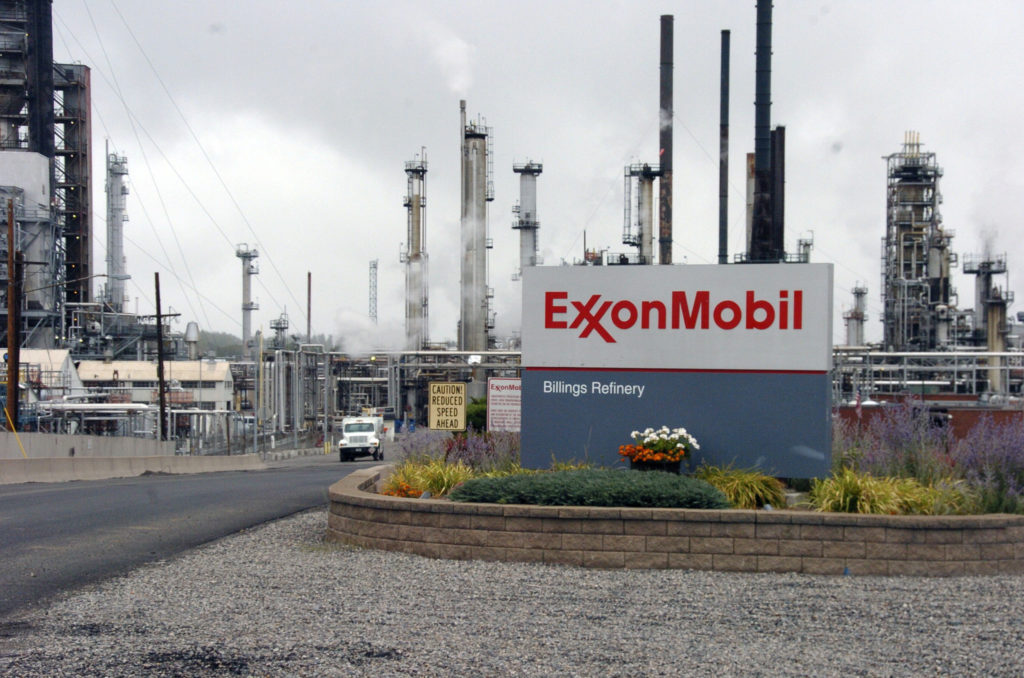

According to a report by the Australian Taxation Office on Thursday, Exxon Mobil Corporation (XOM) did not pay any tax in the country during fiscal year 2016, regardless of the billions of dollars in income from operations on Australian soil it had reported.

Exxon Mobil shares closed higher for the sixth time in the past eight trading sessions on Thursday. The stock edged up 0.33% ($0.27) to $82.55, with the intraday high and the intraday low being at $82.62 and $82.19 respectively.

In the week ended on December 3rd the shares of the energy company added 2.51% to their market value compared to a week ago, which marked a second consecutive period of gains. It has also been the best performance since the week ended on October 1st.

The stock has pared its loss to 0.89% so far during the current month, following a mere 0.07% dip in November. The latter has been the first drop out of three months.

For the entire past year, the shares of the NYSE-listed energy giant gained 15.79%. On the other hand, the stock has retreated 8.54% so far in 2017.

Exxon Mobil reported AUD 6.7 billion ($5.0 billion) in income during fiscal 2016. However, the oil major reported a loss for tax purposes and, thus, it did not pay tax. Similar was the case during the preceding two years.

In a statement, Exxon explained it had no taxable income, because it had invested approximately AUD 18 billion during the past several years in key projects such as the Gorgon LNG and the Kipper Tuna Turrum field among others.

“As these multi-billion investments were completed in 2017 and have started production, the amount of tax paid by ExxonMobil Australia is anticipated to increase significantly”, Travis Parnaby, a spokesperson for the oil company, was quoted as saying by Reuters.

The same media also reminded that the Australian Senate had embarked on a probe into corporate tax avoidance in 2014, which was extended this week. A final report is expected to be issued by the end of May next year.

According to CNN Money, the 23 analysts, offering 12-month forecasts regarding Exxon Mobil’s stock price, have a median target of $84.00, with a high estimate of $100.00 and a low estimate of $70.00. The median estimate is a 1.76% surge compared to the closing price of $82.55 on December 7th.

The same media also reported that 13 out of 28 surveyed investment analysts had rated Exxon Mobil’s stock as “Hold”, while 8 – as “Buy”. On the other hand, 7 analysts had recommended selling the stock.

Daily and Weekly Pivot Levels

With the help of the Camarilla calculation method, today’s levels of importance for the Exxon Mobil stock are presented as follows:

R1 – $82.59

R2 – $82.63

R3 (Range Resistance – Sell) – $82.67

R4 (Long Breakout) – $82.79

R5 (Breakout Target 1) – $82.92

R6 (Breakout Target 2) – $82.98

S1 – $82.51

S2 – $82.47

S3 (Range Support – Buy) – $82.43

S4 (Short Breakout) – $82.31

S5 (Breakout Target 1) – $82.18

S6 (Breakout Target 2) – $82.12

By using the traditional method of calculation, the weekly levels of importance for Exxon Mobil Corporation (XOM) are presented as follows:

Central Pivot Point – $82.87

R1 – $84.72

R2 – $85.98

R3 – $87.83

R4 – $89.68

S1 – $81.61

S2 – $79.76

S3 – $78.50

S4 – $77.24