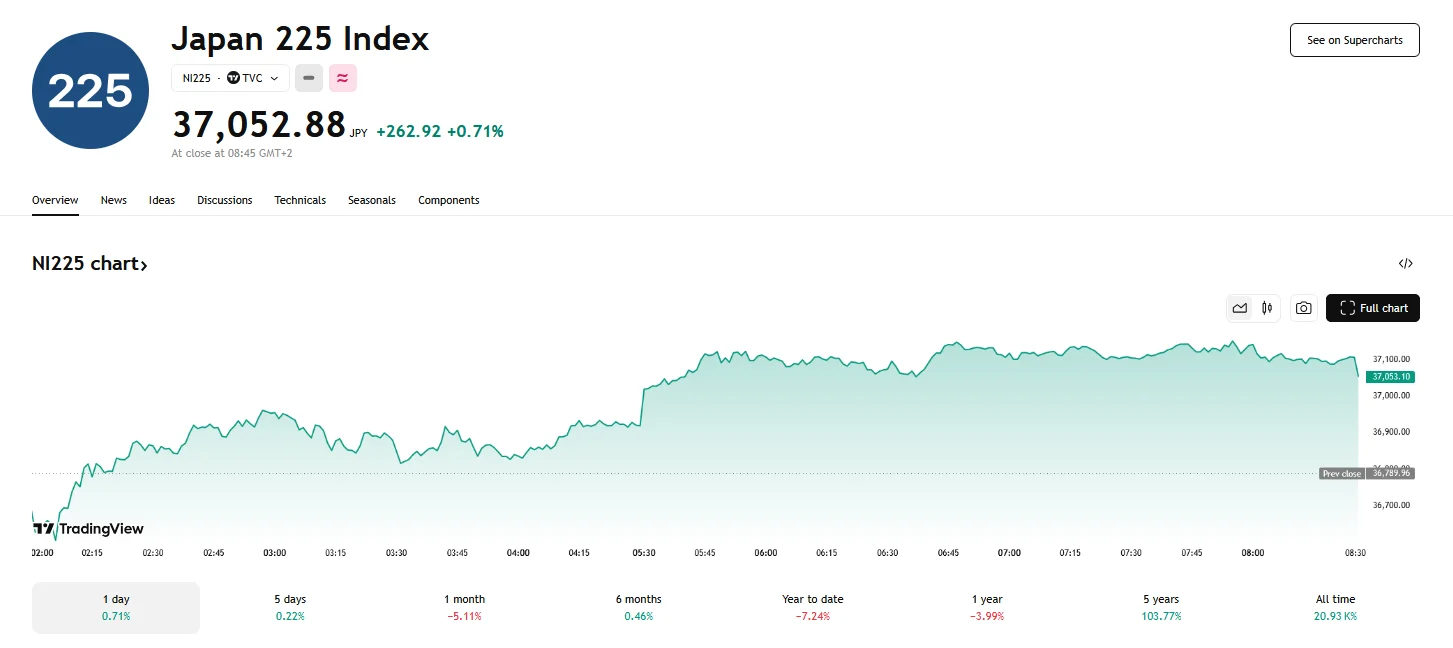

- Japan’s Nikkei 225 rose by 0.71% to 37,052.88 as stocks tied to chips surged. Furthermore, economists anticipate interest rate stability.

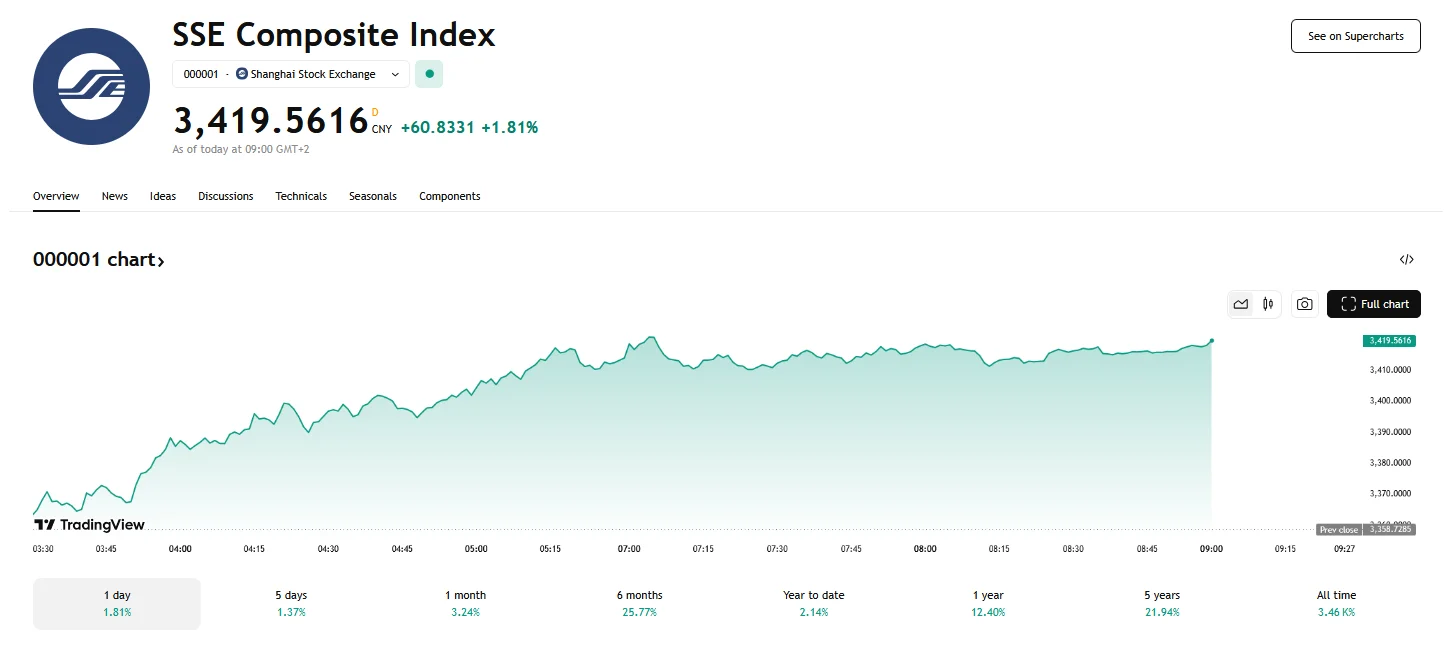

- China’s Shanghai Composite Index reached 3,419.5616, driving a broad Asian market rally.

- Beyond the Shanghai Composite, the CSI 300 Index and Shenzhen Component Index also achieved substantial increases, rising 2.43% and 2.26% respectively.

Asian Markets Surge as Nikkei and Shanghai Composite Hit Highs

The Asian financial landscape witnessed a notable surge on Friday, with key indices demonstrating robust growth. Japan’s Nikkei 225 index concluded trading at 37,052.88, marking a 0.71% increase, while the TOPIX Index also experienced a positive shift, rising by 0.65% to reach 2,715.85.

Within the Japanese market, specific stocks exhibited impressive performances. Manufacturers in the industry surrounding chips achieved notable gains, with Advantest rising by 5.3% while Tokyo Electron enjoyed a 0.75% hike. A prominent factor influencing the Nikkei’s performance is the anticipated stability of interest rates in Japan. According to a Reuters survey, economists largely predict that the Bank of Japan will maintain its current rate settings in March. This expectation provides a degree of certainty for market participants, even as concerns persist regarding the potential economic impact of U.S. President Donald Trump’s trade policies. The median year-end rate forecast for Japan remains at 0.75%, though projections suggest that rates could reach 1% by March 2026.

Meanwhile, Chinese markets experienced a significant upswing, with the Shanghai Composite index climbing by 1.81% to reach 3,419.5616. This upward trajectory represents the index’s peak performance for the year, signaling a renewed influx of domestic capital into broader market sectors. The CSI 300 Index also grew, rising by 2.43% to 4,006.5567, while the Shenzhen Component Index increased by 2.26% to 10,978.2984. The Hong Kong Hang Seng Index also mirrored the upward trend in Asia, hovering above the 24,020 mark with a 2.30% gain.

This positive market momentum in China is attributed to government directives aimed at stimulating consumer spending. State-run financial institutions have been tasked with enhancing consumer finance initiatives and facilitating credit accessibility. This intervention aims to address persistent economic challenges by encouraging increased consumer activity.