Key moments

- Ongoing technical difficulties impede KYC verification and mainnet migration for Pi Network users.

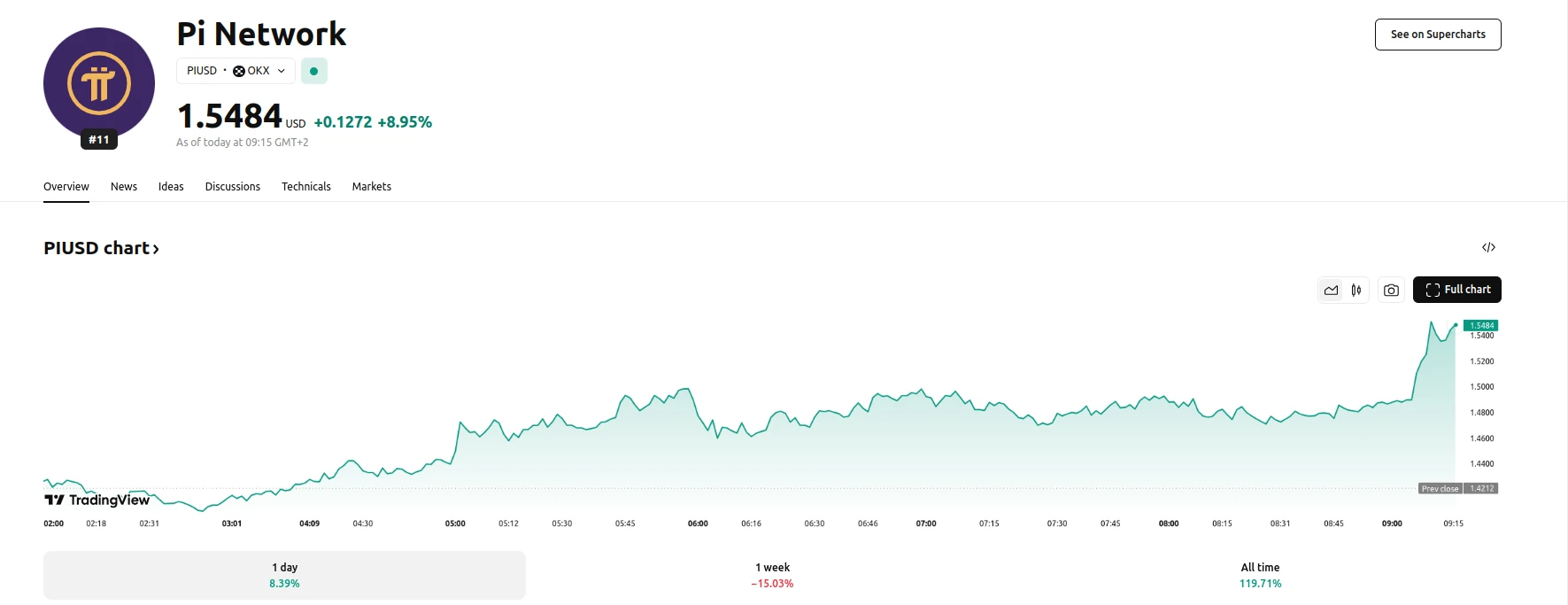

- Pi Coin experiences a 12% decrease in value within a week, trading at approximately $1.55.

- Community anticipation for a Binance listing remains high, despite no official announcement from the exchange.

Pi Network Faces Migration Hurdles and Listing Uncertainty

The Pi Network community is currently navigating a period of significant transition, characterized by persistent challenges in the mainnet migration process. Users, referred to as Pioneers, are encountering obstacles in completing the necessary Know Your Customer (KYC) verification, a crucial step for transferring their accumulated Pi Coins to the mainnet. Despite the implementation of a grace period, technical complications continue to hinder the migration process, resulting in growing user frustration. These issues are creating delays and uncertainties for many within the network.

Simultaneously, the market performance of Pi Coin has demonstrated a downward trend. The cryptocurrency has seen an approximately 12% reduction in its trading value over the past week, settling at approximately $1.55 as of Wednesday. This decline reflects a degree of market skepticism, influenced in part by the lack of clarity surrounding a potential listing on the Binance exchange. A community vote in February revealed a strong preference for a Binance listing, with 87.1% of participants expressing support. However, Binance has yet to issue an official statement regarding the listing of Pi Coin.

The community’s attention is now focused on the upcoming Pi Day, scheduled for March 14th, which also marks the network’s sixth anniversary. There is a sense of hope that Binance might use this occasion to announce the listing of Pi Coin. Nevertheless, without explicit confirmation from Binance, the timing and likelihood of such a listing remain uncertain. The resolution of the KYC and migration issues, along with the outcome of the Binance listing speculation, will play a pivotal role in shaping the future of the Pi Network.