Key moments

- HPE’s quarterly and full-year forecasts missed analyst estimates, leading to a significant drop in share price.

- The company announced a cost-reduction program involving layoffs, aiming for $350 million in savings by fiscal year 2027.

- HPE’s proposed acquisition of Juniper Networks faces legal challenges from the U.S. Justice Department, delaying the deal’s completion.

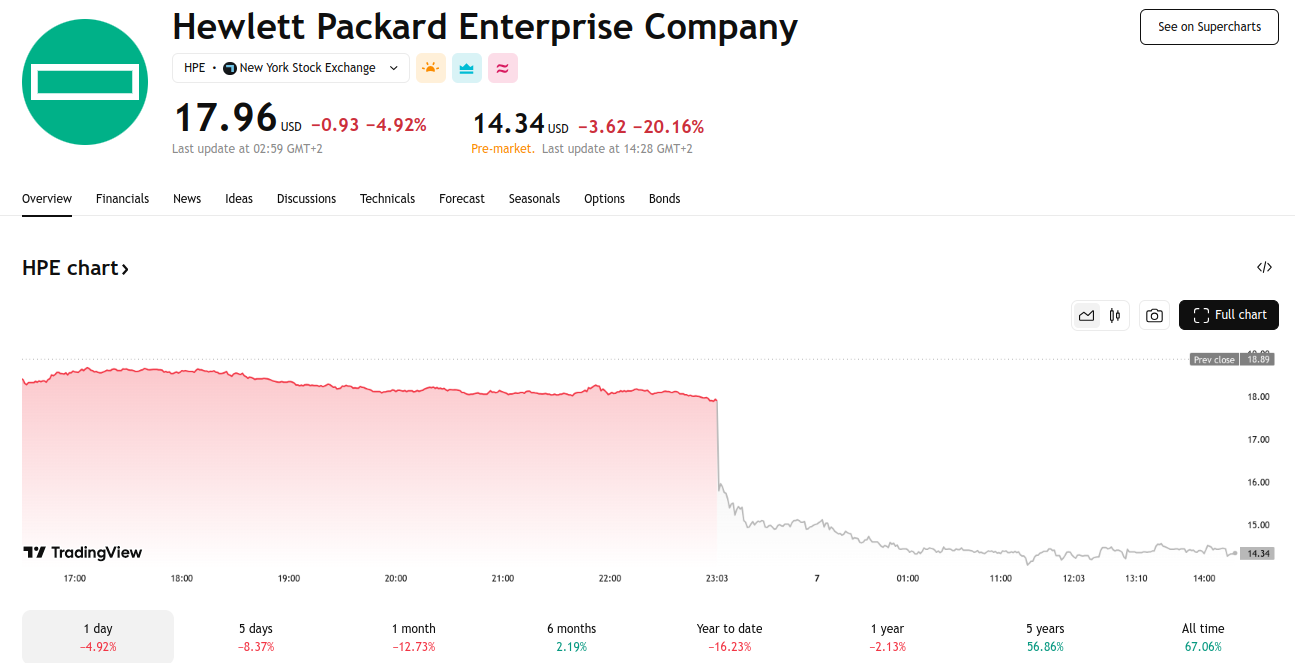

HPE Stock Takes Sharp Dive After Releasing Financial Forecasts That Fall Significantly Short of Wall Street’s Expectations

Hewlett Packard Enterprise (HPE) shares experienced a significant 19% drop in after-hours trading Thursday, triggered by quarterly and full-year financial projections that fell short of analyst expectations. The company’s guidance raised concerns among investors about its near-term performance.

In the fiscal first quarter, HPE reported adjusted earnings per share of 49 cents, meeting consensus estimates, and revenue of $7.85 billion, slightly exceeding the projected $7.82 billion. However, despite a 16% year-over-year revenue increase, the company’s profit was $598 million, or 44 cents per share, up from $387 million, or 29 cents per share, in the same period last year.

“We could have executed better,” admitted CEO Antonio Neri during an analyst call. He attributed the company’s higher-than-normal AI server inventory to a transition towards Nvidia’s next-generation Blackwell GPUs. The backlog for AI systems, however, saw a 29% quarter-over-quarter increase, reaching $3.1 billion, with total server revenue at $4.29 billion.

HPE faced substantial discounting pressures in the traditional server market during the quarter, according to finance chief Marie Myers. In response, the company implemented cost-cutting measures, including restrictions on travel and discretionary spending. “We expect pricing adjustments may negatively impact top-line growth in the near term,” Myers cautioned.

To further streamline operations, HPE announced a cost-reduction program involving layoffs over the next 18 months, aiming for $350 million in gross savings by fiscal year 2027. Approximately 2,500 employees, representing about 5% of the workforce, will be affected.

The company’s proposed $14 billion acquisition of Juniper Networks, announced in January 2024, is facing scrutiny from the U.S. Justice Department, which filed a lawsuit to block the deal. A trial is expected to commence in July, with HPE anticipating the deal to close by October 2025.

HPE’s forward-looking guidance also disappointed investors. The company projected adjusted earnings per share of 28 cents to 34 cents for the fiscal second quarter, with revenue between $7.2 billion and $7.6 billion, significantly below analyst estimates of 50 cents per share on $7.93 billion in revenue. For the full fiscal year 2025, HPE forecasts adjusted earnings per share of $1.70 to $1.90, compared to analysts’ predictions of $2.13 per share.

CEO Neri indicated that HPE plans to adjust prices to reflect increased costs from U.S. tariffs, while noting that he has not observed any business decline due to President Trump’s “Department of Government Efficiency.”