Key moments

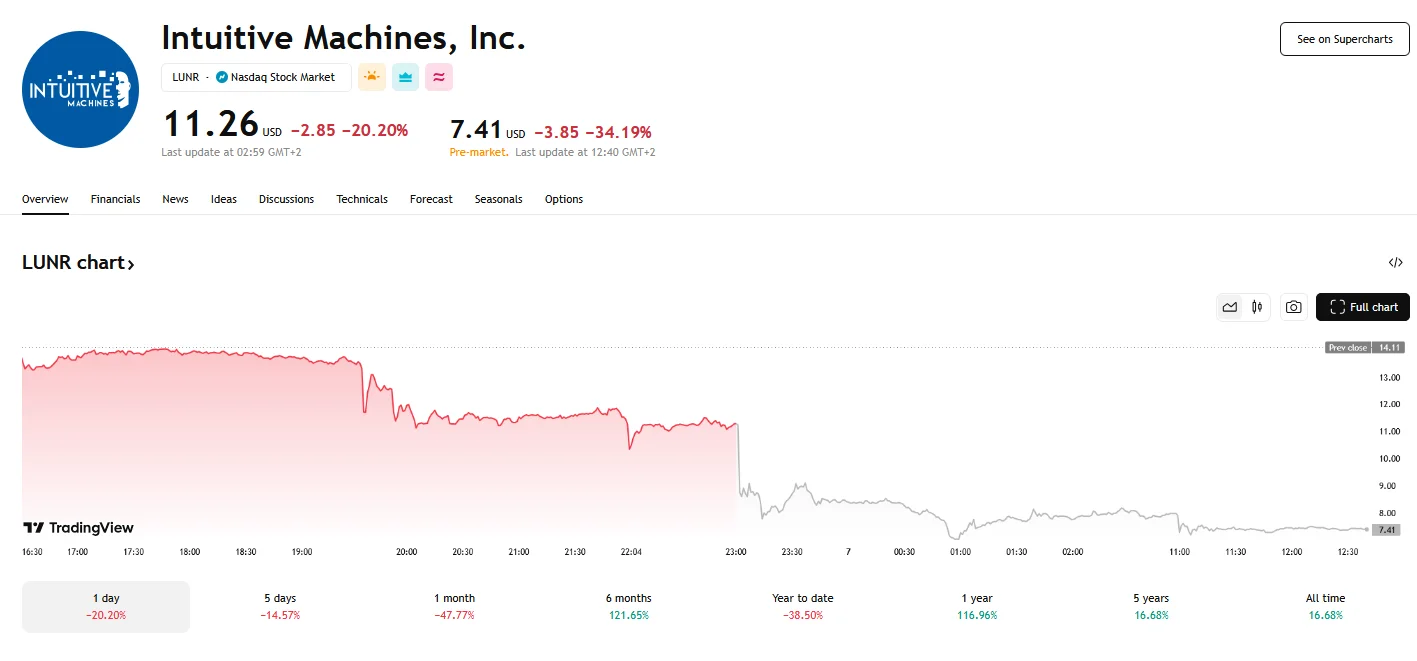

- Intuitive Machines’ stock plummeted 50% in 24 hours after its Athena lander’s uncertain lunar touchdown.

- Shares, closing at $11.26 on Thursday, dipped below $8 post-market, reaching a $7.05 low on Friday.

- The Athena mission’s landing difficulties echo past issues with the Odysseus lander. This pattern of landing precision problems has significantly diminished investor confidence.

The financial markets delivered a sharp rebuke to Intuitive Machines following the company’s latest lunar landing attempt, with stock prices experiencing a dramatic decline. Trading on Thursday concluded with shares valued at $11.26, and as after-hours trading commenced, a wave of concern swept through the investment community. This triggered a significant sell-off that drove the stock price to below $8.

The source of this market volatility stemmed from the ambiguous outcome of the Athena lander’s lunar touchdown. Although the lander did reach the moon’s surface, the live broadcast was abruptly terminated. Concerns were further fueled after company leadership confirmed that data from the Inertial Measurement Unit (IMU) indicated that the lander was likely not in an upright position. CEO Steve Altemus also mentioned that there were difficulties with the laser rangefinders.

The repercussions were immediate and substantial. During the standard trading session on Thursday, Intuitive Machines shares experienced a 20% decline. However, the after-hours trading period witnessed a further plunge, with shares plummeting by more than 30%. This downward trend persisted into Friday, with the stock price reaching a low of $7.05.

The difficulties encountered during the Athena landing bore a resemblance to the challenges faced during the company’s previous lunar mission involving the Odysseus lander. That mission resulted in a hard landing and subsequent toppling due to a malfunctioning laser altimeter. This recurring issue with landing precision raised questions about the company’s technological capabilities and its ability to execute successful lunar landings consistently.

Athena carried a payload of 11 scientific instruments designed to collect data from the lunar south pole, a region of particular interest due to the potential presence of subsurface water ice. The successful completion of this mission was considered crucial for advancing future lunar exploration efforts. Therefore, the uncertainty surrounding the lander’s status cast a shadow over the mission’s objectives and the company’s overall prospects.