Key moments

- Alibaba’s stock experienced a significant jump following the unveiling of its QwQ-32B AI model.

- The “leaner” nature of Alibaba’s new AI model, requiring fewer parameters and less data, is a key factor attracting investor interest.

- Alibaba’s gains are amplified by positive market sentiment in Chinese tech stocks and supportive government policies emphasizing AI development and consumer spending.

Alibaba Shares Surged on Breakthrough AI Model News, Signaling Potential Shift in Competitive Chinese Tech Landscape

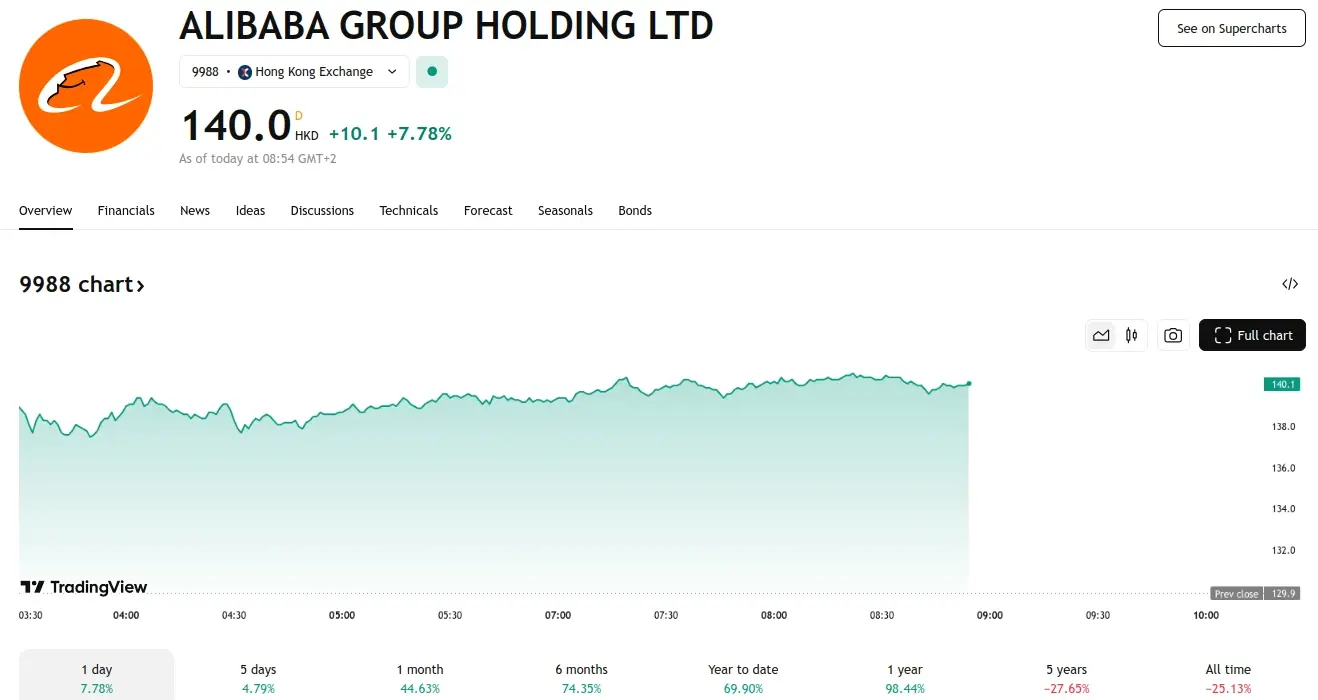

Alibaba Group Holding Ltd. shares surged this week, hitting their biggest intraday gain in weeks, after the tech giant unveiled a new AI model it claims rivals DeepSeek’s performance while using significantly less data. The move is seen as a major win for Alibaba’s AI ambitions and a potential disruptor in the competitive Chinese AI landscape.

The company’s open-source QwQ-32B model, announced Thursday, boasts comparable performance to leading models like DeepSeek’s R1, but with just a fraction of the data parameters. This efficiency play resonated with investors, driving Alibaba’s Hong Kong-listed shares up as much as 7.6%, bolstering a broader rally in Chinese tech stocks.

This surge adds to Alibaba’s impressive market rebound this year, with the company adding roughly $135 billion in market value. Analysts point to a combination of factors fueling the resurgence, including stabilizing core businesses and growing investor confidence in Alibaba’s AI capabilities. The company’s comeback comes after a period of regulatory headwinds.

“There’s quite a few positive drivers for Alibaba with their open-source reasoning model the latest catalyst,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “Their core business is improving and clearly will benefit from China’s push to drive consumption. Investors now also recognize the value that AI will bring to their cloud computing business.”

The broader tech sector also received a boost from Beijing’s signals of continued support for AI development, with officials emphasizing technological innovation and consumption at the National People’s Congress. This policy backing is seen as a key tailwind for companies like Alibaba, which are heavily invested in AI.

The AI space in China remains highly competitive, with a flurry of companies launching new models and services. This week, Manus AI also announced a new general AI agent, highlighting the rapid pace of innovation. The focus on benchmarks and performance is driving investor interest and fueling a race to capture market share in China’s burgeoning AI market.