Key moments

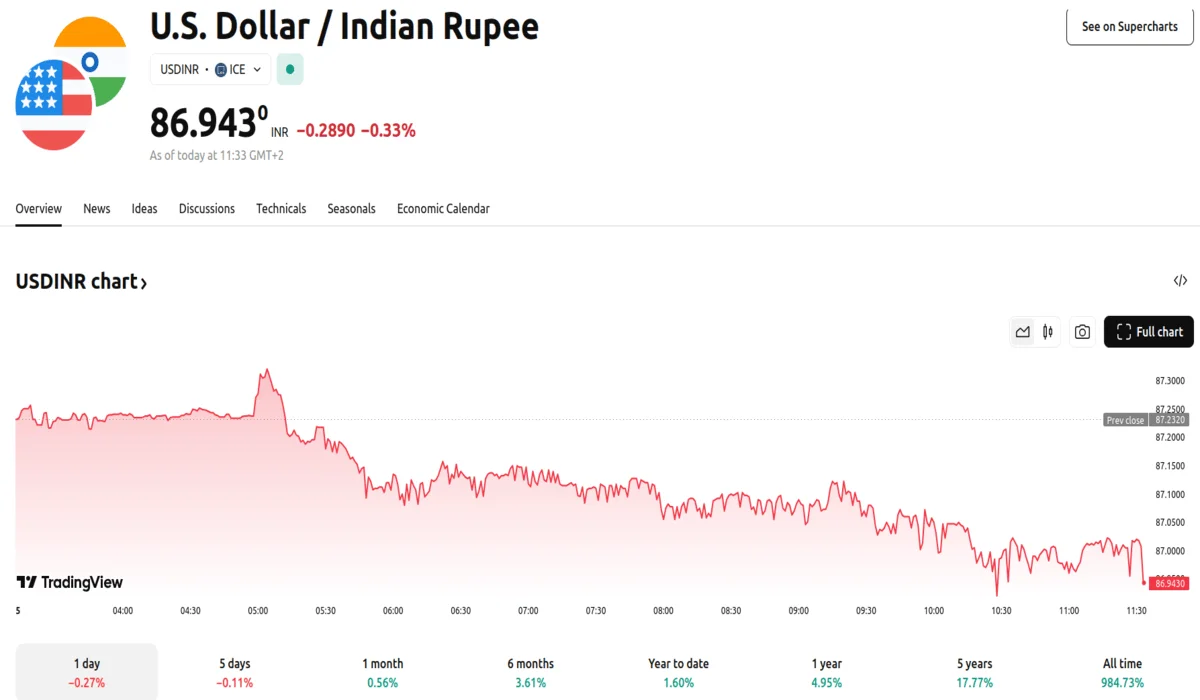

- The Indian rupee experienced a modest increase of 9 paise to reach 87.10 against the dollar in early Wednesday trading.

- The rupee’s initial trading activity commenced at 87.18 against the U.S. dollar within the interbank foreign exchange market.

- The recent outflow of $128 million added to the $12 billion yearly pressure on India’s currency.

Rupee Opened at 87.18 against the U.S. Dollar on Interbank Forex Market

The Indian rupee demonstrated a slight upward movement in early trading, navigating a landscape marked by global trade uncertainties and changing investor sentiment. The Indian currency’s value increased by 9 paise, settling at 87.10 against the U.S. dollar. This appreciation occurred amidst a backdrop of a broadly weakening U.S. dollar, a factor influenced by ongoing trade disputes.

The day’s trading commenced with the rupee opening at 87.18 against the greenback, within the interbank foreign exchange market. The currency then gained ground at 87.10, reflecting a response to prevailing market dynamics. The rupee recovered from its earlier declines on Tuesday, ultimately closing 13 paise higher at 87.19 against the greenback. These dynamics were driven by the impact of President Trump’s tariff policies, which have triggered reactions across global financial markets.

Despite the rupee’s gains, apprehensions regarding a protracted trade conflict persist, potentially exerting downward pressure on the Indian currency. The influence of U.S. tariff-related announcements on Asian currency markets, including the rupee, remains a key factor in intraday trading. News reports concerning potential agreements or continued tariff implementation have introduced volatility.

The Indian rupee’s trading remained confined to a limited range, influenced by global uncertainties stemming from the administration’s policy decisions. According to Amit Pabari, Managing Director of CR Forex Advisors, ongoing sales by foreign institutional investors, including a recent $128 million divestment and cumulative outflows approaching $12 billion for the year, continued to drive rupee prices downward amid prevailing geopolitical instabilities.

Concurrently, the U.S. dollar index, a metric reflecting the dollar’s performance against a collection of major currencies, registered a 0.07% decrease, settling at 105.67.

Mr. Pabari also noted that the decline in crude oil prices offered some relief to the Indian currency. Specifically, Brent crude oil reaching a three-month low of $69.65 per barrel was expected to alleviate India’s import expenses and provide a degree of support to the rupee. In the futures market, Brent crude, the global oil standard, showed a 0.41% reduction, trading at $70.76 per barrel.

Within the Indian stock market, the BSE Sensex, composed of 30 leading companies, experienced a 0.70% increase, rising by 509.70 points to 73,499.63. The Nifty index also saw growth, gaining 0.59%, or 129.90 points, to reach 22,212.55. Exchange data revealed that foreign institutional investors engaged in net equity sales amounting to ₹3,405.82 crore on Tuesday.