Key moments

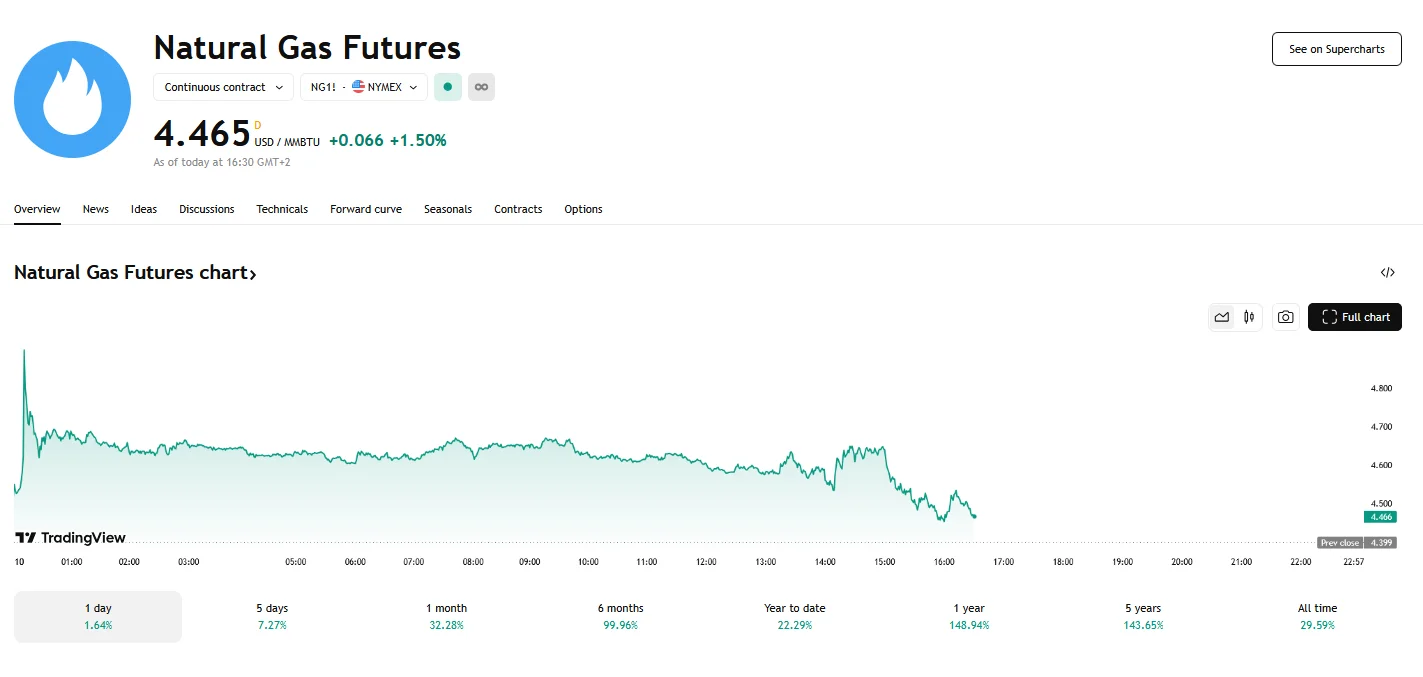

- U.S. natural gas futures have climbed past $4.60 per MMBtu.

- The U.S. is experiencing record liquefied natural gas (LNG) exports, adding significant pressure to domestic supplies.

- Despite entering winter with high inventory levels, a rapid drawdown due to extreme cold has pushed natural gas reserves below the five-year average.

Natural Gas Futures Have Reacted Positively to Environmental and Economic Forces

A dramatic surge has gripped U.S. natural gas markets, with futures contracts climbing above $4.60 per million British thermal units (MMBtu). This notable increase is driven by a complex interplay of environmental factors, heightened demand, and evolving supply dynamics. The recent price elevation is reflective of a broader trend, with the past year witnessing a staggering 160% increase in benchmark natural gas prices.

The primary driver behind this surge is a prolonged period of frigid temperatures, which has triggered a significant escalation in heating demand, placing immense pressure on natural gas inventories. This heightened demand has been further compounded by “freeze-offs,” where freezing temperatures disrupt production, leading to supply constraints.

Data from the U.S. Energy Information Administration (EIA) paints a stark picture of the inventory situation. While natural gas inventories began the winter heating season at levels not seen since 2016, a particularly harsh winter has rapidly depleted these reserves. Inventories have now fallen below the five-year average, a critical threshold that underscores the severity of the supply-demand imbalance.

Beyond domestic heating demand, the U.S. has seen an unprecedented surge in liquefied natural gas (LNG) exports. This record-breaking export activity has placed additional strain on available supplies, contributing to the tightening market. Furthermore, geopolitical tensions and uncertainties surrounding trade, including potential disruptions to Canadian gas exports, have added to the supply concerns.

With prices soaring, drilling activities are accelerating, signaling a potential “production wave.” Producers, who had previously cut back on output in response to lower prices, are now ramping up operations to capitalize on the lucrative market conditions. This resurgence in production is evidenced by an increase in gas rigs and a rise in dry gas production.

The industry anticipates further price strengthening in the coming year, driven by the continued expansion of LNG export facilities and rising global demand. This “strong gas, weak oil” pattern highlights the contrasting fortunes of the natural gas and oil sectors. While oil prices face headwinds from political uncertainties and global market conditions, the natural gas market is experiencing clear price signals that are incentivizing increased production.