Key moments

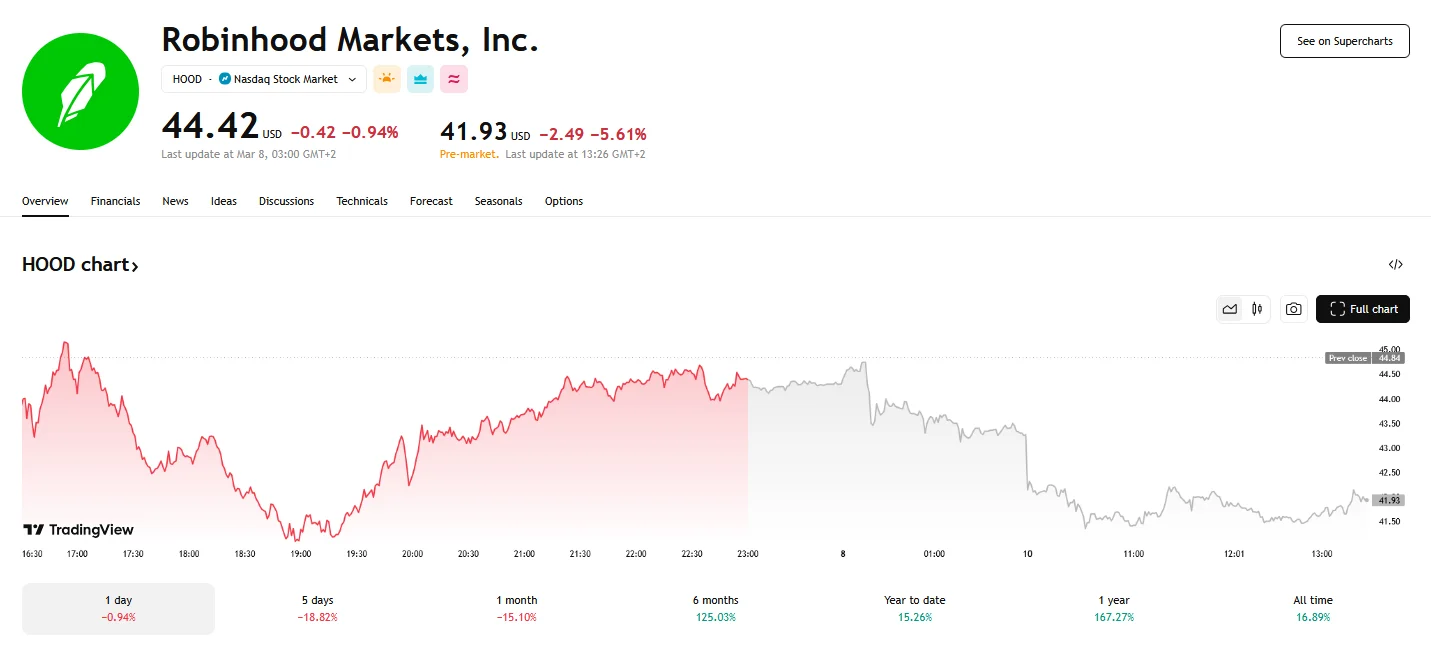

- Robinhood Markets’s share price dropped to $44.42.

- Reduced trading volume, down 39%, fueled market unease. Moreover, Chief Technology Officer Jeffrey Tsvi Pinner sold 5,853 shares of Robinhood stock last Wednesday.

- Robinhood settled a legal battle with FINRA for $29.75 million, paying a $26 million fine and $3.75 million in customer refunds.

Investor Concerns Mounted as Robinhood’s Shares Tumbled to $44.42

Robinhood Markets’s share price has experienced a noticeable decline, falling to $44.42. This figure represents a significant drop from its recent performance, and today’s price touched a low of nearly $41 earlier in the trading session. Contributing to the market’s apprehension was a substantial decrease in trading volume, which plummeted by 39% from the daily average.

The company’s stock faced further pressure following disclosures of insider selling. Chief Technology Officer Jeffrey Tsvi Pinner executed a sale of 5,853 shares last week, with each share averaging $46.81, culminating in a total transaction valued at $273,978.93. As a result, Pinner’s direct ownership was reduced by 25%.

Further adding to investor concerns, substantial volumes of shares were also divested by other company figures, including Daniel Martin Gallagher Jr. and Director Meyer Malka. These transactions, made public via Securities and Exchange Commission filings, played a role in fostering an atmosphere of investor apprehension.

Adding to Robinhood’s woes were regulatory settlements with the Financial Industry Regulatory Authority (Finra). The company was hit with a $26 million fine and had to pay a further $3.75 million in customer refunds. Finra’s findings highlighted several compliance lapses, including inadequate anti-money laundering programs, poor oversight of social media advertisements, and weak customer identity verification practices. These regulatory challenges were not isolated incidents. Robinhood had previously settled with the U.S. Securities and Exchange Commission (SEC) for $45 million over record-keeping and trade reporting violations.

Despite these setbacks, some institutional investors have shown continued interest in Robinhood. EPIQ Capital Group LLC, for instance, acquired a new position in the company during the fourth quarter, purchasing 6,510 shares. Other institutional investors, such as Dorsey & Whitney Trust CO LLC, First Horizon Advisors Inc., and Commerce Bank, also increased their holdings. However, hedge funds and institutional investors hold 93.27% of the stock.