Key moments

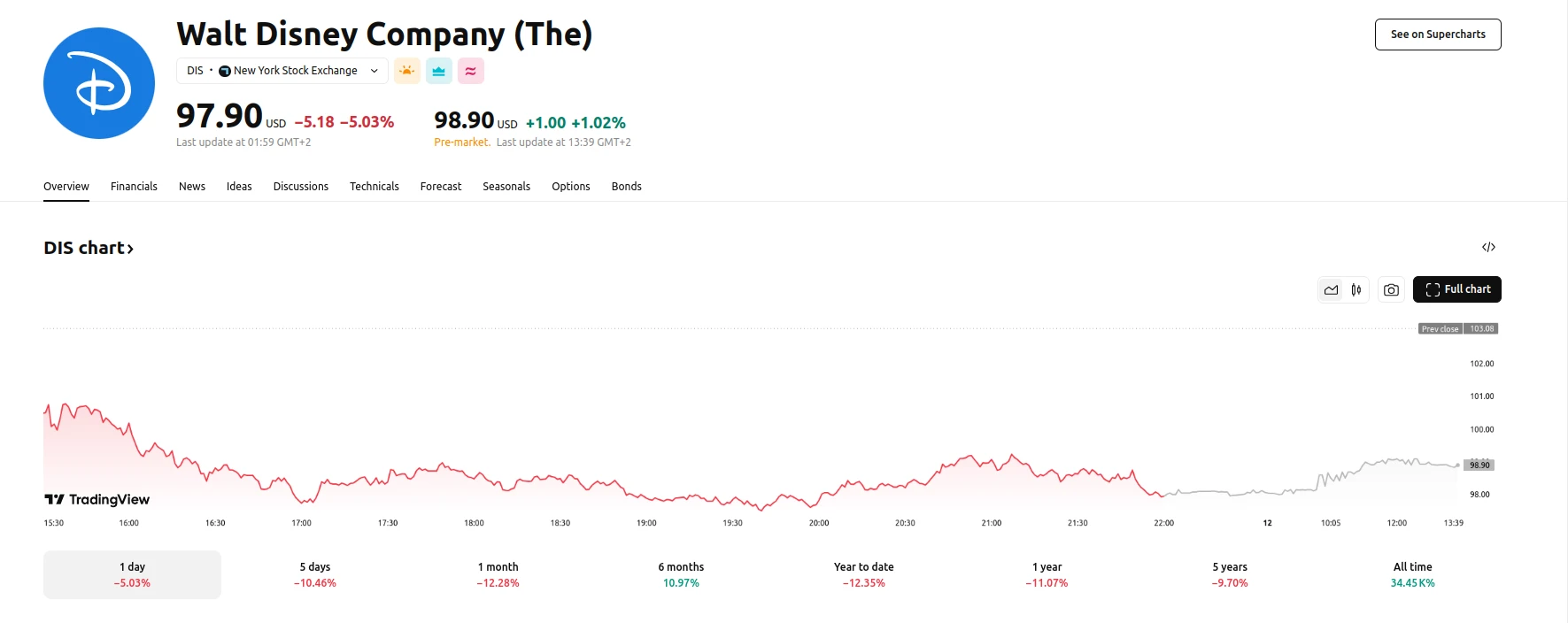

- Significant Stock Value Reduction: Disney’s stock experiences a 13.5% decrease within two weeks, marking a substantial drop unseen since November 2021.

- Consumer Sentiment Impact: Economic experts attribute the decline to waning consumer confidence and reduced discretionary spending, affecting sectors reliant on travel and leisure.

- Operational and Environmental Factors: Disney’s diverse business model and external factors, such as extreme weather and potential service adjustments, add to the company’s challenges.

Consumer Spending Concerns and Operational Challenges Contribute to Stock Drop

The recent decline in Disney’s stock price, moving from $113.80 to $98.44 for a period of less than two weeks, reflects growing concerns about consumer spending habits. The company has not experienced such a steep drop since November 2021. Economists point to declining consumer sentiment as a primary driver, noting that anxieties about rising prices are leading to reduced discretionary spending. With consumer spending constituting a significant portion of the economy, these reductions directly impact sectors like travel and entertainment, both central to Disney’s operations. The data suggests a correlation between the current market downturn and a broader trend of consumers prioritizing essential spending over leisure activities.

Beyond general economic trends, Disney faces specific operational hurdles. The company’s diverse portfolio, encompassing theme parks, streaming services, and movie production, presents unique challenges. While Fitch Ratings maintains a stable outlook for Disney’s Experiences segment, citing potential for growth through capital investment, recent earnings calls have indicated a decline in U.S. theme park income. This decline has been attributed to factors such as adverse weather conditions, including hurricanes, which impacted attendance and revenue. Additionally, the company is grappling with the lingering effects of the COVID-19 pandemic, with some experts suggesting that the surge in stock value during 2021 was artificially inflated by government stimulus measures. The reduction in some basic services following the pandemic is also seen as a contributing factor to reduced customer satisfaction.

Further analysis by experts like Albert Williams points to additional pressures, including the impact of climate change on Florida’s tourism. Increased summer temperatures are reportedly deterring visitors, impacting theme park attendance. Moreover, the current economic uncertainty, potentially exacerbated by trade tensions, is leading consumers to prioritize savings over discretionary spending. Williams suggests that Disney may need to re-evaluate its pricing strategies and service offering to address declining consumer satisfaction and stimulate demand.