Toyota Motor Corp, the worlds largest car manufacturer, reported it has hit a new operating high in the fiscal year that ended March 31st, buoyed by record sales and a weaker yen. The company however predicted profit will fall in the current year as competition in the US intensifies, demand in Japan softens and as its currency edge fades.

Toyota Motor Corp, the worlds largest car manufacturer, reported it has hit a new operating high in the fiscal year that ended March 31st, buoyed by record sales and a weaker yen. The company however predicted profit will fall in the current year as competition in the US intensifies, demand in Japan softens and as its currency edge fades.

Toyota announced on Thursday that its net profit surged by 90% in the 2013/2014 financial year to 1.82 trillion yen ($17.9 billion), while its operating profit rose by 74% to 2.29 trillion yen, breaking a record set before the global financial crisis six years ago.

The company achieved its outstanding results on the back of positive currency effects, which contributed with 900 billion yen to its operating profit, as well as increased vehicles sales and cost reduction efforts. Cost cutting added 290 billion yen to operating income.

Toyota Managing Officer Takuo Sasaki said, cited by the Wall Street Journal: “In addition to the positive impact of the weaker yen, our operating income increased due to marketing efforts such as increased vehicle sales and cost reduction activities through collaboration with our suppliers.”

Toyota managed to outsell all of its rivals in the last financial year and delivered 10.13 million vehicles, making the company the first car maker to surpass the 10-million annual threshold. Toyota now targets global group sales of 10.25 million for the 2014/2015 business year.

Toyota President Akio Toyoda said that the record operating income was mainly based on increased car sales in Japan and North America, as well as the previously mentioned cost reductions. The company said that Japan and North America accounted for 50% of Toyotas consolidated sales, with deliveries of hybrids and the companys premium brand Lexus remaining strong.

However, Toyota underscored greater uncertainty on emerging markets, in contrast to the recovering US and European markets. Sales in Asia outside of Japan are projected to decline in the 2014/2015 financial year. Meanwhile, Japanese automakers are bracing for a record decline in domestic demand due to the implementation of the first sales tax increase in nearly two decades. The fading of Toyotas currency edge is also expected to put a damper on growth in the current year.

The worlds largest car manufacturer said it expects to post a net profit of 1.78 trillion yen ($17.50 billion) in the 2014/2015 business year, below both last years performance and the median estimate of 2.03 trillion yen, according to 24 analysts surveyed by Reuters.

Moreover, Toyota reported net income fell by 5.4% to 297 billion yen in the last financial years fourth quarter from 314 billion a year earlier, mismatching analysts projections for 359.6 billion yen. Operating profits slid to 436 billion yen from 502 billion and sales also fell short of expectations in the three months through March.

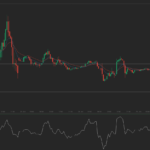

Toyota Motor Corp rose by 0.31% in Tokyo on Thursday and closed the session at 5 528 yen, marking a one-year change of -5.34%. The Japanese car maker is valued at 19.00 trillion yen. According to the Financial Times, the 21 analysts offering 12 month price targets for Toyota Motor Corp have a median target of 7 800 yen, with a high estimate of 8 700 yen and a low estimate of 6 200 yen. The median estimate represents a 41.54% increase from the previous close of 5 511 yen.