US dollar pulled back from session lows against the Japanese yen on Tuesday on stronger than projected data, regarding US durable goods orders. Results boosted optimism about US economic recovery.

USD/JPY reached 97.68 at 12:35 GMT, as the cross hit a session low at 96.95 before the release of US data.

The Commerce Department reported earlier on Tuesday, that Durable Goods Orders in the United States rose by 3.6% in May, exceeding forecasts of a 3.0% increase rate, and confirming the rate, registered during the previous month. Major influence was caused by rising aircraft and military equipment demand. Orders in the aviation sector increased by 51%, boosted by the larger number of orders by Boeing. At the same time, orders in the auto sector decreased by 1.2%. Durable Goods Orders ex Transportation recorded a 0.7% increase in May, while Durable Goods Orders ex Defense added 3.5% during the same month. In the first five months of this year durable goods orders rose by 2.1% on annual basis in consonance with a better performing US manufacturing sector.

Additionally, on Tuesday it became clear that S&P/Case-Shiller Composite-20 Home Price Index in the United States surprisingly rose by 12.05% in April, above the projected 10.60%, while results were revised down to 10.85% during the preceding month from 10.87% previously.

US dollar fell to session lows against the Japanese yen earlier, after officials from the Federal Reserve Bank played down investors concerns over prospects of an exit to the central bank’s Quantitative Easing. The president of the Federal Reserve Bank of Minneapolis, Narayana Kocherlakota, said on Monday that the central bank will stick to the course of continuing its bond purchases, until US unemployment rate was to decline further. Additionally, Dallas Fed President Richard Fisher said, that investors should not overreact to US central bank’s plans of decelerating asset purchases.

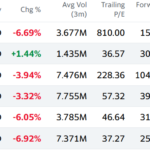

The greenback advanced to session highs against the euro as well, as EUR/USD pair retreated 0.40% to 1.3084.

Meanwhile, Spain and Italy saw borrowing costs rise considerably at auctions of government debt earlier on Tuesday, caused by uncertainty over monetary policy of the United States.

Spain sold 930 million EUR of 3-month bonds at average yield of 0.86%, an increase from 0.33% previously and 2.14 billion EUR of 9-month bonds at an average yield of 1.44%, an increase from 0.78%. At the same time, Italy auctioned 3.5 billion EUR of 2-year bonds at an average yield of 2.4%, which was an increase from 1.1% previously.