Key moments

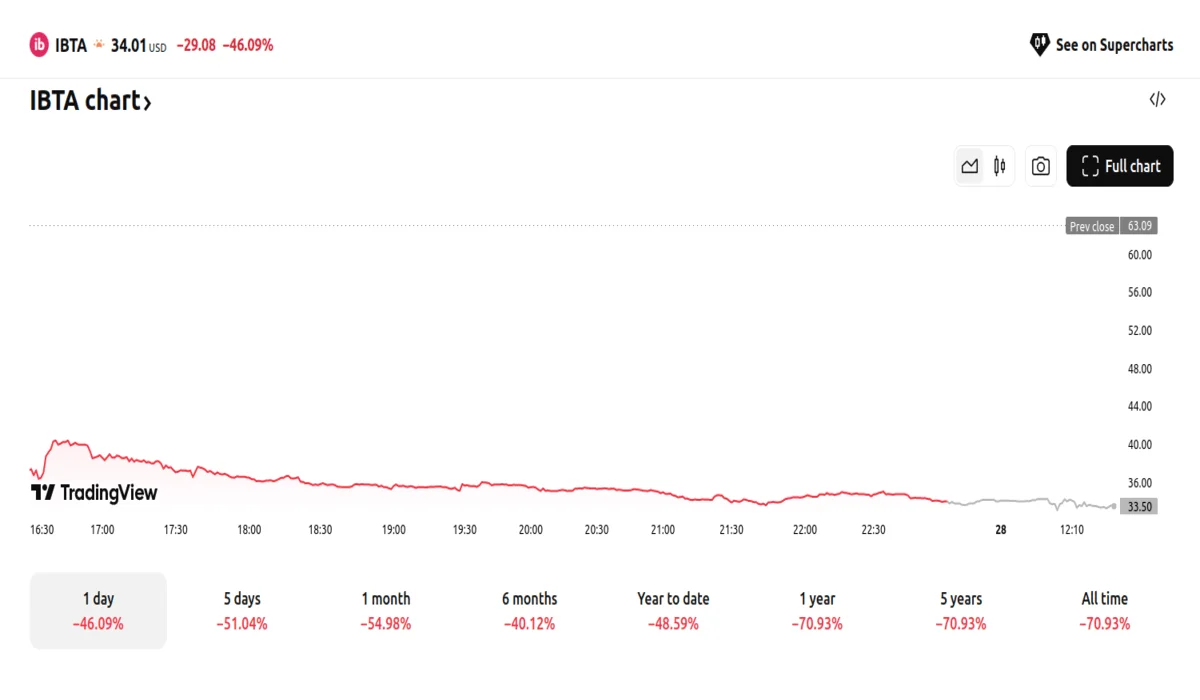

- Ibotta Inc.’s stock price plummeted by 46.09% to $34.01, continuing a steady decline triggered by disappointing Q4 earnings and a weak Q1 forecast.

- Both Citi and BofA Securities analysts downgraded Ibotta’s stock rating from “Buy” to “Neutral,” significantly reducing their price targets due to concerns over advertising supply issues and underperformance in the third-party platform segment.

- While Ibotta achieved substantial year-over-year growth in total revenue and redeemers, it faced challenges in meeting earnings expectations and demonstrating a strong return on ad spend.

Fourth-Quarter Earnings Miss Expectations, Stock Price Plummets 46.09%

Ibotta Inc.’s stock suffered a significant setback, with its share price plummeting by 46.09% to $34.01 on February 28th. The stock has been on a downward trend following the company’s release of its fourth-quarter earnings report, which fell short of market expectations, and a subsequent disappointing forecast for the first quarter of the following year.

The reported financial results revealed adjusted earnings per share of $0.67, missing analyst projections of $0.71. Revenue for the quarter was $98.4 million, showing a 1% year-over-year reduction. Non-GAAP revenue remained flat when adjusted for a one-time benefit from the previous year. Furthermore, Ibotta’s outlook for the first quarter of 2025 indicated revenue between $80 million and $84 million, significantly below the anticipated $90.95 million.

Analysts at Citi responded to these results by downgrading Ibotta’s stock from “Buy” to “Neutral,” slashing the price target from $82 to $44. This adjustment stemmed from concerns about advertising supply issues that were hindering the company’s revenue visibility and profitability. Citi’s analysis highlighted the challenges Ibotta faces in demonstrating a strong return on ad spend to its advertising partners despite its established partnerships with major retailers like Walmart and Instacart.

Similarly, BofA Securities also downgraded Ibotta’s stock rating from “Buy” to “Neutral,” reducing the price target from $90 to $40. The primary concern cited was the underperformance of Ibotta’s third-party platform segment, which had previously been a key growth driver. Analysts pointed to ongoing supply constraints among consumer packaged goods clients as a significant factor contributing to the revenue shortfall.

It is important to note that the company achieved a 15% year-over-year increase in total revenue, reaching $367.3 million, and a 20% growth in non-GAAP revenue. Redemption revenue also saw a substantial 27% increase, reaching $308.8 million. The number of redeemers on the platform grew by 27% to 17.2 million in the fourth quarter. However, the growth in total redemptions was only 1%, indicating a disparity between user growth and engagement. Ibotta’s adjusted EBITDA for the fourth quarter was $27.8 million, representing a 28% margin. Current expectations point towards an EBITDA of between $10 million and $14 million for 2025’s first quarter, with a projected margin of 15%.

The company’s transition to a more programmatic advertising approach is also causing difficulties. Many of Ibotta’s clients are adopting a cautious approach, waiting to see the performance of new marketing channels before committing to their budgets. In spite of these challenges, Ibotta’s management continues to prioritize achieving its near-term financial goals while driving advancements in measurement and targeting capabilities.