Key moments

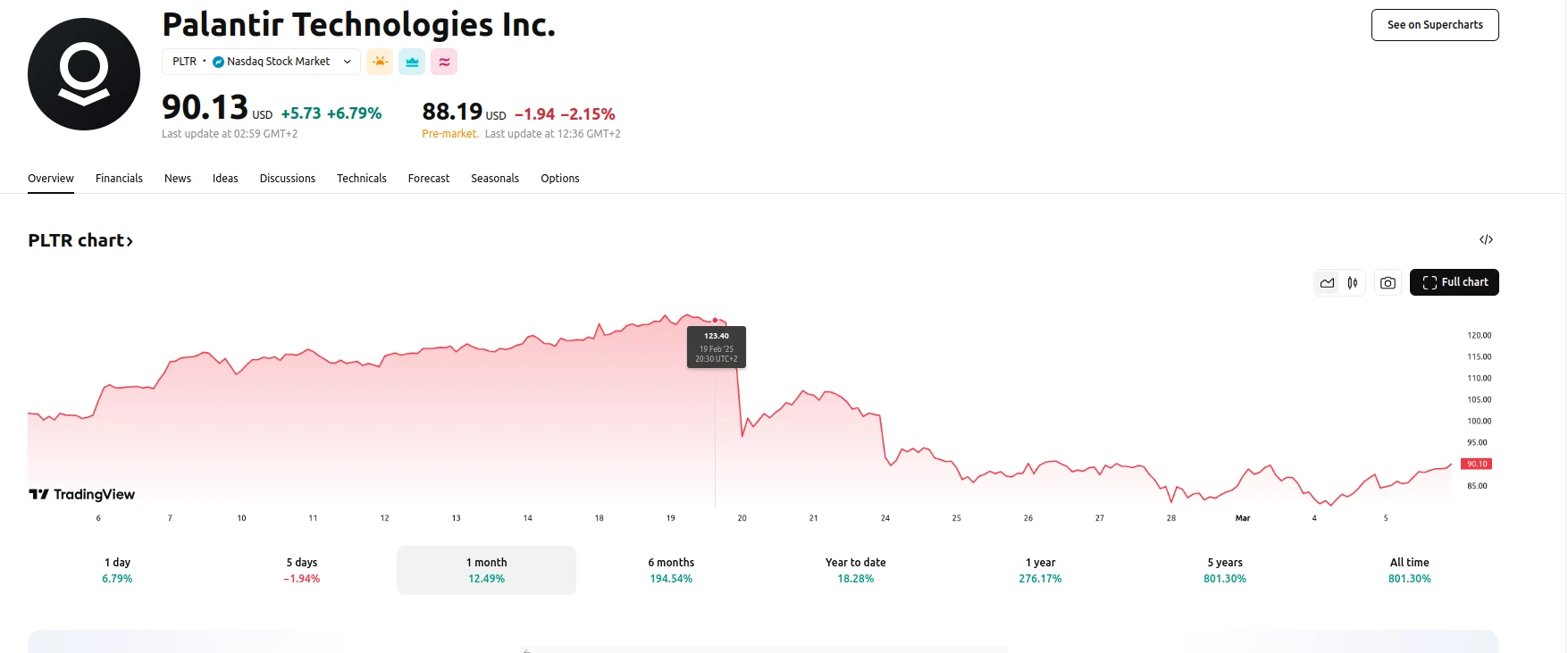

- Palantir stock experiences a 30% decline since its mid-February peak, reversing a period of significant growth.

- CEO Alex Karp announces plans to sell 9,975,000 shares of stock, raising investor concerns.

- Proposed federal spending cuts, particularly within the Defense Department, initially cast doubt on Palantir’s future revenue.

Valuation Concerns and Federal Spending Shifts Impact Tech Firm’s Market Performance

Palantir Technologies (PLTR), a company specializing in software platforms for commercial and government clients, has seen its stock value decrease by roughly 30% since mid-February. This decline marks a significant shift from the company’s previously robust growth trajectory, which had seen its stock price surge considerably over the past two years. The recent drop is primarily attributed to concerns surrounding the company’s valuation and potential shifts in federal spending, particularly within the U.S. government, a key client for Palantir.

One contributing factor to the stock’s decline was the announcement by Palantir CEO Alex Karp of his intention to sell nearly 10 million shares of company stock. While stock sales by executives are not uncommon, the magnitude of Karp’s planned sale raised concerns among investors. Additionally, proposed budget cuts within the U.S. Department of Defense, a major customer for Palantir’s data mining and AI systems, initially fueled fears that the company’s growth could be negatively impacted. Reports of Defense Secretary Pete Hegseth’s directives to slash existing budgets by approximately 8% annually over the next five years contributed to this apprehension.

However, subsequent developments have provided a more nuanced picture. Recent proposals by Republican lawmakers to increase military spending to nearly $1 trillion annually suggest a potential reallocation of funds rather than an outright reduction. Statements from Secretary Hegseth further support this view, indicating a “refocusing and reinvesting” of existing funds. This has led analysts, such as Wedbush’s Dan Ives, to suggest that Palantir may actually benefit from these changes, as its unique software solutions could attract increased IT budget allocations within the Pentagon. The recent market correction has also brought Palantir’s valuation to a more palatable level, potentially attracting new investors.