Key moments

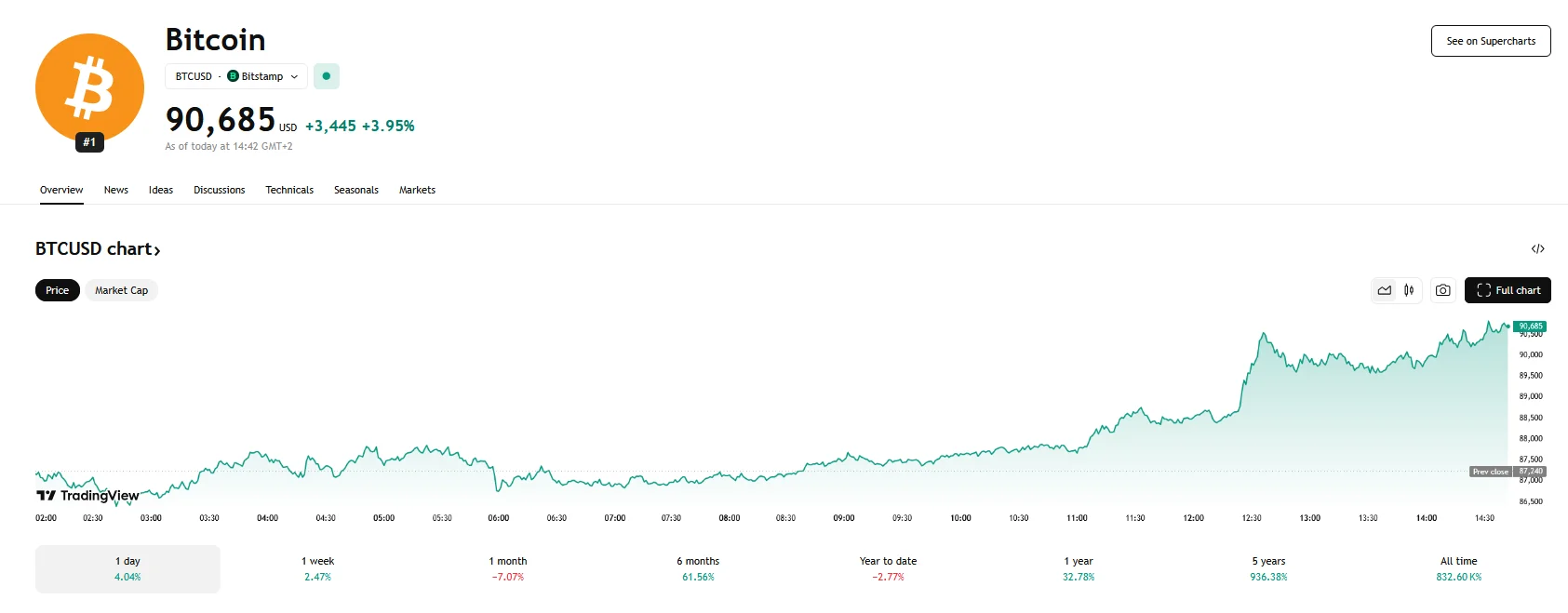

- An initial 7% gain evolved to an even higher price increase, with Bitcoin going above $90,000.

- Positive statements from U.S. officials regarding potential trade compromises with Canada and Mexico significantly boosted investor confidence.

- The total value of the cryptocurrency market surpassed $3 trillion.

Bitcoin Surges Beyond $90,000

Bitcoin’s valuation has eclipsed the $90,000 mark, driven by a confluence of economic and political developments. This upward trajectory followed a period of notable volatility. Wednesday witnessed a substantial uptick in Bitcoin’s price, initiating the day with a robust 7% gain. This positive momentum was fueled by growing optimism surrounding potential trade resolutions. Specifically, statements from U.S. Commerce Secretary Howard Lutnick, suggesting that President Trump might announce a trade compromise with Canada and Mexico, played a pivotal role in boosting investor confidence.

The prospect of softened tariffs on key trading partners provided a significant catalyst for Bitcoin’s ascent. The cryptocurrency, often viewed as a risk on asset, tends to correlate with broader market trends. Therefore, the anticipation of a more stable trade environment contributed to the increased demand for Bitcoin. The surge culminated in Bitcoin’s price surpassing $90,500, with this movement also contributing to the overall crypto market capitalization exceeding the $3 trillion threshold, indicating renewed investor interest in digital assets.

The events of the preceding days had created a climate of uncertainty within the crypto market. President Trump’s earlier pronouncements regarding a strategic cryptocurrency reserve had initially triggered a surge in Bitcoin’s price. However, the subsequent implementation of tariffs on Canada and Mexico led to a sharp reversal.

Secretary Lutnick’s remarks on Tuesday, however, served to alleviate these concerns. His indication that President Trump was inclined to “work something out” with the U.S.’s neighbors prompted some investors to re-evaluate their positions.

The correlation between Bitcoin’s price movements and broader market sentiment was evident. Unlike traditional safe-haven assets, Bitcoin tends to respond to risk-on signals, such as positive trade developments. The prospect of reduced trade tensions created a favorable environment for Bitcoin, leading to its significant price surge. The cryptocurrency’s journey to above $90,000 underscores the dynamic nature of the digital asset market.