Key moments

- $22 million worth of Bitcoin, held in wallets untouched since 2011, has been transferred.

- The movement of these old Bitcoin holdings has raised concerns about potential sell-offs, adding to market uncertainty amid existing macroeconomic pressures.

- While the recent transfer involved a substantial amount, it didn’t qualify as “whale” activity, and the identities of the holders remain unknown.

Long-Dormant Wallets Stir Market as $22M in Bitcoin Were Moved After 14 Years

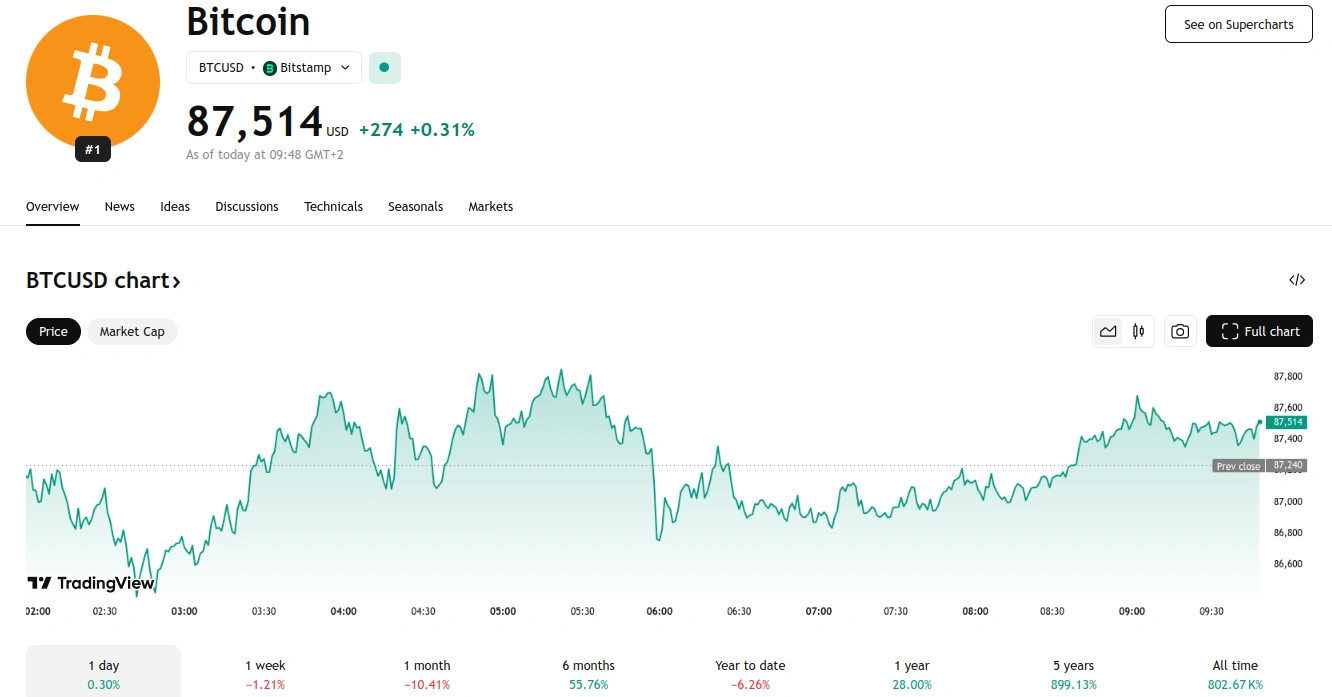

Bitcoin’s price experienced a modest uptick on Wednesday, trading at $87,514 as of 07:48 GMT, amidst heightened speculation surrounding the movement of long-dormant Bitcoin holdings. The recent transfer of substantial Bitcoin amounts, untouched since 2011 when the asset traded around $1, has triggered discussions about potential large-scale selling activities.

On Monday, six antiquated Bitcoin addresses, collectively holding 250 BTC, valued at nearly $22 million at current prices, transferred their holdings to new locations after remaining inactive for 14 years. These wallets, using legacy addresses indicative of the protocol’s earliest days, are rarely utilized for modern Bitcoin transactions.

Such movements from substantial, long-term holders, often termed “HODLers,” can induce market anxiety, as traders and analysts anticipate potential sell-offs following significant transfers. Bitcoin has faced downward pressure in recent weeks, driven by investor exits from risk-on assets, largely attributed to President Trump’s escalating trade tensions and persistent U.S. inflation concerns.

The destination of the transferred coins remains undisclosed, although one address has been linked to the British fintech platform Revolut. This connection fuels speculation that the holder may be preparing to liquidate their holdings amid prevailing macroeconomic uncertainties.

The oldest of the transferred wallets received 50 BTC in February 2011, when Bitcoin’s price was slightly above $1, representing an unrealized gain exceeding 8,310,400% for the mysterious investor. In 2011, Bitcoin’s price surged past $1, reaching nearly $30 before experiencing a subsequent decline, ultimately closing the year at just over $4 per coin.

The identities of the wallet owners remain unknown, but large-scale Bitcoin transfers have become increasingly frequent. Last month, an address holding 50 BTC mined approximately 15 years ago, when the coins were valued at around $0.10 each, began moving coins worth roughly $5 million in total.

Despite the substantial value of Monday’s transactions, the holder’s stash did not meet the threshold to be classified as a “Bitcoin whale,” which requires holdings of over 1,000 BTC, currently valued at nearly $88 million. Blockchain data does not reveal the identities of these large holders, leaving their status as individuals or companies shrouded in mystery.