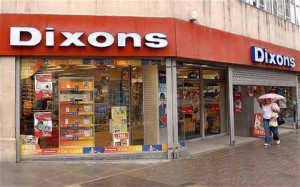

The biggest consumer-electronics retailer in the U.K – Dixons Retail Plc reached a merger agreement with cellphone seller Carphone Warehouse Group Plc. The all-share deal will combine the two companies in a new entity that is estimated to more than 3 billion pounds (5 billion dollars), which is expected to become a leader in the increasingly challenging online retail segment.

The biggest consumer-electronics retailer in the U.K – Dixons Retail Plc reached a merger agreement with cellphone seller Carphone Warehouse Group Plc. The all-share deal will combine the two companies in a new entity that is estimated to more than 3 billion pounds (5 billion dollars), which is expected to become a leader in the increasingly challenging online retail segment.

The negotiations between the companies started in February 2014 and will now put a new powerful player on the market, with combined revenue amounting to about 12 billion pounds (20 billion dollars) and market capitalisation estimated to about 3.74 billion pounds. According to Dixons Retails statement, each of the companies will hold 50% of the new entity, which is to be called Dixons Carphone Plc.

As reported by the Financial Times, the Chairman and Founder of Carphone Warehouse Group Plc – Sir Charles Dunstone commented: “We see the merger of these two great companies as an opportunity to bring our skills together for the consumer and create a new retailer for the digital age.”

The combined company will be headed by Mr. Charles Dunstone as Chairman and Mr. Sebastian James as Chief Executive Officer. The deal is found beneficial to both parties, as Dixons will get a better performance in the mobile phones and tablets areas, and Carphone Warehouse will be provided with access to the purchasing scale of its partner. According to the terms of the deal, the shareholders of Dixons will get 0.155 of the new entitys shares in exchange for each Dixons share.

“Although there are plenty of reasons to view the merger in a positive light, the history of mergers and acquisitions is littered with the corpses of failed unions,” said David Alexander, an analyst at researcher Conlumino, cited by Bloomberg. He also added, cited by the same media: “Carphone Warehouse itself is no stranger to this, having seen its partnership with U.S. electronics giant Best Buy in 2008 peter out three years later in the face of intense competition from Dixons.”

The agreement for the merger comes after years of speculations about both companies. There has been also information about negotiations between Dixons Retail and Carphone Warehouse back in 2011, which have been unsuccessful over valuation.

Dixons Retail Plc was losing 4.68% to trade at 48.52 pence per share by 9:14 GMT, marking a one year change of +32.90%. According to the information published on the Financial Times, the 11 analysts offering 12-month price targets for Dixons Retail Plc have a median target of 56.00, with a high estimate of 60.00 and a low estimate of 41.00. The median estimate represents a 10.02% increase from the last price of 50.90.