Key moments

- Adjusted earnings per share exceeded projections at $2.78, compared to the anticipated $2.61.

- Quarterly revenue reached $9.99 billion, falling slightly short of the expected $10.04 billion.

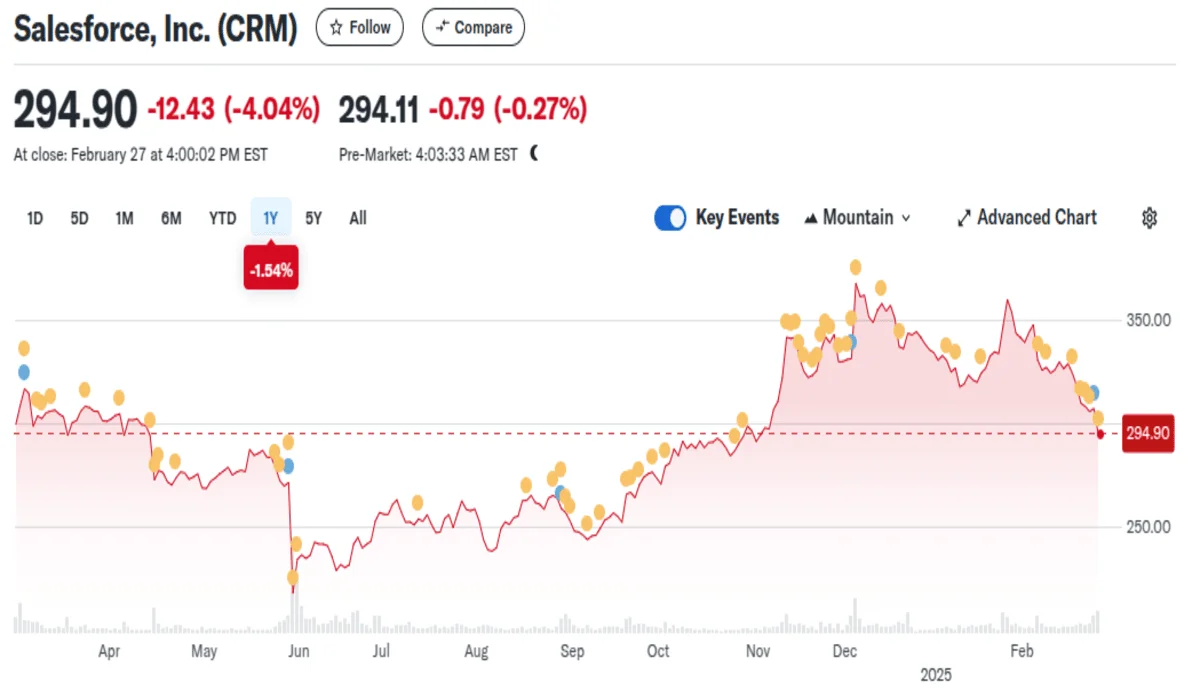

- The company’s stock value experienced a 4% decrease in after-hours trading.

Salesforce’s Stock Dips Despite 7.6% YoY Quarterly Revenue Increase

Salesforce disclosed its fiscal Q4 results, revealing a discrepancy between revenue forecasts and its actual figures. The company’s total revenue for the quarter ending January 31st reached $9.99 billion, a 7.6% increase year-over-year, yet fell below the projected $10.04 billion. Simultaneously, the company’s adjusted earnings per share surpassed expectations, registering $2.78 compared to the predicted $2.61. Net income for the quarter stood at $1.71 billion, or $1.75 per share, up from $1.45 billion, or $1.47 per share, in the prior year.

The company’s subscription and support revenue saw the service segment contribute $2.33 billion, while sales generated $2.13 billion. Both are slightly below analyst consensus. Salesforce also highlighted the progress of its Agentforce AI technology, launched in October. It has facilitated over 380,000 conversations on its help website, with human intervention required in only 2% of all cases. Over 5,000 Agentforce deals have been closed, more than 3,000 of which were paid deals. Annual recurring revenue from data cloud and AI more than doubled compared to the previous year.

For the upcoming fiscal year, Salesforce anticipates adjusted earnings per share between $11.09 and $11.17, and revenue ranging from $40.5 billion to $40.9 billion. This outlook is slightly below the analyst consensus, which projected adjusted earnings per share of $11.18 and revenue of $41.35 billion. For the first quarter, the company expects revenue between $9.71 billion and $9.76 billion, slightly below the projected $9.91 billion. Additionally, Robin Washington is set to assume the position of Chief Financial Officer in March, replacing Amy Weaver.