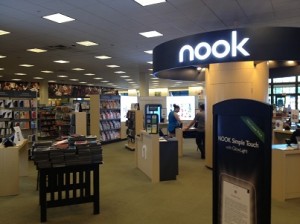

Barnes & Noble Inc. made an official statement, revealing that it intends to split its bookstore chain and its Nook electronic-reader division into independent businesses that will be traded separately. This move of the company is provoked by the falling sales of both units and is planned to improve their performance, which has currently been pressed by more competitive larger companies such as Amazon.com Inc.

Barnes & Noble Inc. made an official statement, revealing that it intends to split its bookstore chain and its Nook electronic-reader division into independent businesses that will be traded separately. This move of the company is provoked by the falling sales of both units and is planned to improve their performance, which has currently been pressed by more competitive larger companies such as Amazon.com Inc.

The current Chief Executive Officer of Barnes & Noble Inc. – Mr. Michael Huseby, who took over in January said in a statement, which was cited by the Financial Times: “We believe our businesses will have the best chance of optimising shareholder value if they are capitalised and operated separately.”

Chief Executive Officer Huseby also commented the situation in a telephone interview for Bloomberg: “The intent behind the proposed separation is to really drive focus behind the two different businesses with focused boards and focused management teams. Retail is doing very well. On the other side of the coin, you have Nook, which has college and the Nook consumer business. College is poised for significant growth.”

The company not only announced its plans for the future spin-off, but also shared that its fourth-quarter results saying that the sales of its same-store bookstore chain are declining, while the Nook electronic-reader division is posting continuous losses. According to Barnes & Noble Inc.s statement, the spin-off is to be finalized over the first three months of next financial year.

The split is part of a series of corporate reorganizations in the media industry that has been on the agenda over the past years. Several companies have already separated their weaker units in order to emphasize on their stronger ones. The spin-off also follows years of analysts and shareholders statements that the bookstore chain division and the Nook electronic-reader unit would be more successful if they are separated from the rest of the company and operate on their own.

Barnes & Noble Inc. was 5.30% up to close at 21.65 dollars per share yesterday, marking a one-year change of +38.69%. According to the information published on CNN Money, the 3 analysts offering 12-month price forecasts for Barnes & Noble Inc. have a median target of 20.00, with a high estimate of 32.00 and a low estimate of 12.00. The median estimate represents a -7.62% decrease from the last price of 21.65.