Yesterday’s trade saw GBP/JPY within the range of 193.04-193.94. The pair closed at 193.85, up 0.11% on a daily basis, while marking a fourth consecutive trading day of gains. The daily rate of increase has been the most modest one since June 25th, when GBP/JPY added 0.08%. In addition, the daily high has also been the highest level since June 26th, when the cross registered a high of 195.28.

Yesterday’s trade saw GBP/JPY within the range of 193.04-193.94. The pair closed at 193.85, up 0.11% on a daily basis, while marking a fourth consecutive trading day of gains. The daily rate of increase has been the most modest one since June 25th, when GBP/JPY added 0.08%. In addition, the daily high has also been the highest level since June 26th, when the cross registered a high of 195.28.

At 8:53 GMT today GBP/JPY was up 0.19% for the day to trade at 194.18. The pair overcame the daily and the weekly R1 levels and touched a daily high at 194.38 at 6:50 GMT. It is now the new highest level since June 26th.

No relevant macroeconomic reports are scheduled to be released from the United Kingdom and Japan today.

Technical Outlook

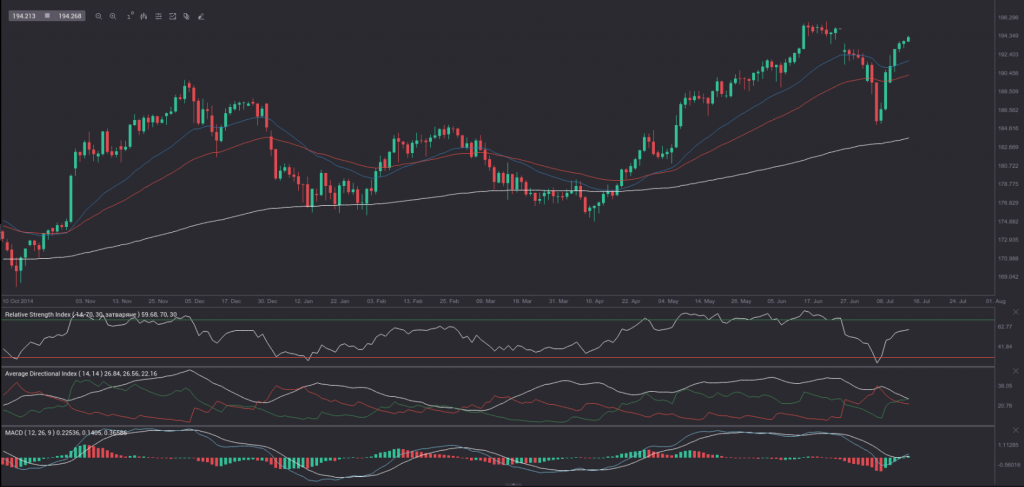

On the daily chart the outlook remains bullish. The perfect order of the 25-day, 50-day and 200-day Exponential Moving Averages is still in place, the Relative Strength Index is above its 50.00 level and still at a convenient distance from the overbought area, while the ADX is still above the 25.00 level and the +DI (green) has crossed above the -DI (red).

In case the bullish momentum continue to build up, we can expect a test of the 195.00 psychological level. A breach above it may lead to a test of the June 26th high (195.28) and ultimately the June 24th high (195.93). The latter has been the highest level since September 25th 2008.

GBP/JPY may be set to form a Double Top formation, but for that we need to witness two identical peaks or two peaks within 5% of each others level. However, the pattern will not be confirmed until we see a close below the July 8th low (185.00), which may appear as a trough. If, on the other hand, we see a close above the second peak, then the formation may be a failure.

Bond Yield Spread

The yield on Japanese 2-year government bonds went as high as 0.013% on July 16th, after which it slid to 0.010% at the close to lose 0.002 percentage point on a daily basis.

The yield on UK 2-year government bonds climbed as high as 0.666% on July 16th, or the highest level since June 27th (0.679%), after which it fell to 0.608% at the close to lose 2.1 basis points (0.021 percentage point) for the day, while marking the first drop in the past seven trading days.

The spread between 2-year UK and 2-year Japanese bond yields, which reflects the flow of funds in a short term, contracted to 0.598% on July 16th from 0.619% during the prior day. The July 16th difference has been the lowest one since July 14th, when the yield spread was 0.592%.

Meanwhile, the yield on Japan’s 10-year government bonds soared as high as 0.461% on July 16th, after which it slid to 0.455% at the close to lose 0.006 percentage point compared to July 15th, while marking the first drop in the past three days.

The yield on UK 10-year government bonds climbed as high as 2.158% on July 16th, after which it slipped to 2.082% at the close to lose 4.8 basis points (0.048 percentage point) on a daily basis, while marking the first drop in the past seven trading days.

The spread between 10-year UK and 10-year Japanese bond yields narrowed to 1.627% on July 16th from 1.669% during the prior day. The July 16th yield difference has been the lowest one since July 10th, when the spread was 1.624%.

Pivot Points

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 193.61. In case GBP/JPY manages to breach the first resistance level at 194.18, it will probably continue up to test 194.51. In case the second key resistance is broken, the pair will probably attempt to advance to 195.08.

If GBP/JPY manages to breach the first key support at 193.28, it will probably continue to slide and test 192.71. With this second key support broken, the movement to the downside will probably continue to 192.38.

The mid-Pivot levels for today are as follows: M1 – 192.55, M2 – 193.00, M3 – 193.45, M4 – 193.90, M5 – 194.35, M6 – 194.80.

In weekly terms, the central pivot point is at 189.06. The three key resistance levels are as follows: R1 – 193.12, R2 – 195.72, R3 – 199.78. The three key support levels are: S1 – 186.46, S2 – 182.40, S3 – 179.80.