Johnson Matthey PLC is selling its gold and silver refineries for £118 million as the company shifts its attention to its core chemicals and technology operations.

Johnson Matthey PLC is selling its gold and silver refineries for £118 million as the company shifts its attention to its core chemicals and technology operations.

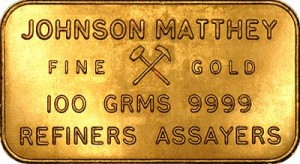

Japan’s Asahi Holdings will take control over the plants in Salt Lake City, USA and Brampton in Canada, which employ around 340 people. Those facilities melt down old jewelry, mining ore and discarded industrial materials into gold and silver bars.

For the full-year ended March, the refineries reported sales of £44 million, with returns of approximately 25%. However, for the half-year Johnson Matthey posted a 23%-sales decline in those businesses due to lower prices and described the environment as “challenging.”

Johnson Matthey did not specify weather plunging gold and silver prices influenced its decision to dispose of the refineries. The metals have lost 12% and 18% since March, respectively, as the US dollar strengthened amid recovery in the worlds biggest economy.

“We think this is a sensible move given the midterm outlook for gold/silver prices remains unpromising and there are few synergies with the rest of the group,” said Adam Collins, analyst at Liberum, cited by the Financial Times.

Johnson Mattheys CEO Robert MacLeod said the sale of the refineries is a part of the companys “long term strategy” to shift its focus on utilizing its know-how in chemicals in order to provide high technology solutions.

Under that plan, Johnson Matthey will retain its platinum production facilities in UK and the US, as they have substantial importance for the companys leading catalyst manufacturing businesses. In the past few years, Johnson Matthey has made efforts to be seen as an advanced materials company and not another maker of gold and silver bullion.

The all-cash agreement is expected to close by the end of March 2015.

In Ocbtober, Johnson Matthey said it is buying Clariants energy storage division for £46 million, marking its third acquisition in the segment within two years.

Johnson Matthey PLC lost 2.50% on Friday and closed at GBX 3 201 in London. On Monday the stock gained 1.47% to trade at GBX 3 248 at 14:41 GMT, marking a one-year increase of 2.78%. The company is valued at £6.56 billion. According to the Financial Times, the 13 analysts offering 12-month price targets for have a median target of GBX 3 600, with a high estimate of GBX 4 050 and a low estimate of GBX 2 900. The median estimate represents a 12.46% increase from the last close price of GBX 3 201.