Key moments

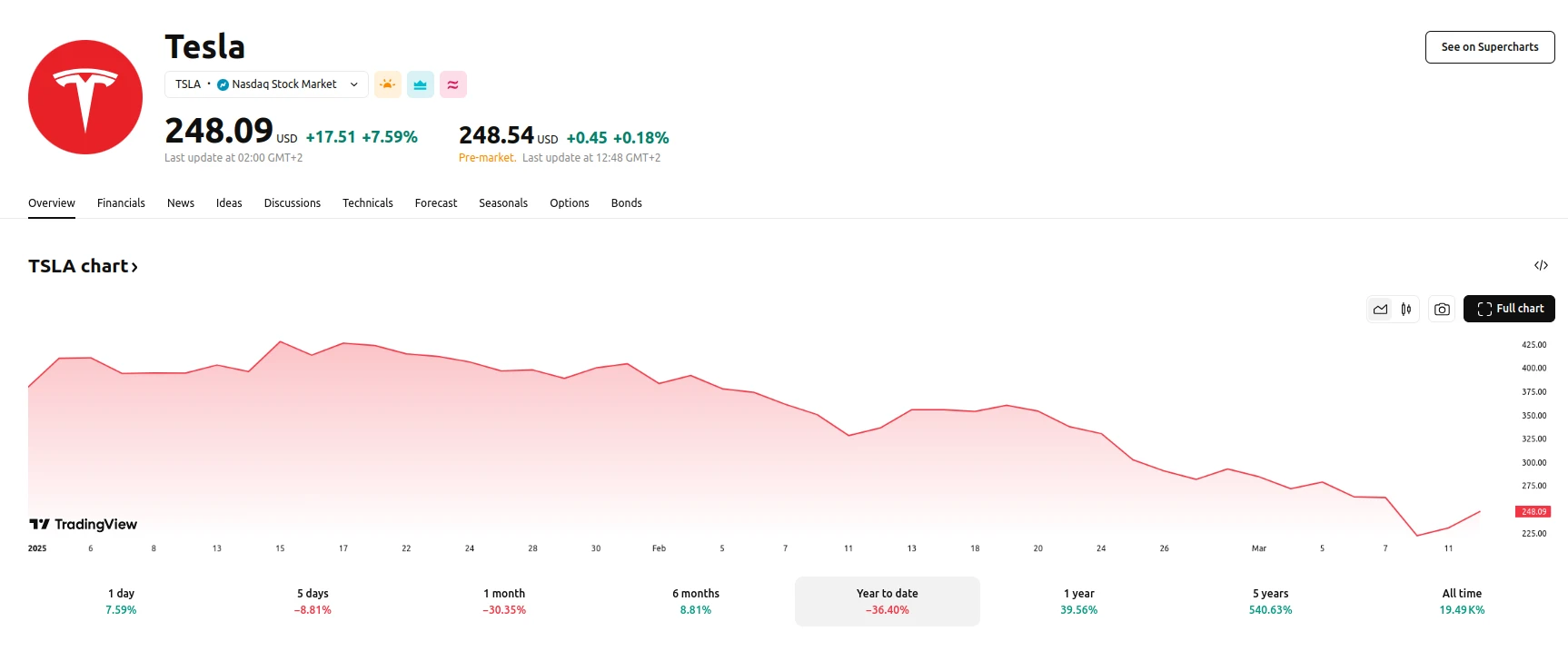

- Tesla’s year-to-date stock performance shows a 36.4% decline.

- JP Morgan reduces its Tesla price target to $120, citing expected delivery decreases.

- Public protests and boycotts impact Tesla’s brand perception and sales.

Tesla Stock Under Pressure Amid Delivery Concerns and Shifting Market Sentiment

Tesla’s stock has experienced a significant downturn, with a 36.4% year-to-date decrease. This decline reflects growing concerns among investors regarding the company’s future performance. JP Morgan has responded to these concerns by revising its price target for Tesla shares, lowering it from $135 to $120. This adjustment is based on the brokerage’s prediction of a second consecutive year of reduced vehicle deliveries. JP Morgan analysts anticipate Tesla delivering approximately 1.78 million vehicles in the current year, which represents a 1% decrease compared to the previous year. This projected decline in deliveries has contributed to a shift in market sentiment towards the electric vehicle manufacturer.

Furthermore, Tesla is facing challenges related to its brand perception. Public protests and boycotts have emerged, with demonstrations occurring at Tesla stores across the United States and globally. These expressions of disapproval are attributed to public reactions towards Elon Musk’s actions relating to his involvement in significant reductions to the U.S. federal workforce and the discontinuation of agreements providing resources for global humanitarian aid.

The evolving political landscape, including Elon Musk’s role within the Trump administration’s Department of Government Efficiency, has also contributed to the complexity of the situation. The President’s declarations regarding the protection of Tesla dealerships, while intended to show support, also highlight the tense atmosphere that surrounds the company. Despite a recent 10% rebound following a severe one-day drop, Tesla’s stock remains significantly below its peak, indicating the challenges the company faces in navigating both market and public perception.