Key moments

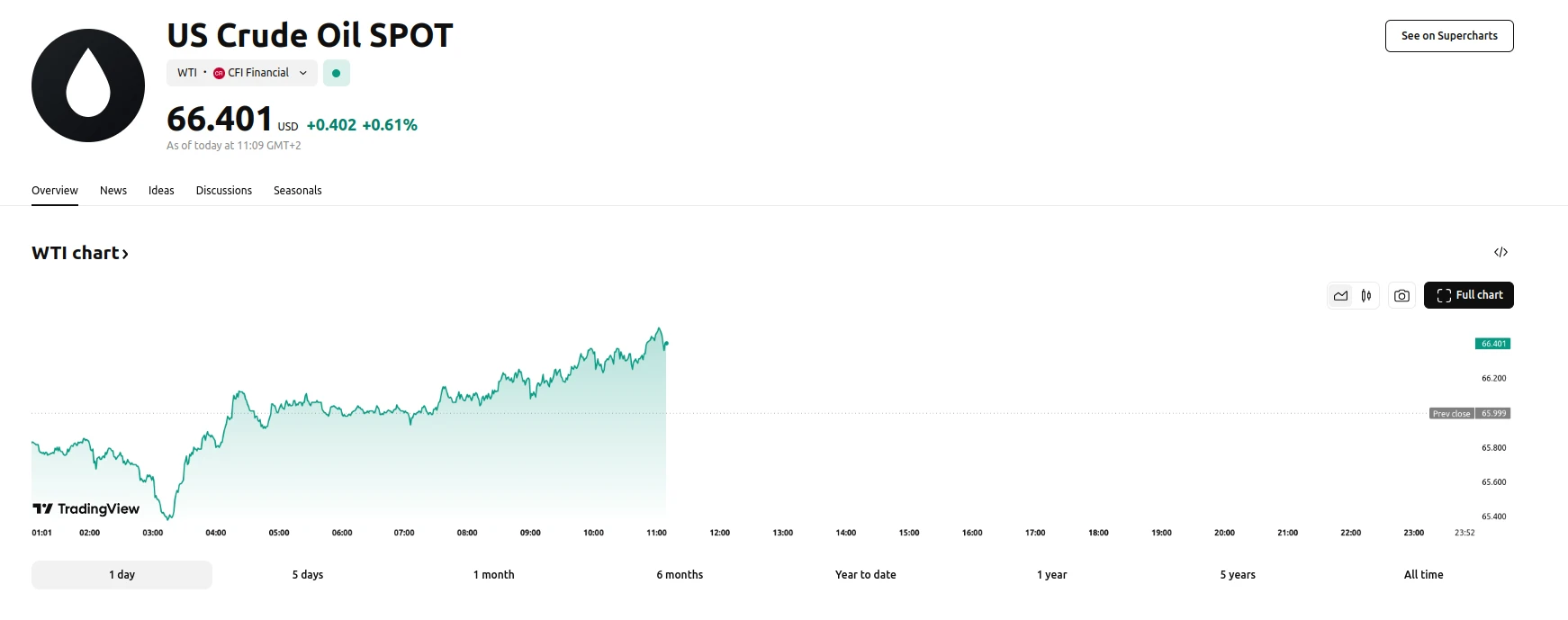

- WTI crude oil price experiences a modest increase, reaching approximately $65.90 per barrel, following previous session losses.

- Concerns regarding potential economic slowdown due to US tariffs and retaliatory measures from trading partners create market uncertainty.

- Economic indicators from China, a major oil importer, signal deflationary pressures, impacting global oil demand forecasts.

Global Trade Tensions and Economic Indicators Influence Oil Market

West Texas Intermediate (WTI) crude oil saw a slight recovery in early European trading, settling around $65.90 per barrel. This uptick follows a period of decline, but the market remains cautious due to prevailing economic uncertainties. The primary concern stems from the potential impact of US tariffs and the retaliatory measures implemented by key trading partners, including Canada and China. These trade disputes have raised fears of a broader economic slowdown, which could subsequently reduce global oil demand.

The imposition of tariffs by the US, and the subsequent countermeasures taken by countries like Canada and China, have introduced significant volatility into the market. Retaliatory tariffs, such as Ontario’s increase in electricity prices for US consumers and China’s tariffs on US agricultural products, illustrate the escalating trade tensions. These actions have contributed to concerns about a potential disruption in global economic growth, which is a key driver of oil demand. Furthermore, President Trump’s characterization of the economy as being in a “transition period” has been interpreted by investors as a potential indication of an impending economic downturn.

Adding to the market’s apprehension are the economic indicators emanating from China, a leading global oil importer. Recent data suggests deepening deflationary pressures within the Chinese economy, despite governmental stimulus initiatives. The observed decline in consumer and factory-gate prices has raised concerns about the country’s economic health and its potential impact on oil consumption. In addition, the announcement from OPEC+ regarding a potential increase in oil production in April, combined with the possibility of reversing that decision if market imbalances occur, creates further uncertainty.