- A potential peace deal between Russia and Ukraine is weighing on oil prices due to the possibility of sanctions being lifted.

- Reports of declining U.S. crude oil inventories are offering some support to oil prices.

- Brent crude oil futures suffer slight price decrease at $72.83 per barrel.

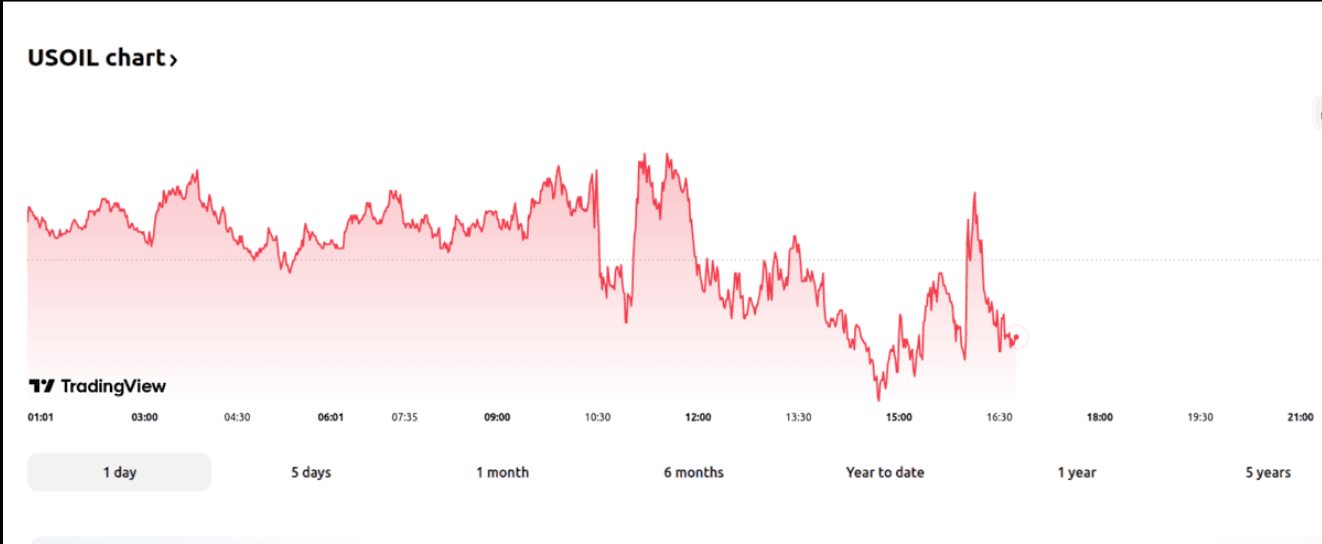

Oil prices remained relatively stable on Wednesday, hovering near two-month lows, as the possibility of a peace agreement between Russia and Ukraine exerted downward pressure. This potential resolution to the conflict has raised hopes of sanctions relief, which could significantly impact global oil supply. Conversely, a reported decline in U.S. crude oil inventories provided some support to prices.

Brent crude futures traded slightly lower at $72.83 a barrel by 12:56 GMT, while U.S. West Texas Intermediate crude oil futures also saw a minor decrease to $68.80.

The prospect of a Russia-Ukraine peace deal has been gaining traction, according to ING commodities strategists. The market is also closely monitoring the potential implications of a minerals agreement between the U.S. and Ukraine, which could further pave the way for the lifting of Russian sanctions, thereby reducing supply uncertainty.

Adding to the downward pressure on prices, Saxo Bank analyst Ole Hansen highlighted concerns about potential economic consequences stemming from U.S. trade policies, including tariffs and initiatives to boost oil exports from countries like Iraq. These policies could trigger trade wars and hinder economic growth, impacting oil demand.

On a more positive note, market sources citing American Petroleum Institute data indicated a 640,000-barrel decrease in U.S. crude stocks for the week ending February 21. This data, if confirmed by the official Energy Information Administration (EIA) report later on today, would represent the first decline in U.S. crude oil inventories since mid-January, offering some price support. Analysts project a 2.6 million barrel increase in U.S. crude stockpiles.

Concerns about the potential impact of U.S. trade policies on global economic growth have weighed on oil prices, overshadowing worries about tighter near-term supply despite recent U.S. sanctions against Iran, according to ANZ Bank analysts.