During yesterday’s trading session USD/CAD traded within the range of 1.0862-1.0905 and closed at 1.0869.

At 11:24 GMT today USD/CAD was losing 0.06% for the day to trade at 1.0860. The pair touched a daily high at 1.0855 at 9:20 GMT.

Fundamental view

United States

The initial jobless claims in the US probably fell to 309 000 in the week ended June 7th, from 312 000 a week ago, according to the median estimate by experts.

The statistical arm of the US Department of Labor will release an official report at 12:30 GMT today. If jobless claims fall more than expected, this will provide support for the US dollar.

In addition, Retail Sales in the US probably jumped 0.6% in May from a month ago, when they rose 0.1%.

The indicator includes the total volume of wholesale and retail sales (cash or credit) of companies, mainly specializing in the retail sector. Sales are measured net, after deduction of the costs of refinancing. They do not include taxes paid by the buyer directly to the local government or the federal budget. These calculations measure the value of the operations used mostly by stores, whose main activity is retail sales. The index excludes retail sales made by manufacturers, wholesalers, and other core businesses who operate in sectors, other than the retail sector. This is the percentage change in the index from the previous month.

At the same time, retail sales, excluding sales of autos or core retail sales probably rose 0.4% last month, after remaining flat in April. Sales of autos, which comprise about 20% of total retail sales are excluded from the index, because their high volatility distorts the overall trend. Therefore, data without auto sales is considered a better indicator of the changing market trend. This is the percentage change in the index from the previous month.

Higher-than-expected readings would have a bullish effect on the greenback. The US Census Bureau will release an official report at 12:30 GMT.

Canada

Selling prices of new homes in Canada probably rose 0.3% in April compared to a month ago, following a 0.2% increase in March. The New Housing Price Index is a key indicator, reflecting the health of nation’s housing market. In case prices surged more than anticipated, this would have a bullish effect on the loonie.

Statistics Canada will release the official data at 12:30 GMT.

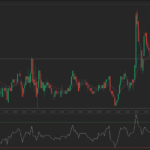

Technical view

According to Binary Tribune’s daily analysis, in case USD/CAD manages to breach the first resistance level at 1.0895, it will probably continue up to test 1.0922. In case the second key resistance is broken, the pair will probably attempt to advance to 1.0938.

If USD/CAD manages to breach the first key support at 1.0850, it will probably continue to slide and test 1.0836. With this second key support broken, the movement to the downside will probably continue to 1.0809.