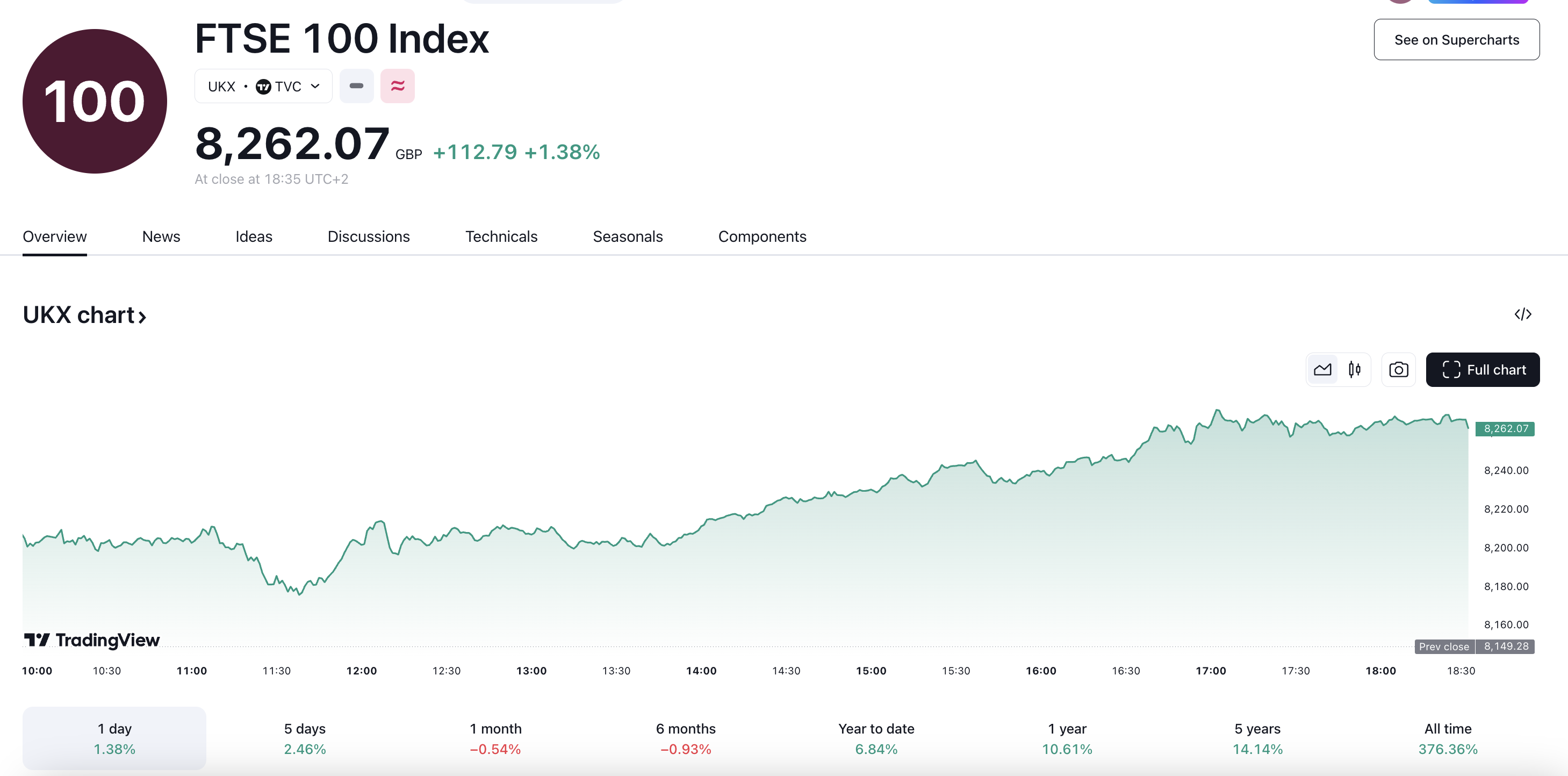

The FTSE 100 index surged 1.4% on Friday, capping off a stellar week with a 2.5% gain – its strongest weekly performance since May 7. Meanwhile, the British pound plummeted 0.6% to a six-month low of $1.25105, as disappointing economic data revealed a contraction in UK business output in November and a sharper-than-expected decline in retail sales in October.

The decline in sterling favored dollar-earning companies, such as AstraZeneca and Unilever, which saw significant share price increases. However, banks faced pressure due to weak business activity data, which raised concerns about the UK’s economic outlook.

The pound’s decline was triggered by disappointing business output and retail sales data, which showed a contraction in private sector activity for the first time in over a year. The weak data has led traders to expect future interest rate cuts by the Bank of England, despite the current uncertainty surrounding the UK’s economic prospects.

The UK’s economic uncertainty has been exacerbated by the recent budget, which raised taxes on businesses and the wealthy. The contraction in private sector activity has raised concerns about the UK’s economic growth prospects, and traders are now expecting the Bank of England to maintain current interest rates next month, with potential cuts next year.