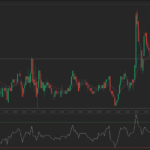

Thursdays trade marked a close to 4,5 year high movement of the USD/JPY, after the reported exceedingly strong economic growth from Japan than estimated. During the late European trade session the pair gained almost 0.40%, reaching 102.59-60.

It was announced that Japan achieved a 0.9% increase in its GDP during the first quarter of the year, surpassing the estimated 0.7% increase. It showed a possible boost of consumer spending, while weakly positioned yen contributed the increase of Japans export.

Still markets await the crucial series of indicators from United States, including Jobless Claims, Consumer Price Index (CPI), Housing Starts, Philadelphia FED Index and Building permits, while some investors tend to speculate about the end of the asset purchasing course by Federal Reserve in short-term.

Meanwhile, euro lost almost 0,20% against the US dollar, close to six week lows, reaching 1.2860-64.

Earlier it became clear, that Harmonized Index of Consumer Prices (HICP) slowed down by 0.1% during April, at par with estimates, while in annual terms the consumer inflation rate remained 1.2%.

It was also announced that single currency zone achieved a larger than expected trade surplus during March of 22.9 billion euros from a revised 10.1 billion euro surplus during the previous period. Forecasts showed a surplus of barely 6.5 billion euros.