Yesterday’s trade saw EUR/SEK within the range of 9.1531-9.1980. The pair closed at 9.1834, losing 0.08% on a daily basis.

At 6:14 GMT today EUR/SEK was up 0.02% for the day to trade at 9.1844. The pair touched a daily high at 9.1884 at 6:04 GMT.

Fundamental view

Euro zone

Business climate in Germany probably worsened in September, with the respective gauge slipping to 105.8 from 106.3 in August.

The IFO Business Climate Index reflects entrepreneurs’ sentiment in regard to current business situation and their expectations for the next six months. The index is based on a survey, conducted by phone and encompasses 7 000 companies, that operate in sectors such as manufacturing, construction, wholesaling and retailing industry. The Business Climate Balance represents the difference between the percentage share of respondents that are optimistic and the share of respondents that are pessimistic. The index can fluctuate between -100, which suggests all responding companies assess their situation as poor and expect business conditions to deteriorate, and +100, which suggests all responding companies assess their situation as good and expect an improvement in business conditions.

The IFO Business Climate Index is comprised by two equally-weighted sub-indexes – a gauge of expectations and a gauge of current assessment. The IFO expectations index probably dropped to 101.2 in September from 101.7 in August, while the IFO current assessment index probably slid to 110.1 in the current month from 111.1 in August. If any of the gauges registered a larger than projected decline, this might have a bearish effect on the common currency.

The CESifo Group is to release the official numbers at 8:00 GMT.

Sweden

Confidence among consumers in Sweden probably improved in September, with the corresponding gauge rising to a reading of 97.8, according to the median estimate by experts. In August the index of confidence was reported at 96.9.

The Consumer Confidence Indicator (CCI) signifies what household plans to purchase durable goods are and what the level of consumer sentiment on the economic situation in Sweden, personal finances, inflation and savings is. The survey encompasses a sample of 1 500 households, interviewed on a monthly basis. The indicator represents the difference between respondents, who gave a positive opinion, and those, who gave a negative opinion. Readings between 90 and 100 indicate weaker than normal confidence, while readings between 100 and 110 indicate stronger than normal confidence. Any improvement in the gauge of sentiment, which exceeds market expectations, usually supports the krone.

Swedens National Institute of Economic Research is expected to release the official data at 7:00 GMT.

Technical view

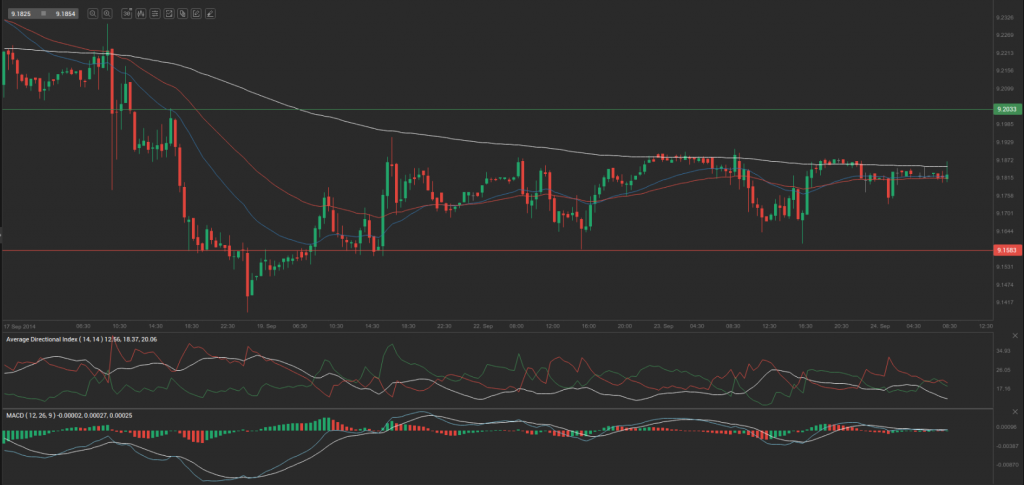

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 9.1782. In case EUR/SEK manages to breach the first resistance level at 9.2033, it will probably continue up to test 9.2231. In case the second key resistance is broken, the pair will probably attempt to advance to 9.2481.

If EUR/SEK manages to breach the first key support at 9.1583, it will probably continue to slide and test 9.1333. With this second key support broken, the movement to the downside will probably continue to 9.1134.

The mid-Pivot levels for today are as follows: M1 – 9.1234, M2 – 9.1458, M3 – 9.1683, M4 – 9.1907, M5 – 9.2132, M6 – 9.2356.

In weekly terms, the central pivot point is at 9.1947. The three key resistance levels are as follows: R1 – 9.2556, R2 – 9.3350, R3 – 9.3959. The three key support levels are: S1 – 9.1153, S2 – 9.0544, S3 – 8.9750.