Key moments

- Silver prices are currently testing near-term support at the $32.21 level, as indicated by the nine-day EMA.

- The 14-day RSI stays above the 50 threshold, reinforcing the prevailing bullish sentiment in the market.

- A recovery back into the established ascending channel would strengthen the positive outlook and pave the way for further price gains.

Silver Prices Are Experiencing Period of Consolidation, Testing Key Support Levels as Traders Weigh Bullish Indicators Against Potential Downside Risks

While gold has garnered significant investor attention by surpassing the key $2,100 per ounce level, silver is poised to enter a period of substantial value appreciation, potentially outperforming gold in terms of growth.

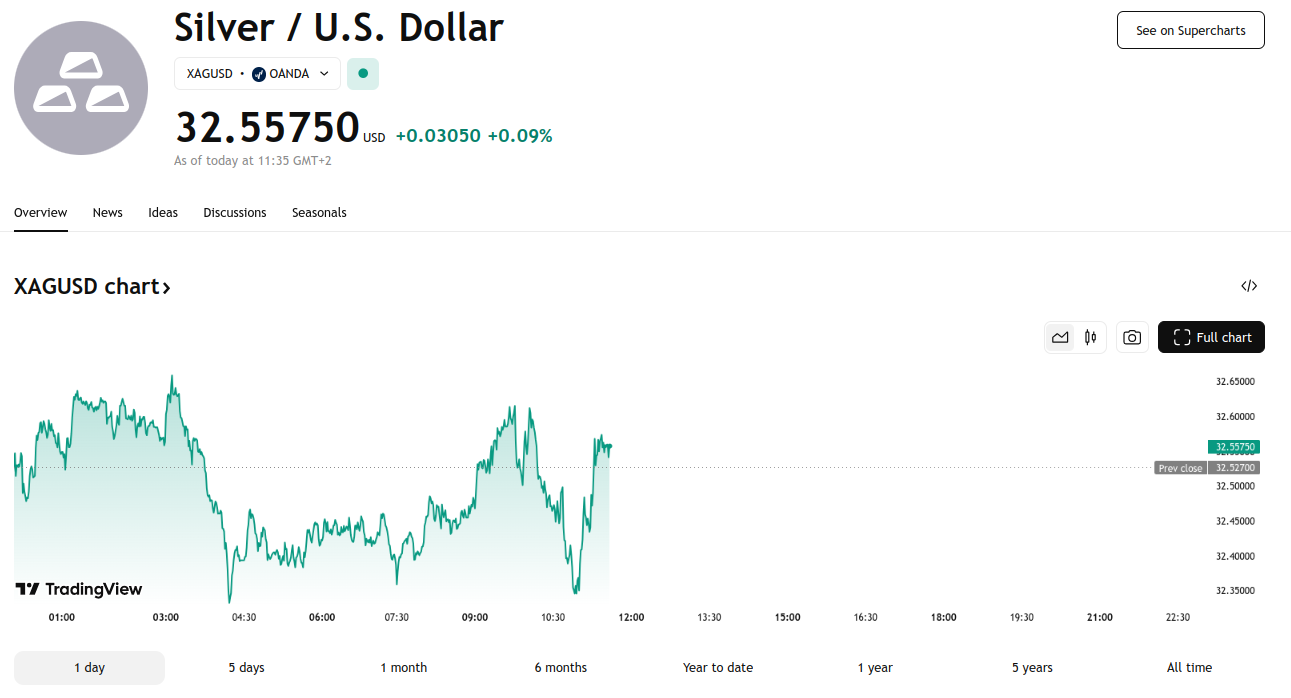

The silver price (XAG/USD) has experienced a three-day period of relative stagnation, trading around $32.55 during Monday’s European session. Technical analysis of the daily chart suggests a moderation of the bullish trend, with silver recently breaching an ascending channel formation.

Silver has maintained its position, supported by market expectations of Federal Reserve interest rate reductions and heightened safe-haven demand amidst ongoing trade tensions. The metal reached an intraday low of $32.32 before recovering, remaining within its current weekly trading range.

Silver prices remain above the nine-day and 50-day exponential moving averages (EMAs), signaling continued strength in short-term momentum. Furthermore, the 14-day relative strength index (RSI) remains above the 50 mark, confirming the presence of a bullish bias.

A successful return to the ascending channel pattern would reinforce the positive market outlook, potentially propelling silver prices to test the four-month high of $33.40, recorded on February 14. A breach of this level could drive prices towards the channel’s upper boundary at $34.20.

Should silver’s value decline, the XAG/USD pair could find its first line of defense at the nine-day EMA, positioned at $32.21. A drop below this point may dampen short-term bullishness, potentially pushing the price toward the $31.61 support area. Deeper declines could see support tested at the two-month low of $30.70, established on February 3.