Key moments

- US Copper Premiums Surge, Diverging From Global Prices

- Domestic Production Constraints Highlight Import Reliance

- UBS Predicts Continued Volatility and Suggests Risk Management Strategy

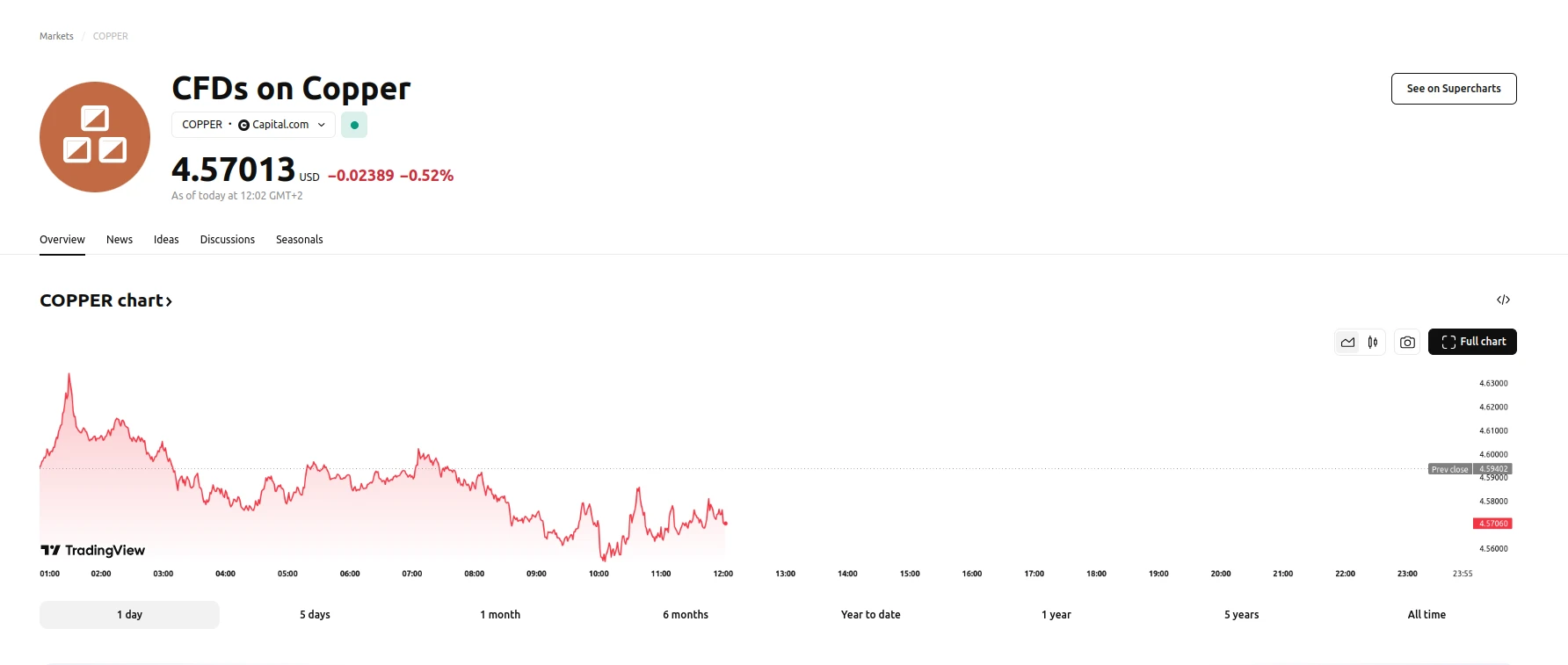

US Copper Price Surges 13% Amid Tariff Uncertainty, Outpacing Global Markets

The U.S. copper market is experiencing heightened volatility, primarily driven by concerns surrounding US tariffs on imports. Recent observations by UBS indicate a significant divergence in copper prices, with U.S. premiums over international rates, specifically the London Metal Exchange (LME), witnessing a sharp increase. Notably, the U.S. price of copper has surged by 13%, surpassing the 8% rise recorded at the LME. This disparity is largely attributed to the prevailing uncertainty surrounding U.S. tariff policies, which UBS analysts anticipate will contribute to maintaining the elevated price premium in the immediate future.

A critical factor contributing to the market’s sensitivity is the challenge of rapidly replacing refined copper imports with domestic production. UBS research highlights the substantial time required to bolster U.S. production and processing capabilities. Investments in these areas necessitate several years before reaching full operational capacity. This dependence on imports leaves the U.S. market vulnerable to fluctuations caused by tariff changes. The inherent limitations in quickly scaling up domestic supply are exacerbating the current price volatility and contributing to the premium observed in the US market compared to the international one.

Furthermore, UBS forecasts that the potential implementation of tariffs on U.S. copper imports will lead to increased price volatility in the coming months. This volatility is expected to arise as supply channels and domestic demand within the U.S. adapt to the newly imposed tariff structure. While short-term fluctuations are anticipated, UBS maintains its long-term perspective on the structural imbalance within the copper market. This imbalance, characterized by supply constraints and increasing demand, is expected to continue influencing price dynamics.

In response to the current market conditions, UBS has recommended a strategic approach involving the sale of downside price risks in copper to capitalize on yield. This strategy aims to mitigate potential losses associated with price volatility while leveraging the existing market dynamics.