Key moments

- Cracker Barrel reported a 1.5% YoY revenue increase in Q4 2024 to $949.4 million, exceeding analyst expectations.

- The company’s stock saw an 11.5% increase to $44.93 after its Q4 earnings were announced.

- Adjusted earnings per share (EPS) of $1.38 surpassed analyst consensus estimates by 27.2%, a sign of strong profitability.

Cracker Barrel’s Solid Q4 Financial Performance Caused Stock to Soar by 11.5%

Cracker Barrel (CBRL) has delivered a robust financial performance in Q4 2024, exceeding analyst expectations across key metrics. The company’s revenue reached $949.4 million, representing a 1.5% increase compared to the same period last year and surpassing analyst estimates by 0.7%. This growth is attributed to strong execution by the company’s teams and strategic improvements in off-premise channel profitability during the holiday season.

The company’s adjusted EPS of $1.38 significantly outperformed analyst consensus estimates of $1.09, representing a 27.2% beat. Adjusted EBITDA also exceeded expectations, reaching $74.63 million compared to analyst estimates of $61.32 million, a 21.7% beat. Furthermore, Cracker Barrel’s full-year EBITDA guidance of $215 million, at the midpoint, surpassed analyst projections of $207.8 million.

Despite industry-wide softness, Cracker Barrel’s performance was bolstered by improvements in key guest and operational metrics. The company’s operating margin remained stable at 3.1%, consistent with the same quarter last year, while the free cash flow margin was 6.3%, also in line with the previous year. The company’s restaurant count increased slightly to 726 locations, up from 725 in the same quarter last year.

Cracker Barrel’s performance reflects its ability to navigate challenging market conditions and deliver strong results. The company’s focus on operational efficiency and profitability, particularly in its off-premise channels, has contributed to its success. Its well-established brand and country-themed dining experience continue to resonate with consumers.

While Cracker Barrel’s Q4 performance was impressive, the company’s long-term sales growth has been modest. Over the past five years, the company’s compounded annual growth rate was 2.3%, as its restaurant footprint remained relatively unchanged.

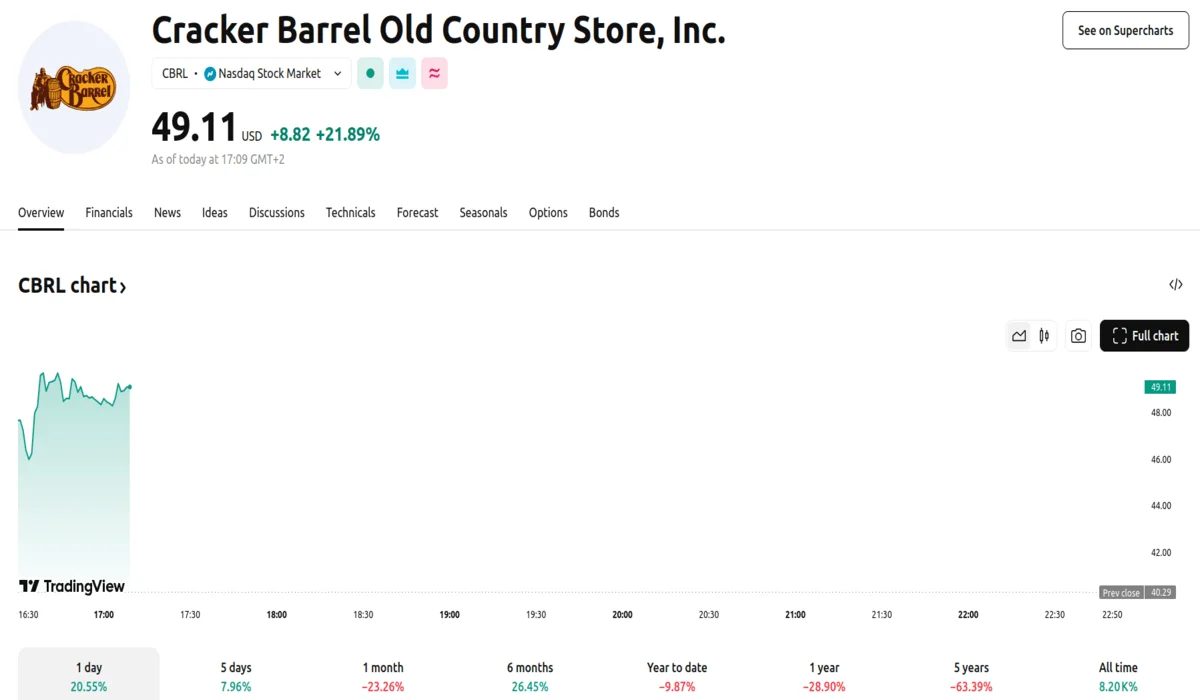

Cracker Barrel’s focus on improving same-store sales, which have grown by an average of 1.8% per year, is also a positive indicator. This growth is driven by a combination of higher prices and increased foot traffic at existing locations. The company’s stock price experienced a significant surge immediately after the release of its Q4 results, trading up 11.5% to $44.93. It trades at $49.11 for a 21.89% increase at the time of publication.