Yesterday’s trade saw CAD/MXN within the range of 11.9126-11.9964. The pair closed at 11.9719, gaining 0.23% on a daily basis.

At 7:53 GMT today CAD/MXN was down 0.03% for the day to trade at 11.9681. The pair touched a daily low at 11.9617 at 4:10 GMT.

Fundamental view

Canada

Manufacturing sales in Canada probably increased 1.0% in July compared to June, according to market expectations, following another 0.6% in June. The Monthly Survey of Manufacturing features statistical data regarding sales of finished goods, inventories, unfilled orders and new orders in Canadian sector of manufacturing. About 10 500 items and 27 000 companies are encompassed.

Manufacturing sales are considered as an indicator of demand in the future. An increase in the number of goods and unsold inventories suggests, that demand is not sufficient and vice versa. On the other hand, an increase in sales (shipments) speaks of strong demand. Therefore, in case shipments rose at a higher than projected pace, this would provide support to the loonie. Statistics Canada will release the manufacturing data at 12:30 GMT.

In addition, at 16:30 GMT Bank of Canada Governor Stephen Poloz is expected to take a statement. He took office in June 2013 for a mandate of seven years.

Technical view

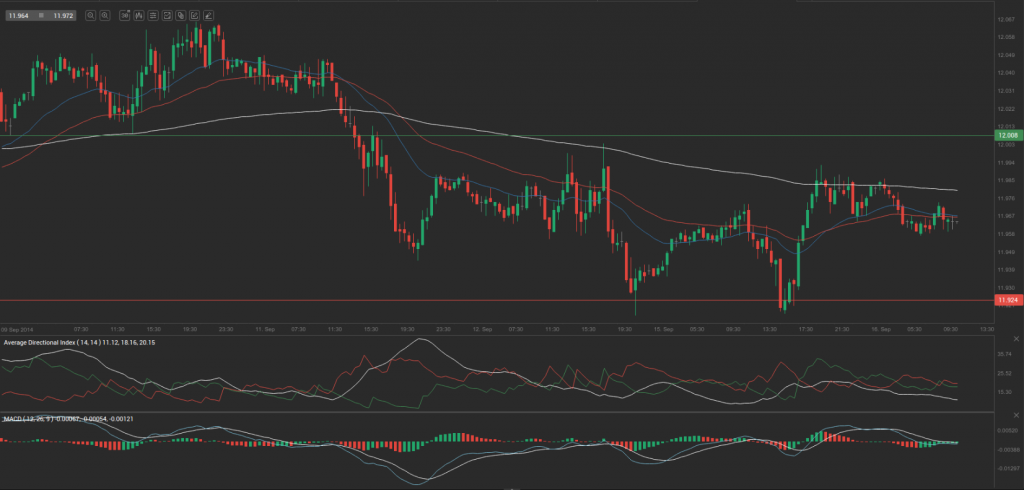

According to Binary Tribune’s daily analysis, the central pivot point for the pair is at 11.9603. In case CAD/MXN manages to breach the first resistance level at 12.0080, it will probably continue up to test 12.0441. In case the second key resistance is broken, the pair will probably attempt to advance to 12.0918.

If CAD/MXN manages to breach the first key support at 11.9242, it will probably continue to slide and test 11.8765. With this second key support broken, the movement to the downside will probably continue to 11.8404.

The mid-Pivot levels for today are as follows: M1 – 11.8585, M2 – 11.9004, M3 – 11.9423, M4 – 11.9842, M5 – 12.0261, M6 – 12.0680.

In weekly terms, the central pivot point is at 11.9767. The three key resistance levels are as follows: R1 – 12.0398, R2 – 12.1324, R3 – 12.1955. The three key support levels are: S1 – 11.8841, S2 – 11.8210, S3 – 11.7284.