Key moments

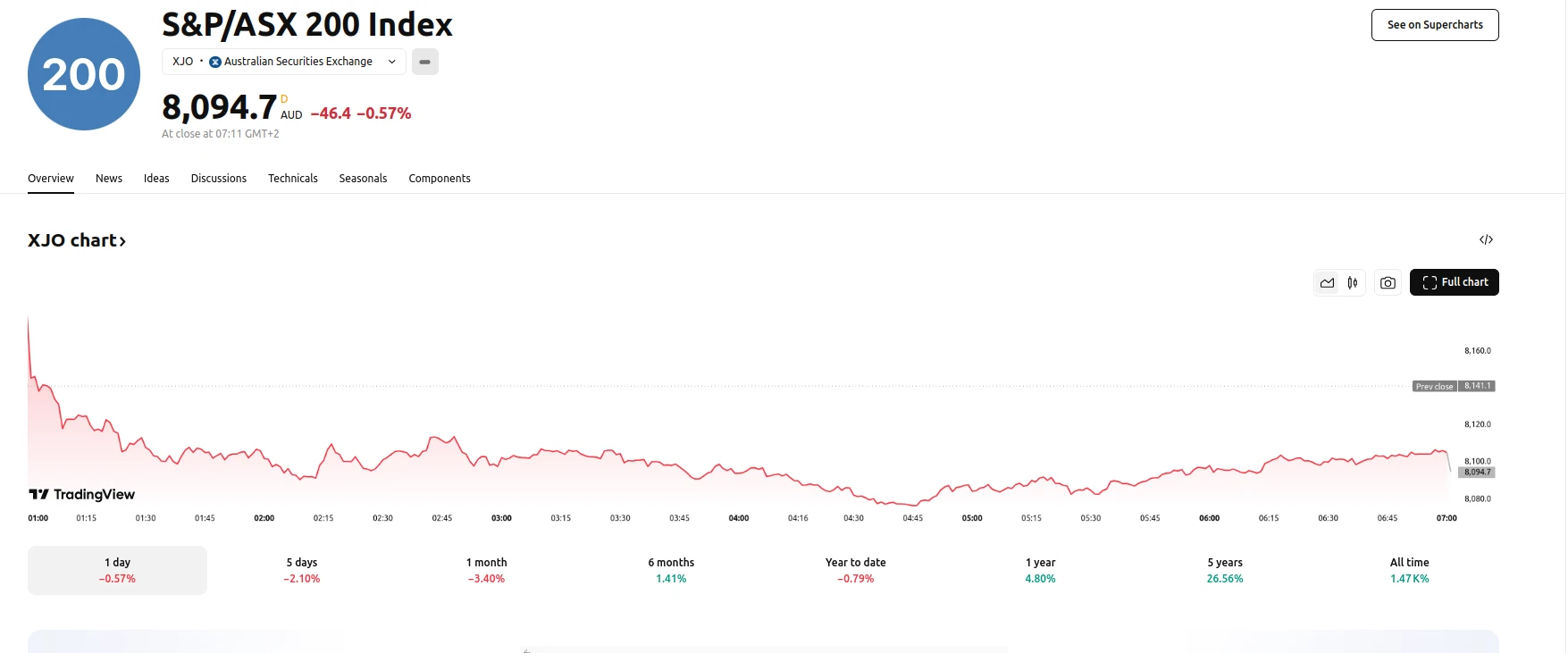

- Australia 200 experiences its eleventh decline in fourteen sessions, despite positive global market cues.

- Energy sector reaches its lowest level since January 2022, driven by multiple negative factors.

- Financial sector approaches February lows, while technology sector remains the sole positive performer.

Domestic Market Diverges from Global Optimism, Energy Sector Under Pressure

The Australia 200 index has exhibited a persistent downward trend, contrasting sharply with the positive performance of Wall Street and encouraging global economic developments. This divergence is particularly pronounced in the energy sector, which has plummeted to multi-year lows. The index’s decline, marking its eleventh drop in the last fourteen trading sessions, underscores a disconnect between domestic market sentiment and the broader global optimism fueled by factors such as the US auto tariff exemption and stronger-than-expected US service sector data.

The energy sector’s significant decline, falling 5.9% this week and reaching its lowest point since January 2022, is attributed to a confluence of negative factors. These include concerns surrounding US economic growth, potential changes in US sanctions on Russia, and OPEC+ decisions to increase output. Furthermore, tariff concerns have contributed to the struggling crude oil market, adding pressure to Australian energy companies. This sector’s performance is a major drag on the overall Australia 200, highlighting the vulnerability of the domestic market to global energy market fluctuations.

In addition to the energy sector’s woes, the financial sector is also showing signs of weakness, edging closer to its February lows. Despite positive news from Germany, China, and Australia’s own GDP figures, these positive indicators have failed to translate into sustained market confidence. Conversely, the technology sector stands out as the sole positive performer, buoyed by the strong overnight performance of the US Tech 100. This sector’s resilience highlights the varying impact of global trends on different segments of the Australian market.