Artificial intelligence is increasingly shaping how investors process information and make decisions. While many platforms focus on surface-level sentiment analysis or automated alerts, a smaller group is attempting something more ambitious. Edge Hound positions itself in that category, aiming to serve as an intelligence layer for financial markets rather than a traditional trading signal provider.

This review takes a closer look at Edge Hound’s methodology, technology, team, and long-term vision to understand how it differs from existing AI-driven financial tools.

What Is Edge Hound?

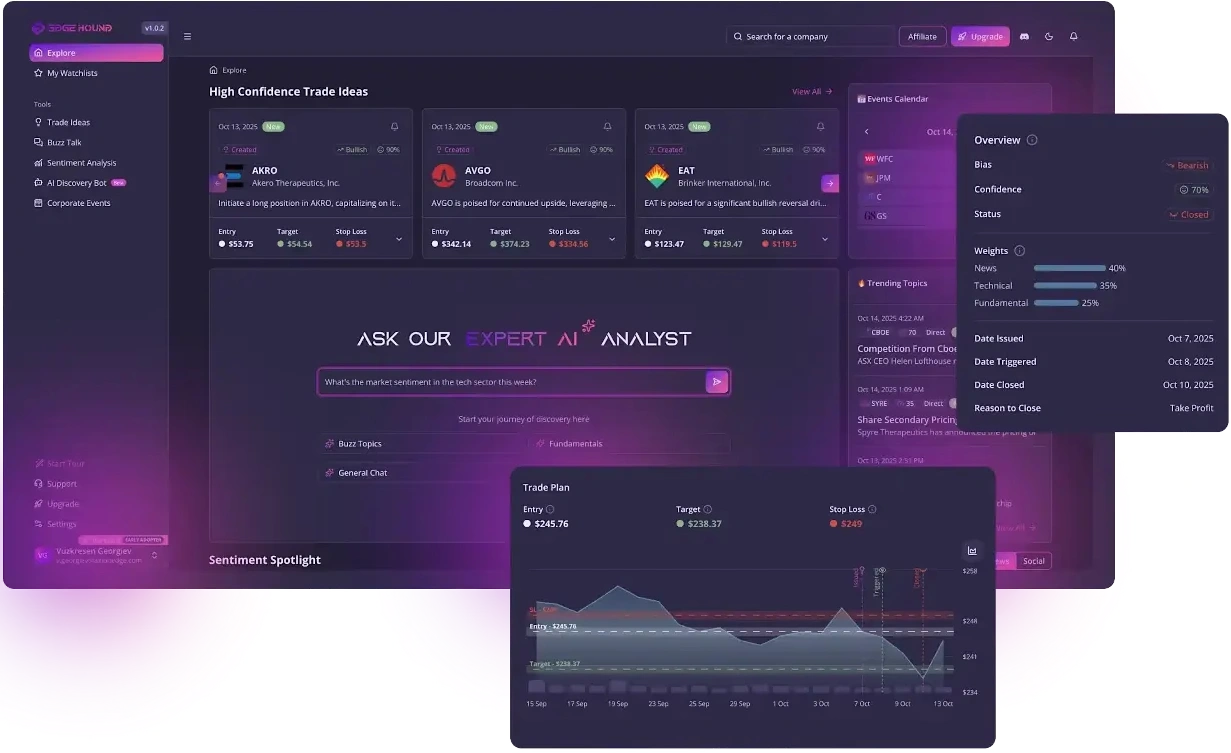

Edge Hound is an AI-powered financial research platform designed to analyze equities through a combination of large-scale data ingestion, proprietary artificial intelligence models, and structured reasoning systems. Rather than offering trade execution or copy trading, the platform focuses on producing daily, decision-ready research for each covered stock.

The product is built to help users understand not only what is happening in the market but also why it is happening and which factors may influence future outcomes.

A Multi-Agent AI Architecture

What most clearly differentiates Edge Hound is its AI architecture. Instead of relying on a single natural language processing pipeline or sentiment score, the platform operates multiple specialized AI analyst agents in parallel.

Each agent evaluates a company or situation independently, focusing on different dimensions such as fundamentals, narrative flow, macro exposure, or structural risks. These outputs are then consolidated through what the team refers to as a Collective Oracle, a system that weighs, reconciles, and synthesizes competing perspectives into a unified assessment.

The goal is to approximate a multi-perspective analytical process similar to how a human investment committee might operate, but at machine scale.

Knowledge Graphs and Hidden Dependencies

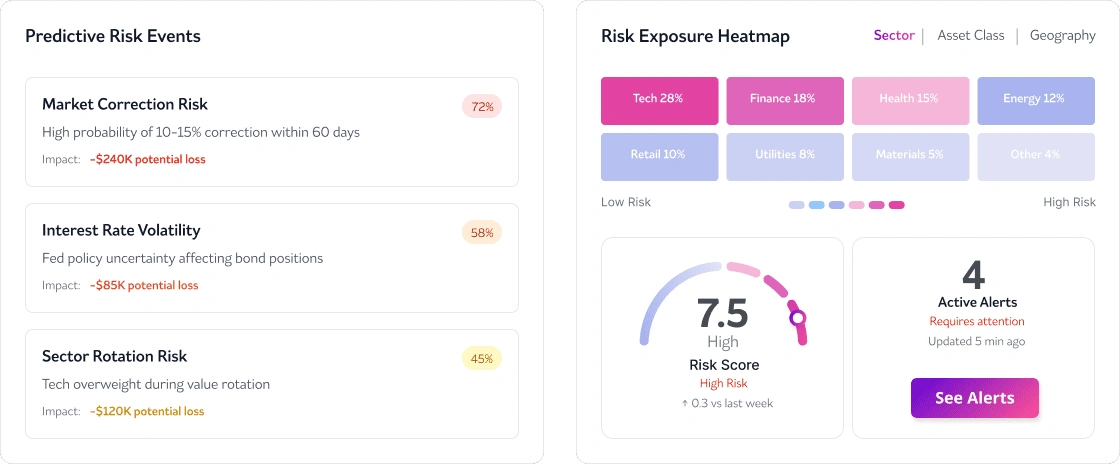

Edge Hound also employs knowledge graphs designed to capture second- and third-order relationships between entities. These relationships go beyond surface-level correlations and aim to identify what the platform calls hidden dependencies.

Examples include supply chain exposure, regulatory linkages, executive-level patterns, macro sensitivity, and cross-sector influences. The intention is to identify connections that traditional fundamental analysis or sentiment dashboards may overlook.

This subsystem is currently in beta. According to the team, the primary technical challenge lies in balancing graph depth with system performance. To address this, Edge Hound is developing a hybrid architecture where vector databases operate in parallel with the graph layer to accelerate context retrieval without compromising structural integrity.

Concrete production examples are expected once the testing cycle is complete.

The Role of Academic Rigor and Human Oversight

Edge Hound’s team includes individuals with strong academic backgrounds in mathematics, computer science, and physics. The founders themselves have years of experience in both academic teaching and real-world market participation.

One co-founder has lectured in computer science at the university level for eight years. The broader team includes an associate professor of nuclear physics, an associate professor with a PhD in mathematics and AI engineering, and engineers with deep expertise in machine learning and applied mathematics.

This academic foundation informs how models are designed and validated, but the team emphasizes that theory alone is not sufficient. Human oversight remains a core part of the system. AI-generated insights are informed by practical market experience, and the platform is explicitly designed to support decision-making rather than replace it.

Even as the company works toward long-term Financial AGI capabilities, human judgment is viewed as essential.

User Education and Risk Awareness

Edge Hound is aware of the risk that AI-generated trade ideas can be misunderstood as financial advice. During early testing with approximately 2,000 users, the team observed that even simplified interfaces can be misinterpreted without proper guidance.

To address this, the company is developing structured educational content including tutorials, walkthroughs, and best-practice guides. The platform also includes multiple layers of disclaimers to reinforce that users must conduct their own due diligence.

Each stock is presented in a one-page summary that is updated daily. The aim is to reduce information overload while preserving analytical depth. The platform saves users time but still requires active engagement and critical thinking.

Product Roadmap and Future Outlook

Edge Hound has outlined an ambitious roadmap. Near-term goals include expanding coverage to 5,000 U.S. stocks, followed by European and Asian equities, ETFs, and fund structures.

By mid-2026, the platform plans to introduce Forex and CFD instruments, crypto assets, an expanded self-evolving knowledge graph, and a What-If analysis engine for scenario modeling. The team is also exploring prediction markets, building on its multi-agent and oracle-based architecture.

Later stages include a B2B API, options coverage, and broker integrations designed to create an end-to-end financial intelligence ecosystem.

Important: While Edge Hound’s multi-agent AI architecture can surface nuanced insights, its outputs remain probabilistic assessments—not certainties. Every investor should double-check data sources, align conclusions with personal investment objectives, and consider professional advice where necessary. Remember that past performance does not guarantee future results, and the rapid pace of market change can quickly invalidate any model. Treat the platform as a decision-support tool, not an automatic trading trigger.

Final Assessment

Edge Hound is not a conventional trading signals product, nor is it a lightweight sentiment dashboard. It is a deep analytical system that mirrors how professional investors think, reason, and contextualize information.

Its strengths lie in its architecture, data-science ambition, and intellectual rigor. The platform will appeal most to users who want to understand businesses and market dynamics at a structural level rather than chase short-term signals.

As AI continues to reshape investing, Edge Hound represents a serious effort to move beyond shallow automation toward a hybrid future where machines handle complexity and humans retain judgment and responsibility.