Key moments

- Snowflake’s price increase was largely fueled by its strategic integration of AI technologies, including partnerships with Microsoft and OpenAI.

- The company anticipates product revenue to reach $4.28 billion by January 2026, representing a 24% increase.

- Snowflake’s stock performance notably outshone that of AI heavyweight Nvidia and software rival Salesforce.

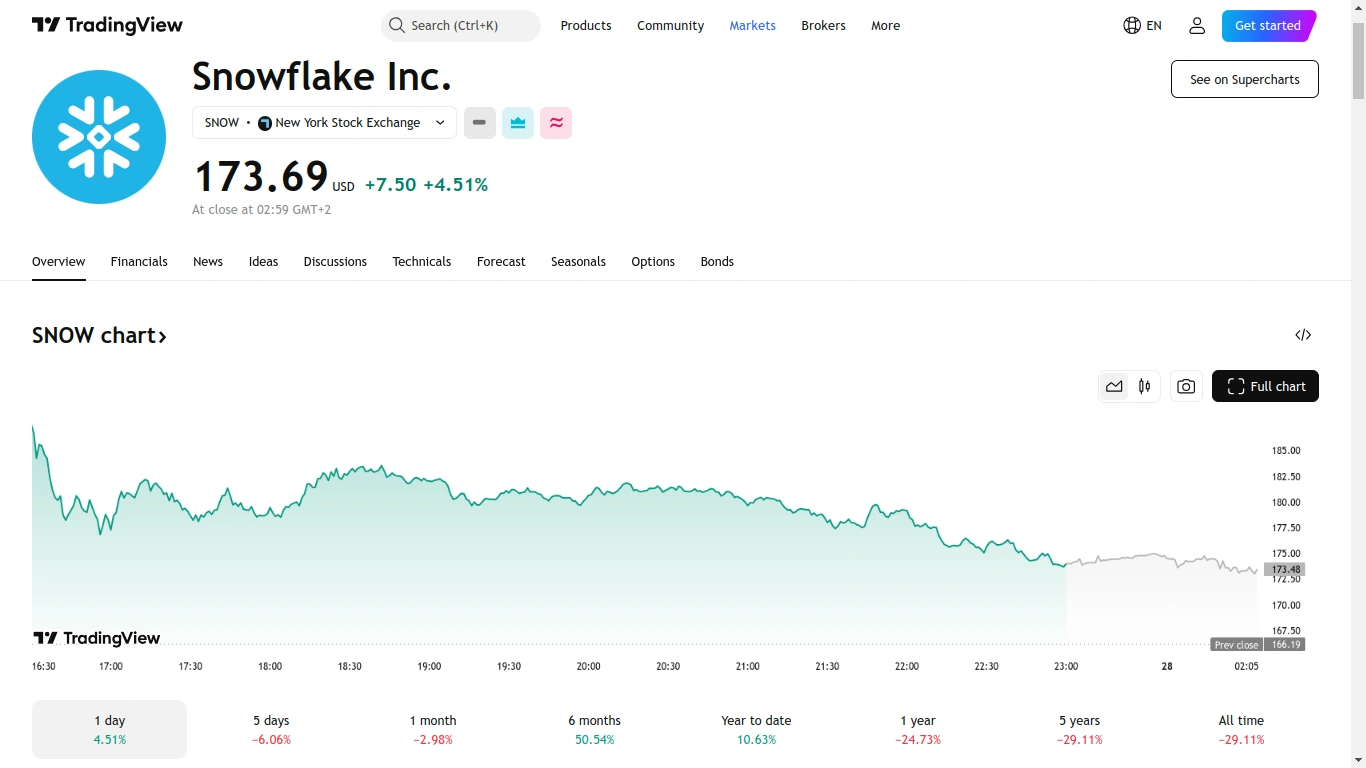

Snowflake’s stock experienced a significant 12% increase due to strong earnings and optimistic future projections

Snowflake’s stock experienced a significant 12% surge on Thursday, driven by strong earnings and optimistic future projections, reversing recent declines. The cloud-based AI company’s stock soared to $188 per share, marking a notable rebound after a period of losses since mid-February.

The company’s better-than-anticipated financial results and particularly strong guidance are attributed to its intensified focus on artificial intelligence. Snowflake has strategically integrated its platform with advanced AI language models and recently expanded its collaboration with Microsoft, enabling users to directly utilize OpenAI on its platform. This strategic move is significantly contributing to the company’s financial performance.

Snowflake anticipates product revenue to reach $4.28 billion by January 2026, representing a 24% increase, surpassing analyst estimates of $4.23 billion. This robust revenue forecast is largely due to the introduction of new AI-driven products.

This positive financial outlook provides a welcome boost to investors following a challenging start to 2024, during which the stock plummeted by over 20%. The company’s performance is also seen as a promising indicator for the software sector’s role in the ongoing AI boom.

Interestingly, Snowflake’s stock performance outshone that of AI heavyweight Nvidia, which, despite delivering strong earnings, saw a lukewarm investor response with a nearly 3% drop.

Similarly, Snowflake outperformed software rival Salesforce, which experienced a 4% decline after tempering expectations regarding the immediate revenue impact of its AI tool, Agentforce. This divergence highlights Snowflake’s successful AI integration strategy and its optimistic outlook compared to its peers.