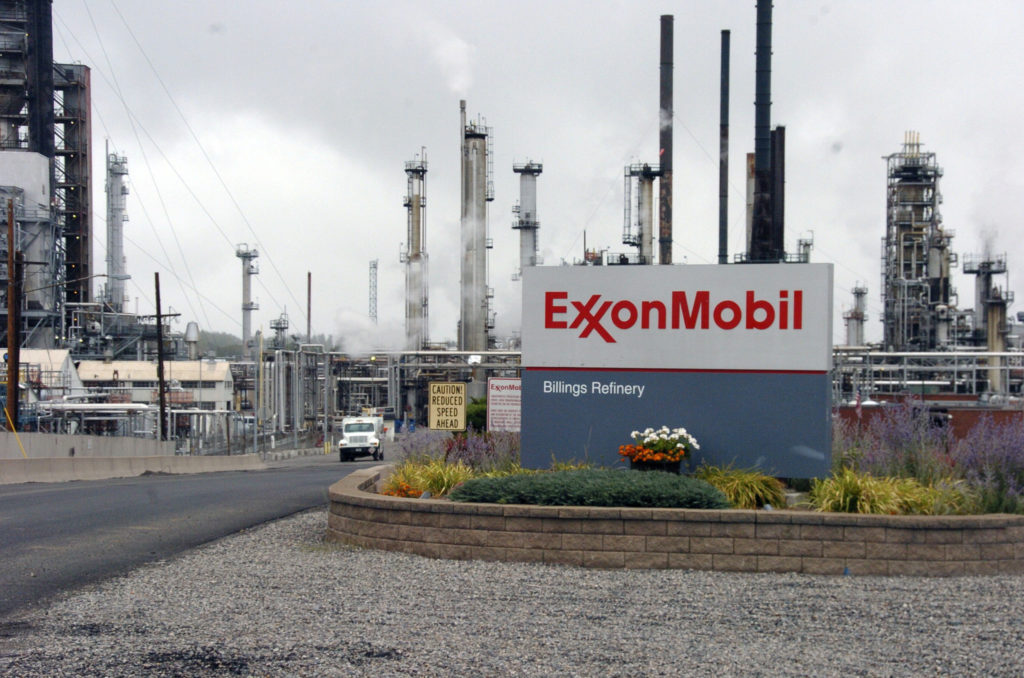

According to a statement by Exxon Mobil Corp on Tuesday, it intends to set up a plastics plant on the US Gulf Coast in an attempt to respond to increasing Asia demand. The company plans to invest several hundred million dollars in the project, while a final decision is to be made later in 2018.

Exxon Mobil shares closed lower for a second consecutive trading session on Tuesday. The stock edged down 0.22% ($0.16) to $73.99, with the intraday high and the intraday low being at $74.68 and $73.96 respectively.

In the week ended on March 18th the shares of the energy company added 0.75% to their market value compared to a week ago, which marked the third gain out of five weeks.

However, due to the recent streak of losses, the stock has extended its slump to 2.31% so far during the current month following a 13.24% drop in February. The latter has been the worst monthly performance in more than ten years.

For the entire past year, the shares of the NYSE-listed energy giant went down 7.33% following a 15.79% surge in 2016.

”Abundant supplies of domestically produced oil and natural gas have reduced energy costs and created new sources of feedstock for U.S. chemical manufacturing”, John Verity, President of ExxonMobil Chemical Co, was quoted as saying by Reuters.

”Most of our planned investment in the Gulf Coast region is focused on supplying emerging markets like Asia”, he added.

The facility is expected to begin operations by 2021 and is aimed to bolster Exxon’s manufacturing capacity by up to 450 000 tons annually.

The project is also expected to create about 60 permanent jobs as soon as the production process is initiated.

According to CNN Money, the 21 analysts, offering 12-month forecasts regarding Exxon Mobil’s stock price, have a median target of $86.00, with a high estimate of $102.00 and a low estimate of $70.00. The median estimate is a 16.23% surge compared to the closing price of $73.99 on March 20th.

The same media also reported that 14 out of 25 surveyed investment analysts had rated Exxon Mobil’s stock as “Hold”, while 6 – as “Buy”. On the other hand, 5 analysts had recommended selling the stock.

Daily and Weekly Pivot Levels

With the help of the Camarilla calculation method, today’s levels of importance for the Exxon Mobil stock are presented as follows:

R1 – $74.06

R2 – $74.12

R3 (Range Resistance – Sell) – $74.19

R4 (Long Breakout) – $74.39

R5 (Breakout Target 1) – $74.62

R6 (Breakout Target 2) – $74.71

S1 – $73.92

S2 – $73.86

S3 (Range Support – Buy) – $73.79

S4 (Short Breakout) – $73.59

S5 (Breakout Target 1) – $73.36

S6 (Breakout Target 2) – $73.27

By using the traditional method of calculation, the weekly levels of importance for Exxon Mobil Corporation (XOM) are presented as follows:

Central Pivot Point – $74.82

R1 – $76.12

R2 – $77.11

R3 – $78.41

R4 – $79.70

S1 – $73.83

S2 – $72.53

S3 – $71.54

S4 – $70.54